Bitcoin’s halving is estimated to take place in less than a day, and transaction fees are surging. This is indicative of users willing to pay a premium for their transactions to be prioritized and also of the increased number of unconfirmed transactions.

Bitcoin Transaction Fees Above $3

Transaction fees on Bitcoin’s network have been increasing in the past few days as the halving is estimated to take place in less than 24 hours.

According to data from Bitinfocharts, on Friday, May 8th, the average transaction fee was about $3.19, which is more than 350% more than what it was four days earlier on May 4th (around $0.6).

The last time transaction fees were that high was back in July 2019 when the average transaction fee was about $3.4.

Bitcoin’s network has seen increased transactions at times of severe price volatility. Back in December 2017, when the price reached its all-time high of around $20,000, the average transaction fee was about $55.

What Causes High TransactionsFees?

Higher transaction fees suggest that users are willing to pay more to get their transactions prioritized and to reduce the waiting time, which could be tied to more people using the network.

It’s entirely possible that the increased strain on the network is caused by the upcoming Bitcoin halving. Once it happens, the amount of Bitcoin that miners get for validating the transactions will be slashed in half.

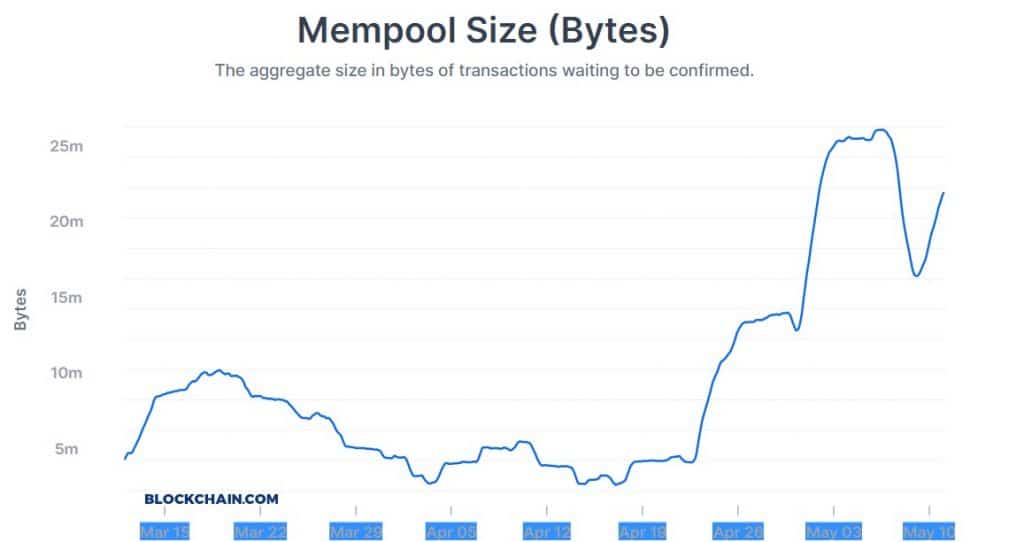

It’s also the case that lately, the network has seen an increased amount of unconfirmed transactions.

As seen in the above chart, the aggregate size of transactions yet to be confirmed has increased substantially throughout the last week. It remains interesting to see how the market will react to the third-ever halving and whether or not there will be an increase in Bitcoin’s transaction fees.

The post Bitcoin Transaction Fees Increase With More Than 300% Days Before The Halving appeared first on CryptoPotato.

The post appeared first on CryptoPotato