Bitcoin is remembering to be volatile again!

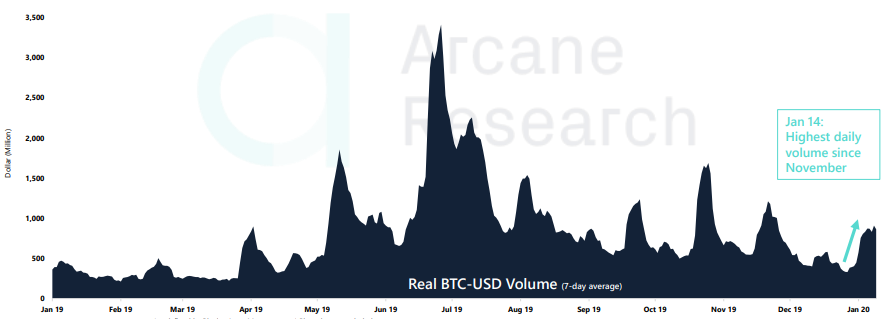

The real trading volume for Bitcoin is back up to its November 2019 levels after its price broke out of the lows seen during the holiday season. Thanks, in good measure, to the volatile few weeks the cryptocurrency is having.

According to the latest report by Arcane Research, Bitcoin, earlier this week, recorded its highest 7-day average trading volume for the past 3 months. The average trading volume for the past week was in the range of $800 million – $900 million, a significant high considering the fact that December’s trading volume went below $500 million due to Bitcoin’s relatively stable price.

Source: Bitcoin Real Volume, Arcane Research

On 14 January, Tuesday, as Bitcoin began the day with a 4 percent pump in under two hours, breaking $8,500 for the first time since mid-November, the real trading volume notched an unprecedented $1.7 billion.

Here, it should be noted that the report measures real trading volume, according to Bitwise real 10. In March 2019, Bitwise Asset Management had released a report where it categorized 10 exchanges that reported “real volume.” The exchanges were Binance, Coinbase, Gemini, Poloniex, Bittrex, Bitstamp, bitFlyer, Bitfinex, Bitfinex, and itBit. In this report, however, itBit’s data has been excluded.

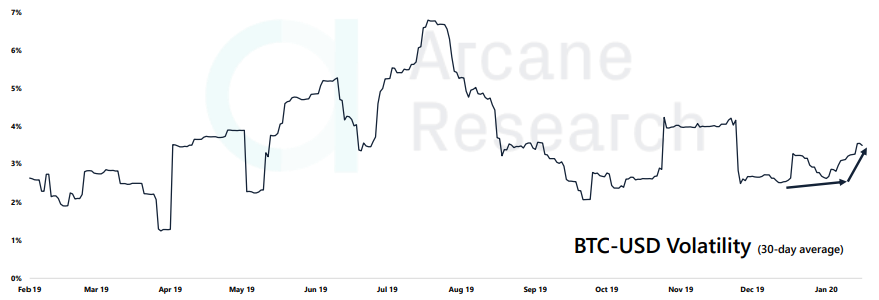

When volume spurts, volatility is not far behind.

Source: Bitcoin 30-day Volatility, Arcane Research

Bitcoin’s 30-day volatility is back up to November levels, according to the report. Now hovering at around 3.5 percent, the volatility has been steadily increasing since the beginning of the month.

After Bitcoin’s massive 10 percent single-day gain on 19 December, a surge that took it from $6,600 to over $7,200, the volatility had been in a slump. During the Christmas-New Year period, Bitcoin’s price was locked in and stayed around $7,500, pulling the volatility to as low as 2 percent.

Both volume and volatility have now turned around, making massive gains as the price continues to test the $9,000 ceiling. The Bitcoin market is, however, fickle and sensitive to various elements. For instance, Bitcoin’s biggest daily gain of 2019 came a day after it entered its Death Cross, a trading term meant to signal a bearish period. Hence, this increase in volatility and volume should be taken with a pinch of salt.

Arcane is not quite pessimistic. The report stated that “this time is different,” adding that the increasing volume and volatility are collectively an “upwards trend.”

The post appeared first on AMBCrypto