Since its inception, Bitcoin has been the most popular payment tool among criminals operating in the markets of the darknet. Even today, with mainstream attention, global regulation, and billions in daily traded volume, the use of the decentralized, censorship-resistant, and universal cryptocurrency has not waned, but its sourcing has changed, which can open up a can of worms going forward.

John Jefferies, chief financial analyst at CipherTrace, a blockchain analytics company told AMBCrypto that, in terms of countries, the biggest recipients of funds coming from criminal sources is Finland. Yes, the Nordic country at the cap of Europe, known for its saunas, lakes and Makkara is where Bitcoin from criminal sources is ending up. Not China, with the highest concentration of miners, the United States, the home of the original Silk Road, or Russia, where the world’s biggest darknet markets are centered, but Finland.

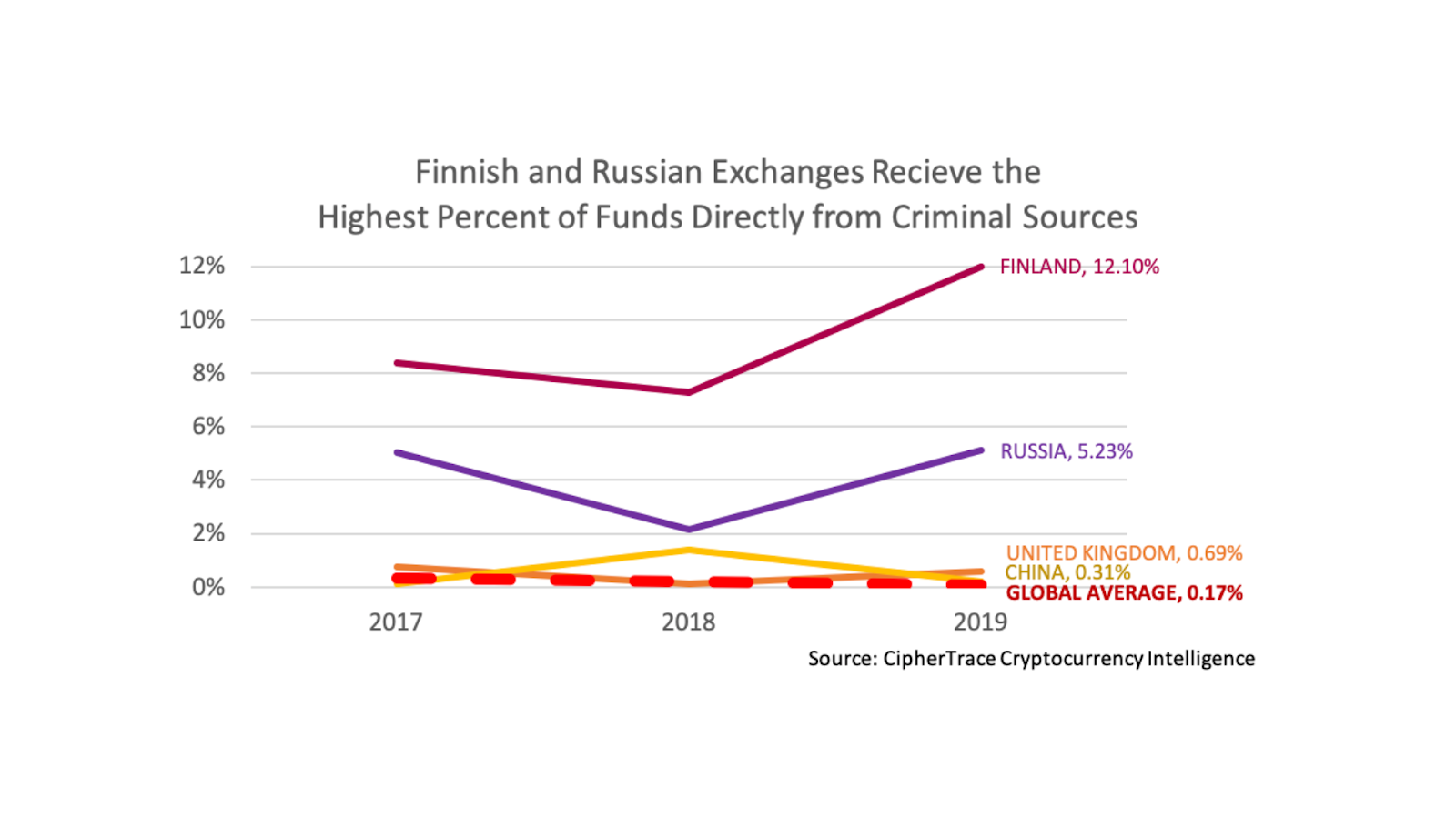

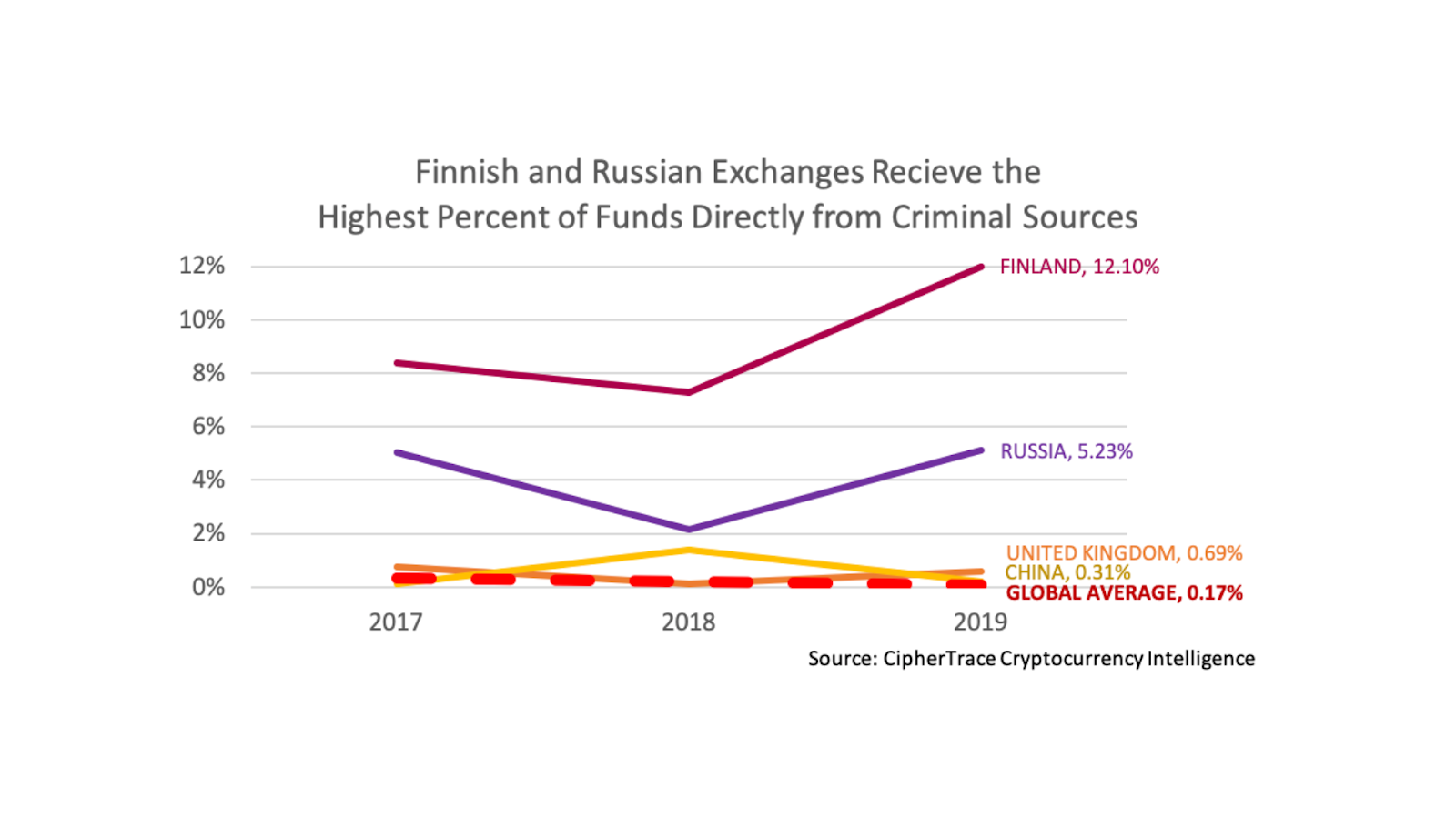

Country origin of exchanges receiving crypto from criminal sources| Source: CipheTrace

The main reason Bitcoin from criminal sources end up in Finnish territory is because of one exchange – LocalBitcoins. Jefferies stated that LocalBitcoins “contributed to the high percentage of funds coming from criminal sources,” speaking generally of the country of origin and more specifically of the P2P exchange.

As can be seen in the chart above, Finnish exchanges contributed 12.1 percent, courtesy of LocalBitcoins, followed by Russian exchanges with 5.21 percent. The United Kingdom and Chinese exchanges complete the top-4 with 0.69 percent and 0.31 percent respectively.

The global average as per CipherTrace if 0.17 percent which means that, on average, for the countries which have cryptocurrency exchanges, they received 0.17 percent of funds directly from criminal sources. While Chinese and British estimates were 1.82 and 4.05 times the global average, the Finnish receipts were 71.17 times the average, emphasizing how important P2P exchanges are to criminal activity.

With this data out there, two questions are pertinent – why the use of P2P exchanges? and is being the recipient of criminal funds their own use? On the first question, P2P exchanges are relatively regulation-lax and simply act as a middleman in transactions. This prevents such exchanges from engaging in financial transactions involving banks and governing bodies of participants countries.

Secondly, P2P exchanges are now seeing rising activity in several countries, many of which aren’t solely because of criminal activity. For instance, the volume of Bitcoin for local fiat currency via P2P exchanges has surged to new-highs in countries like Argentina, Chile, Kenya Nigeria and Lebanon. In other countries, there is a high premium on Bitcoin for local fiat. A key reason for this is because of the dampening economic situation, with some countries in worst strife than others, citizens are turning to Bitcoin for capital flight, and with the absence of a domestic or international spot exchange, they rely on P2P exchanges.

Criminal activity is and will always be a part and parcel of the use of cryptocurrencies, but the universal, censorship-free and decentralized aspects of Bitcoin have another use-case, one which P2P exchanges are a feature of, and not a bug.

The post appeared first on AMBCrypto