Over the past week, the crypto-market seemed to gain a new lease of life after the world’s largest cryptocurrency, Bitcoin, went past its crucial resistance at $11k. In fact, 2020 has proved to be, in more ways than one, a key year for digital assets, including Bitcoin. However, as more users find cryptocurrencies and digital assets to be more accessible, certain questions rear their heads. For instance, since many of the market’s altcoins fared so well when Bitcoin was stagnating, is the crypto-market about to note a sudden shift in how it operates?

During a recent episode of The Scoop podcast, Steve Ehrlich, CEO at Voyager, discussed issues pertaining to Bitcoin and how in recent years, the crypto-market has diversified dramatically. Ehrlich went on to say that it is a mistake for users to think of crypto exclusively in terms of Bitcoin. Over the last decade, with the digital assets market growing quite substantially, varying assets that cater to different demographics have emerged. Ehrlich highlighted,

“I do believe that the market’s so much bigger and deeper than Bitcoin, and it’s just a mistake being made…That’d be like saying, I only want to invest in just a handful of stocks. There’s so much more to the infrastructure and what’s being built on the crypto side.”

The past month demonstrated how many of the market’s altcoins were able to initiate their own rallies, despite Bitcoin being hindered by the $10k resistance. Voyager’s CEO argued that crypto has seen increased adoption OVER the past month, adding that in the month of July, close to 80% of all trading and investing was centered around non-Bitcoin assets.

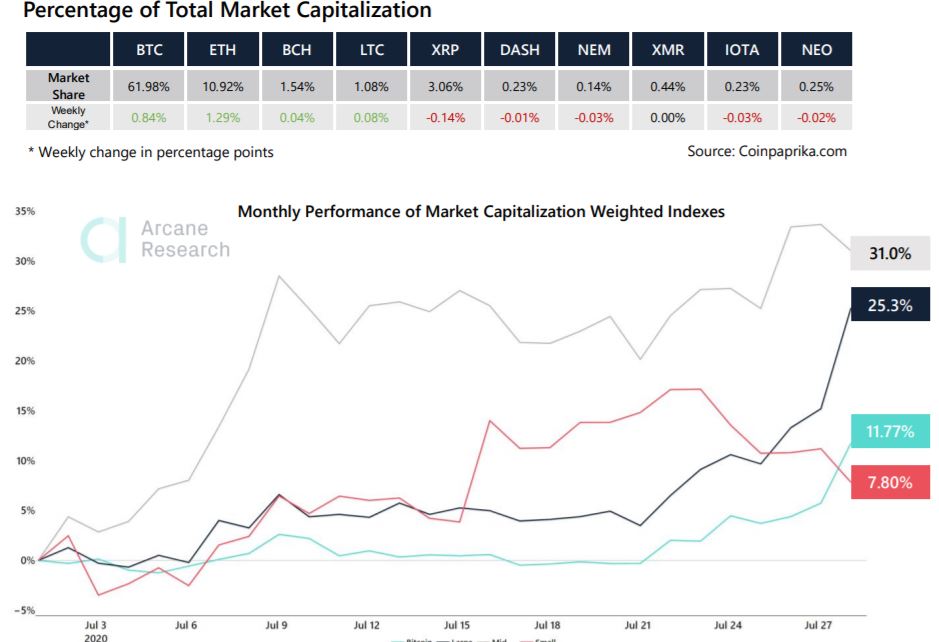

Interestingly, according to data provided by Arcane Research’s latest report, there has been a surge in mid-cap cryptos, with many of these assets posting notable returns. That being said, Bitcoin’s dominance across the market remains overwhelming, despite the word’s second-largest crypto registering significant gains.

Ehrlich also claimed that these crypto-assets need to be developed to bring about a ‘deeper crypto-market’ for its users and customers. For many traders dealing with crypto and digital assets, this ‘deeper crypto-market’ not only entails more diversity in coins, but allows users to take advantage of a market that is more than just Bitcoin. He said,

“All those things that traders and investors are used to seeing on the traditional online brokerage products, that aren’t the professional trading solutions. Those are what I consider a deeper product for crypto.”

The post appeared first on AMBCrypto