In light of the fact that the crypto-industry is still in its nascent phase, various studies using different metrics have assessed the market’s trends and performances over the past few years.

Although the market draws a common affinity to Bitcoin, other crypto-assets such as Ethereum and XRP have a strong user base and influence of their own too.

Coinmetrics, a crypto-analytics platform, assessed the crypto-market even further after it recently revealed a rank list of crypto-assets by the method of auditability. The analysis done by the platform involved the facilitation of audits based on node operations and ledger reconstruction.

The study stated that node audits were chosen because it was a software that implemented the asset’s protocol, connects to the P2P network, and verifies the blockchain. Synchronization of the node with the current state of the network is also instrumental towards accessing most data, which varied from asset to asset.

It was reported that Coinmetrics managed to assess 35 unique nodes, of which Binance Chain presented an anomaly as its source code was not available.

In terms of ledger reconstruction, the platform extracted the necessary data from the node. The study read,

“All nodes offer some form of API to access this data, with varying levels of user-friendliness, documentation, and completeness.”

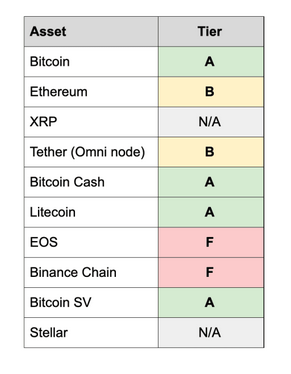

Ranking in terms of Node Operations

Source: Coinmetrics

The audit overseen with respect to the node found that the likes of Bitcoin, Bitcoin Cash, Litecoin, and Bitcoin SV received the highest grade, A, due to the ease of synchronization, updates, and network maintenance.

Ethereum was awarded grade B as auditing an ETH node required tracing which elongated the synchronization time period.

EOS and Binance Chain were at the bottom of the list with grade F, due to their inherent complexity in extracting necessary data to complete an audit.

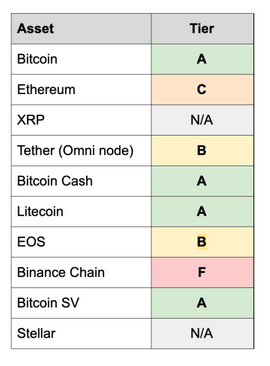

Ranking in terms of Ledger Reconstruction

Source: Coinmetrics

The auditing based on Ledger reconstruction pictured a similar result as Bitcoin and other PoW coins got a grade A after tracking their UTXO data from the node facilitated a simple task.

Auditing EOS transactions was a grueling task. However, it received a decent ranking of grade B.

Ethereum was awarded a grade C as the study stated,

“The current state of the tools we use don’t allow a full reconstruction of the ledger only using the data exposed by tracing, the changes made in the DAO hard fork have to be manually implemented.”

From the study, it can be observed that besides PoW tokens, the transparency and mediation in other crypto-assets are more complex than it appears on the surface. Despite being the 2nd largest crypto-asset, Ethereum received an average evaluation, whereas the largely controversial Bitcoin SV aced the audit process. However, such audits do not indicate or dictate the price valuation of any crypto-asset as tokens like XRP are still generally successful.

The post appeared first on AMBCrypto