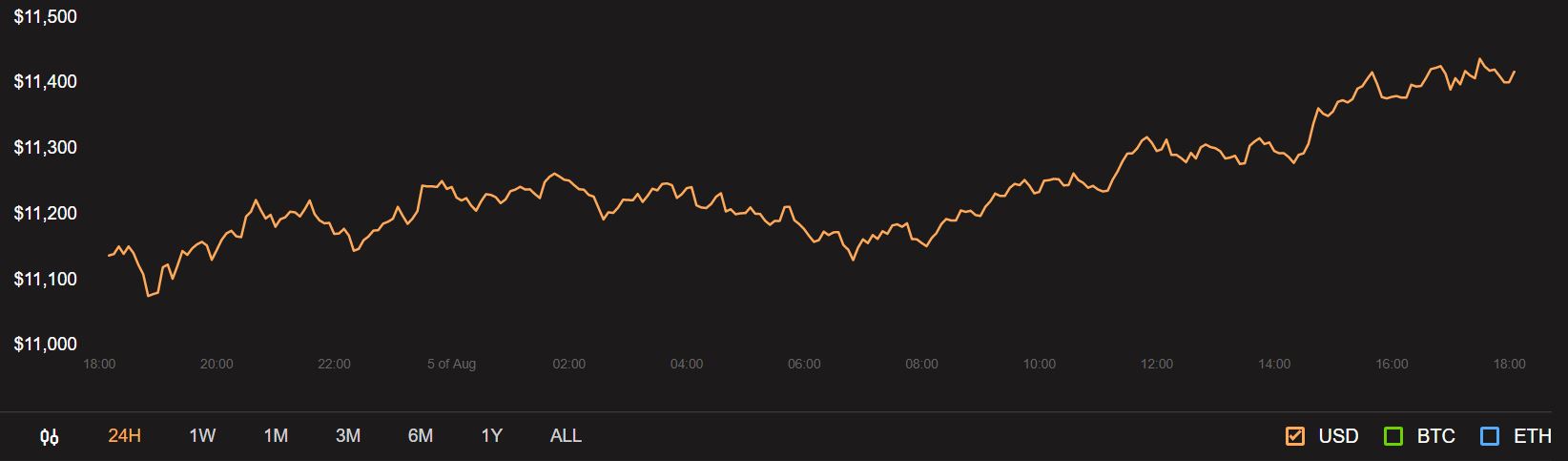

The dreaded consolidation of Bitcoin finally ended as the price of the asset began going higher. The asset had an eventful week as it crossed $10k and stayed above it for the first time since August 2019. This rise in price was from $9,88 to a peak witnessed at $12,030. However, a sharp fall to $11,120 shifted attention to the volatile market. At press time, Bitcoin was being traded at $11,417 with a 24-hour trading volume of $7.6 billion.

Source: CoinStats

This sudden spike in turn seems to have caused quite a few changes in the BTC on-chain metrics.

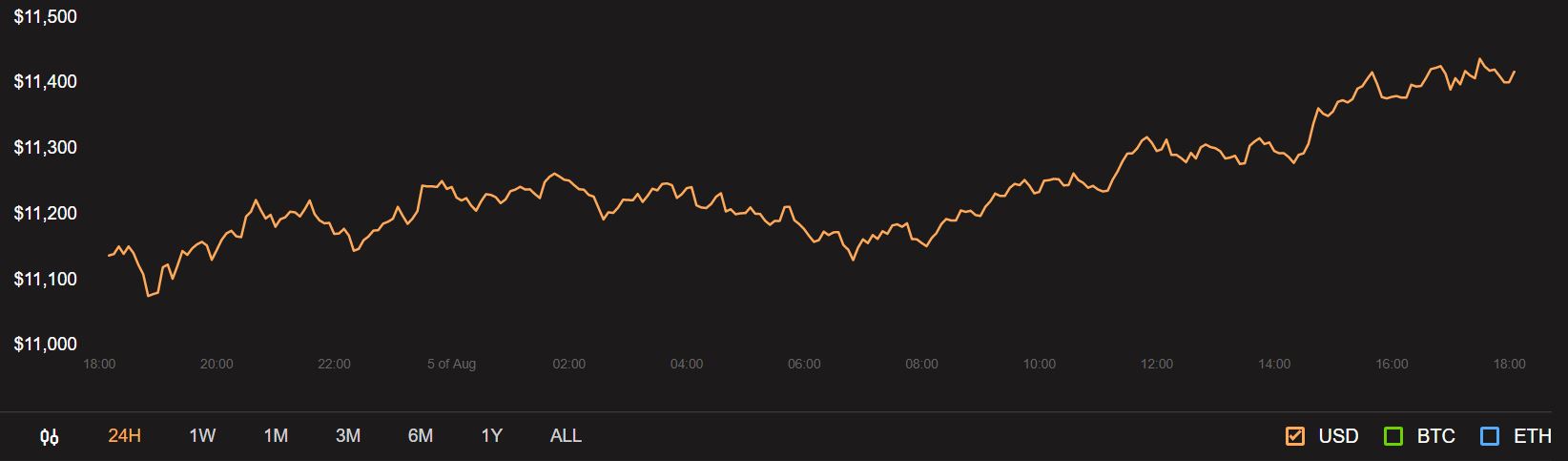

The change began with the sentiment in the market. When the value of BTC was striding higher, the sentiment in the market had changed to ‘extreme greed’ and had touched 80 before the dump this weekend. However, this sentiment has changed and lowered to ‘greed’, but investors have been asked to be aware as historically, the sentiment has not remained at this level for long and been an indication of a market top getting close, as per Arcane.

Source: Arcane

However, data suggested that the last time the metric crossed 80 was on 15 and 19 June, after which the BTC price gained almost 50% within the next 10 days before topping out. This could suggest that even though BTC was approaching a top, there was still more room for the investors to gain.

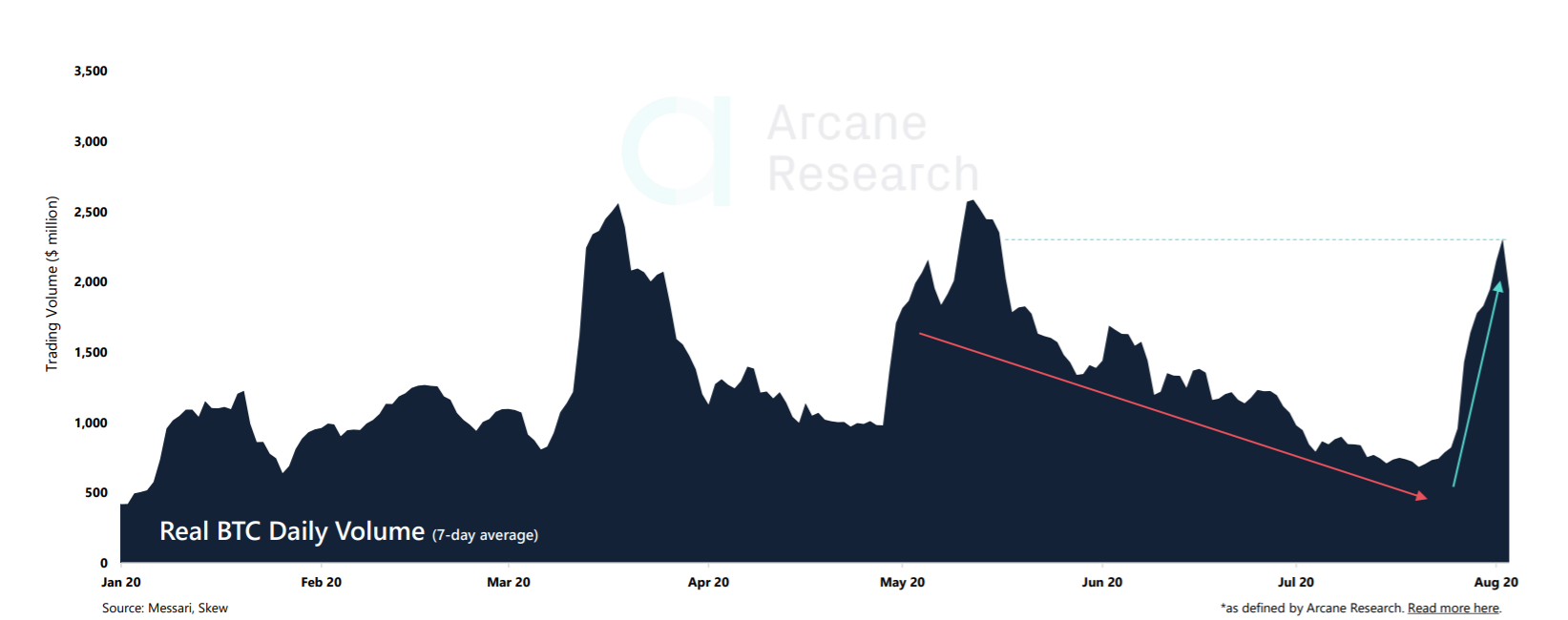

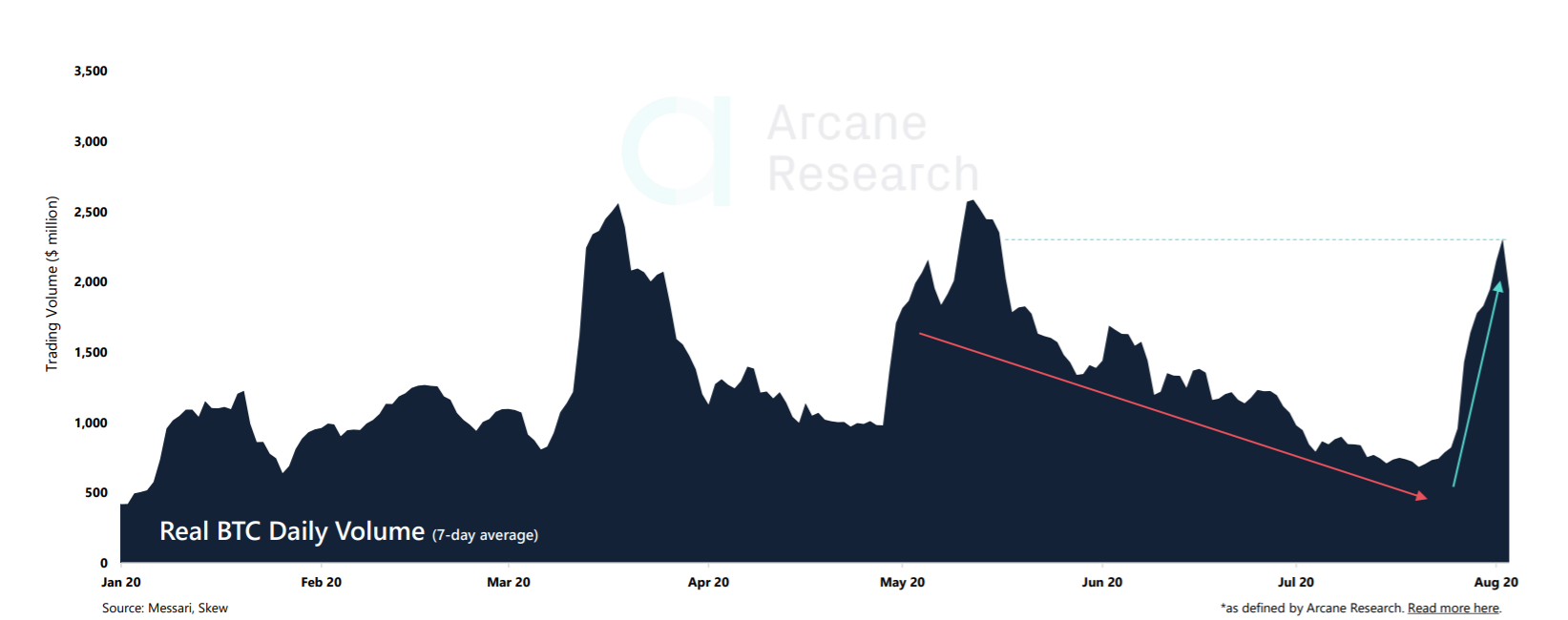

The rising volume was suggestive of many traders returning to the BTC market once again. The volume that peaked in May noted a huge decrease in the following months. However, as the price of BTC rallied, trading activity was back along with the volume.

Source: Arcane

Due to strong moves over the past week, BTC volume was now approaching its yearly peak, establishing the change in trend.

As the sentiment changed with a growing price and volume in the BTC market. The volatility has also been growing and despite the dump over the weekend, it has been on a rise. Currently, the 7-day volatility reaching 5%, the highest level since bitcoin halving at the beginning of May. Even though growing volatility was not the indication of a bullish or bearish market, it could mean the following change in trend could cause major changes in the outlook of the market.

The post appeared first on AMBCrypto