Bitcoin, Gold, and the S&P500 have collectively shared the center stage when it comes to market movement in 2020. While the crypto-asset has periodically taken sides, at the moment, Bitcoin is more correlated with the traditional stock market.

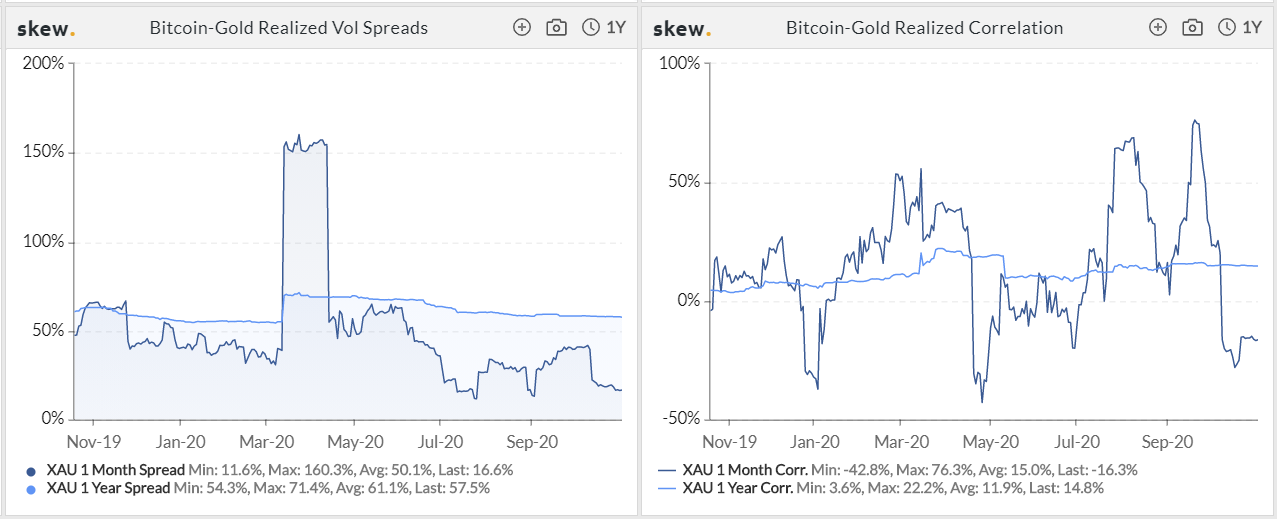

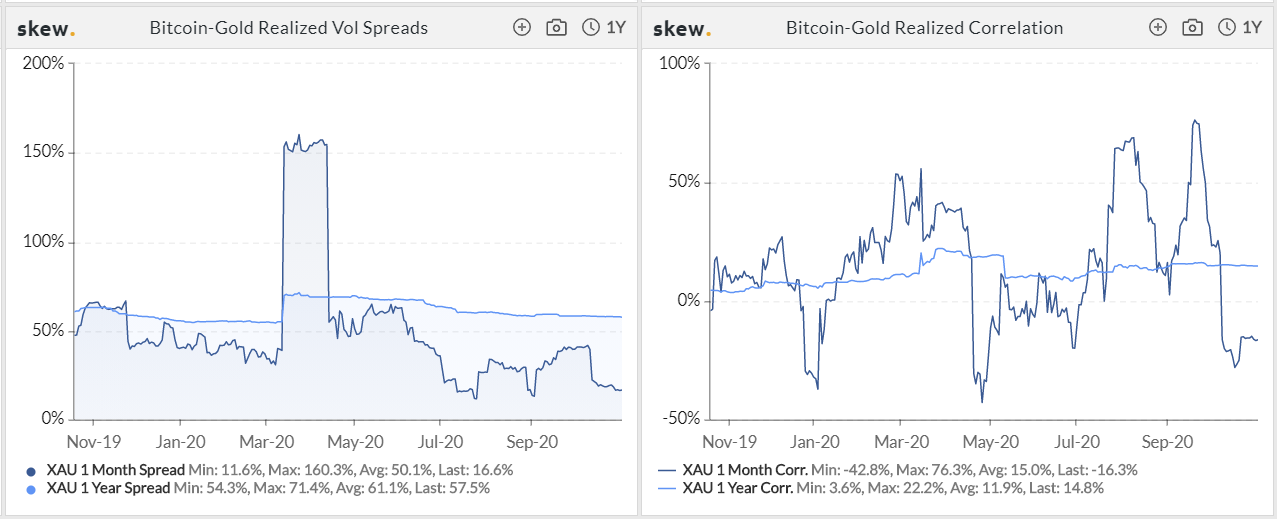

Source: Skew

When comparing recent Skew charts of Bitcoin’s relationship with Gold and the S&P 500, it can be observed that over the past few weeks, the realized volatility of Bitcoin dropped, with respect to the other two assets. In fact, the drop in realized vol suggested that BTC hadn’t been very volatile over this period. Now, while Bitcoin’s correlation with Gold has noted a stark decline over the past couple of weeks, the correlation with the S&P 500 is still at a relatively high range.

Bitcoin might face implications of high S&P 500 correlation

Although being highly correlated to the traditional market has often paid dividends for Bitcoin, it might not be the right time to exhibit the same behavior. The primary reason is in front of everyone – The U.S stock market is yet to put the risk of economic uncertainty in the rearview mirror.

Right now, the S&P 500 is dwelling near its yearly high at 3483 points, but it has been possible only because the Federal Reserve has been green-lighting unlimited QE to sustain the market without boundaries or limitations. While it is allowing the market to tick in the short-term, it might be heading towards a detrimental circle of insolvency.

According to Raoul Pal, a former Goldman Sachs hedge fund manager, the S&P 500 is slowly carving out a huge top pattern with its high. In his webinar, Pal suggested that the present phase is a ‘typical period,’ before the market goes bust. Provincial examples indicate that the crashes witnessed in 1929, 2001, and 2008 represented a similar bullish pullback, before extreme price drawdowns.

However, Pal added that insolvency is what worries him the most. The longer it takes the overall global economy to recover, the more workers will be laid off, and that effect might create a domino effect of creating structural problems within the entire economy.

Finally, there’s the matter of COVID-19.

Cases in Europe increase; European Markets to fall first?

While the global population might be thinking that we are at the end of the road with this pandemic, they might need to think twice. According to a recent WSJ report, cases in the EU overtook the U.S on 15 October, after effectively flattening the curve in previous months.

Needless to say, a ‘second wave’ of the virus might be taking place with no signs of a legitimate vaccine. From an economic point of view, it is not an ideal situation for the global stock market because a sell-off for corporations and indices in the EU will directly affect the U.S markets as well.

NASDAQ’s European market taking a hit will lead to a decline for the U.S stock as well, creating a ripple effect for the likes of S&P 500, Dow Jones, etc.

Finally, U.S elections might play a significantly crucial part. Analysts suggest that a win for the Democrats would be detrimental for the S&P 500, while Trump’s triumph might pump the stock’s value.

While accounting for so much variable change, it puts Bitcoin in a tough spot, and its heightened correlation might be another drawback for the crypto if things go south in the future.

The post appeared first on AMBCrypto