A recent report indicated that the number of Bitcoin whales has started to decrease following months of increased accumulation. Contrary to most expectations, history shows that retail investors are typically taking advantage of similar conditions, which could signify the beginning of a new run-up.

Bitcoin Whales Accumulation Slows Down

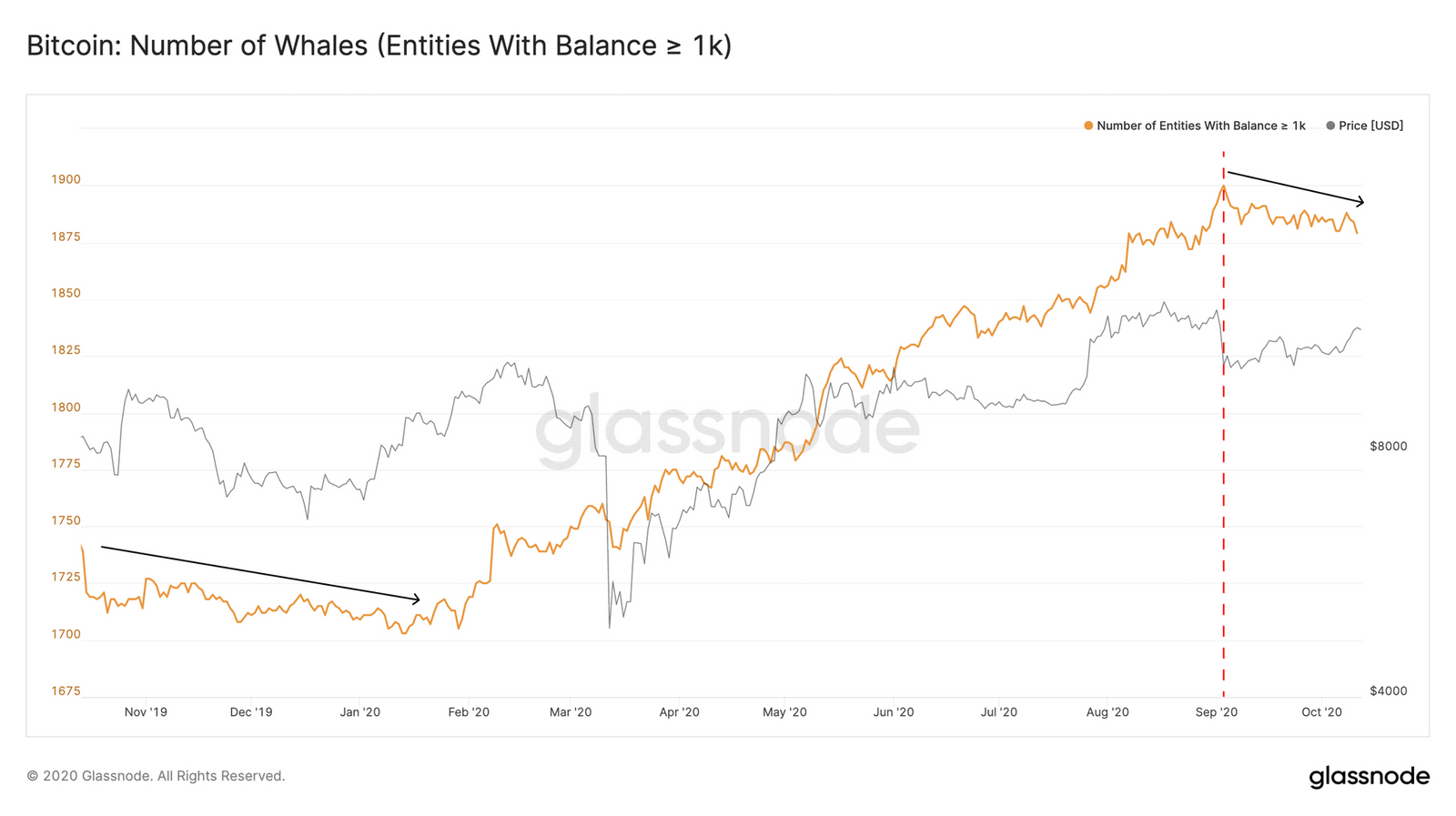

Bitcoin whales are considered addresses that own at least 1,000 BTC. As CryptoPotato reported previously, the number of such entities has been continuously expanding in the past several months. Even after the completion of the third halving, whales kept on accumulating, using most price dips as an opportunity to buy at lower levels.

However, the situation could be reversing as of September. According to data from the popular analytics company Glassnode, “the number of whales has actually started decreasing.” This is the first decline registered in about a year.

The general sentiment among the cryptocurrency community suggests that once whales seize purchasing more of an asset, they are expecting a price drop. However, Glassnode argued that the current developments could work in precisely the opposite manner.

“Historically, the start of a decline in the number of BTC whales has often signified increased interest from retail investors and the beginning of a run-up to a market top.”

The company admitted that the decline is slow and perhaps in its early stages, but it could prompt severe volatility for Bitcoin in the upcoming weeks and months.

No BTC Rush To Exchanges

Usually, when Bitcoin experiences a sharp price increase, many investors are cashing out profits by sending their coins to exchanges to sell them. In the past week, the primary cryptocurrency gained about $1,000, which raised concerns that a similar scenario is about to occur again.

Ki Young Ju, the CEO of another crypto analytics resource CryptoQuant, claimed that this is not the case this time. A company metric dubbed ‘mean exchange inflow’ measures how many bitcoins are transferred to exchanges for trading or selling.

Ju explained that the danger zone is around and above 2 BTC. He reassured that “we are still in the safe zone,” despite the latest price increases.

However, it’s worth noting that the metric has registered a serious increase in the past hours from well below 1 to nearly 1.5. If this trend continues, it could imply upcoming price drops for Bitcoin.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato