Bitcoin’s push over $10,000 was long-awaited. After nearly three months of trading flat, Bitcoin jumped out of its most stagnant trading period since March 2019 with an ascent over $10,000. Now, it looks like this move has awakened a sleeping giant that was waiting to pounce on a bullish market.

According to a recent report by Chainalysis, the stagnancy in Bitcoin’s price contributed to a stagnancy in the movement of the cryptocurrency. The report stated that by early-July 2020, a time when the price was $9,200, 56 percent of all mined Bitcoin was held at its “current address for more than a year.” This meant that a clear majority of all Bitcoin had not been moved and remained stagnant, despite the price ranging between $5,000 to $13,000 in the past year.

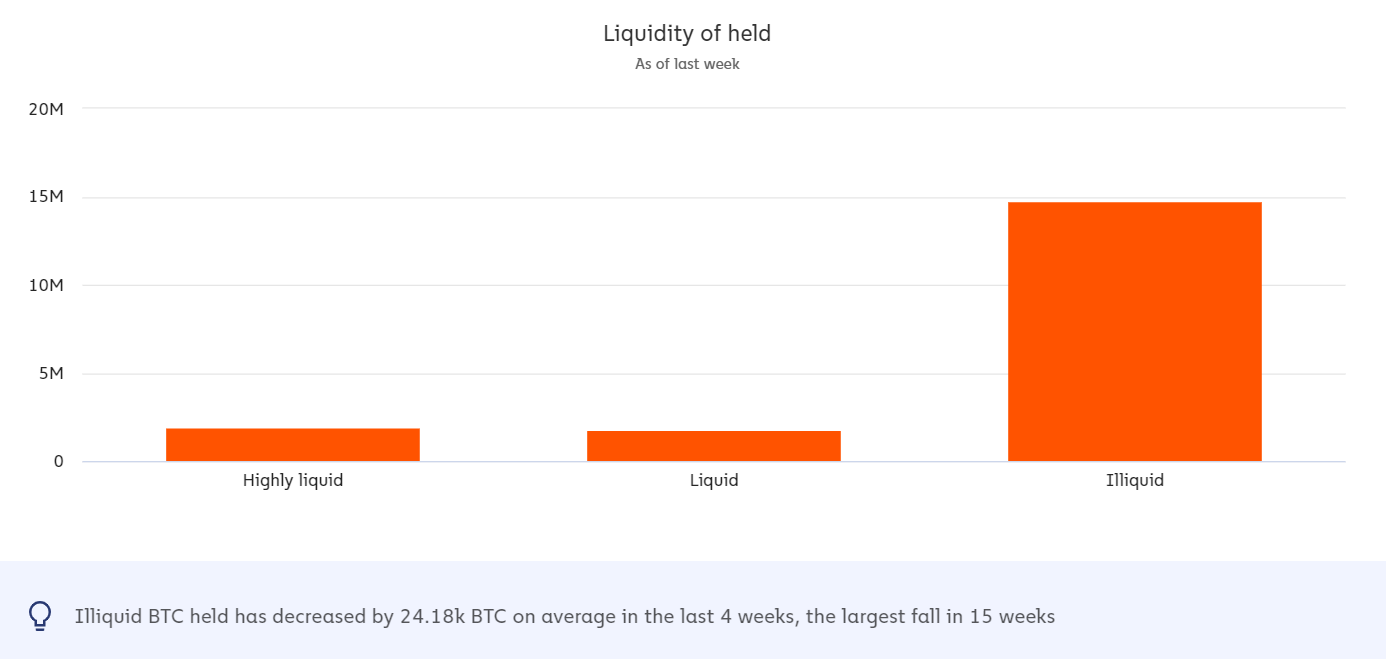

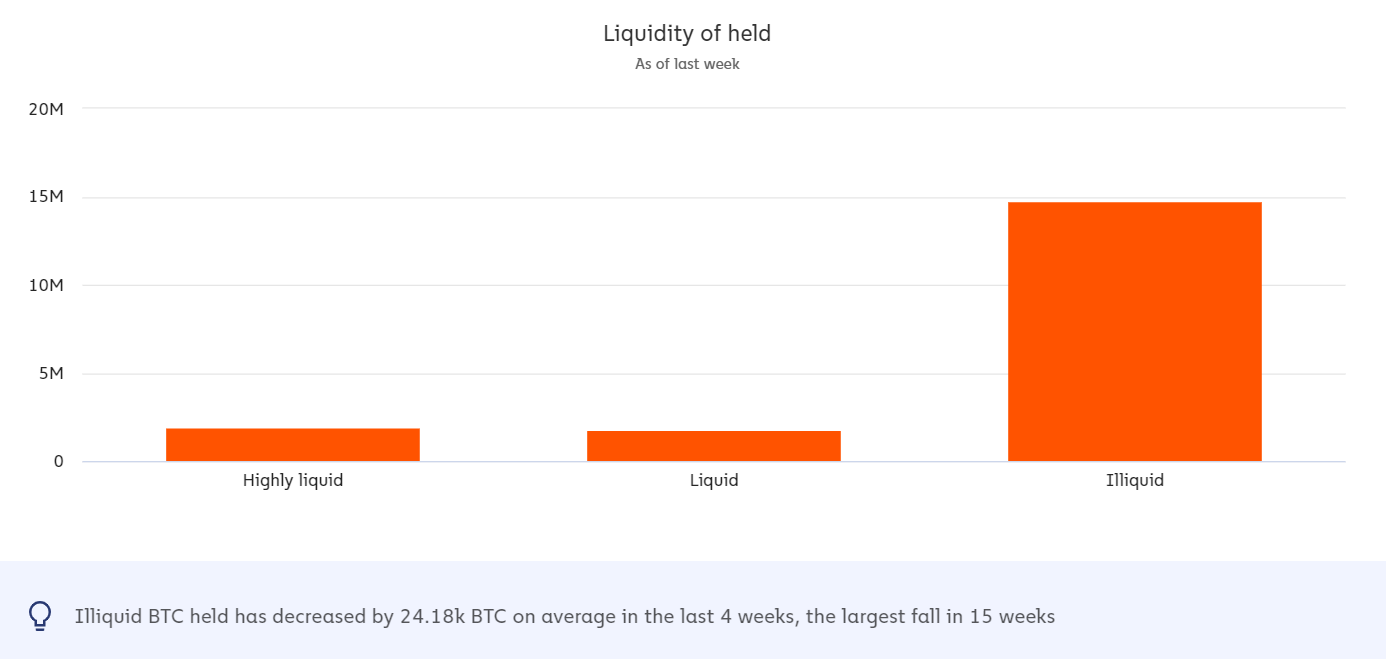

Further, of these mined Bitcoin, 80 percent were “illiquid.” The report defined “illiquid” as Bitcoin “held by an entity, in a wallet or group of connected addresses, which sends on average less than one-quarter of the Bitcoin they receive.” This means that of all the Bitcoin mined, 80 percent saw less than a fourth of liquidations as defined by sending any Bitcoin received.

The conclusion of the report reiterated the ‘hodling’ sentiment of most investors,

“This data leads us to conclude that most Bitcoin is held as a long-term investment and rarely moves. “

In fact, the “old, cold Bitcoin” trend continued in Q2 of 2020 [April – June] with an increase of 3 percent in “illiquid” Bitcoin and 2 percent in stagnant Bitcoin compared to the previous quarter. A reason for this increase could be the lack of price action since May, or the halving scheduled for the middle of the quarter.

Discarding lost and other longer-locked Bitcoins, the 10 percent of minority Bitcoin which saw movement, an estimated 1.77 million Bitcoin, priced at $15 billion, saw ‘rapid trading.’ Among these Bitcoin, 81 percent or 1.43 million BTC was held for “less than two weeks before being sent” and 67 percent or 1.18 million BTC was held by “highly liquid entities” or entities that send more than 75 percent of all cryptos they receive.

Focusing on the “illiquid” Bitcoin mentioned previously, how did they react to this week’s market movement? While it is still too early to say, there are inklings of these dormant wallets awakening to the move.

Bitcoin liquidity of Bitcoin held | Source: Chainalysis markets

According to Chainalysis markets, “illiquid” Bitcoin noted a massive fall. Over the past four weeks, “illiquid” Bitcoin decreased by 24,180 BTC on average, its largest fall in since April. While the number 24,180 BTC in absolute terms represents $265.98 million, in percentage terms, it represents a 0.13 percent drop in “illiquid” Bitcoin from 79.92 percent of all Bitcoin mined to 79.79 percent.

Still, these dormant accounts were inactive when the price was higher at $13,000 and now, when the price is at $11,500, they have made a $268 million transfer. That is notable, to say the least.

The post appeared first on AMBCrypto