Since Bitcoin’s inception, the world’s largest cryptocurrency is up by 12 million percent. 12M percent, and no, that is not a t1ypo. The price of Bitcoin was up by 12,173,746%, as of writing, and this was not even Bitcoin’s ATH. However, while outsiders may be surprised by the scale of the growth, the point is that this is by design, and not by coincidence.

Source: BTCUSD on TradingView

When Bitcoin’s short-term time frame was considered, the cryptocurrency’s price looked bad, especially given its inverse correlation with the Dollar Index and an undeniable correlation with the U.S. stock market. However, it is a short-term outlook and hence, it will last for just a short duration of time.

Before getting into it further, it is worth mentioning that central banks around the world have been intervening with the natural flow of economic cycles. The outcome of this is rampant inflation. This helps not only the stock market, but Bitcoin too.

Bitcoin’s fundamentals

There is a multitude of reasons why, in the long-term, Bitcoin’s price and fundamentals are looking optimistic. Here are a few worth mentioning,

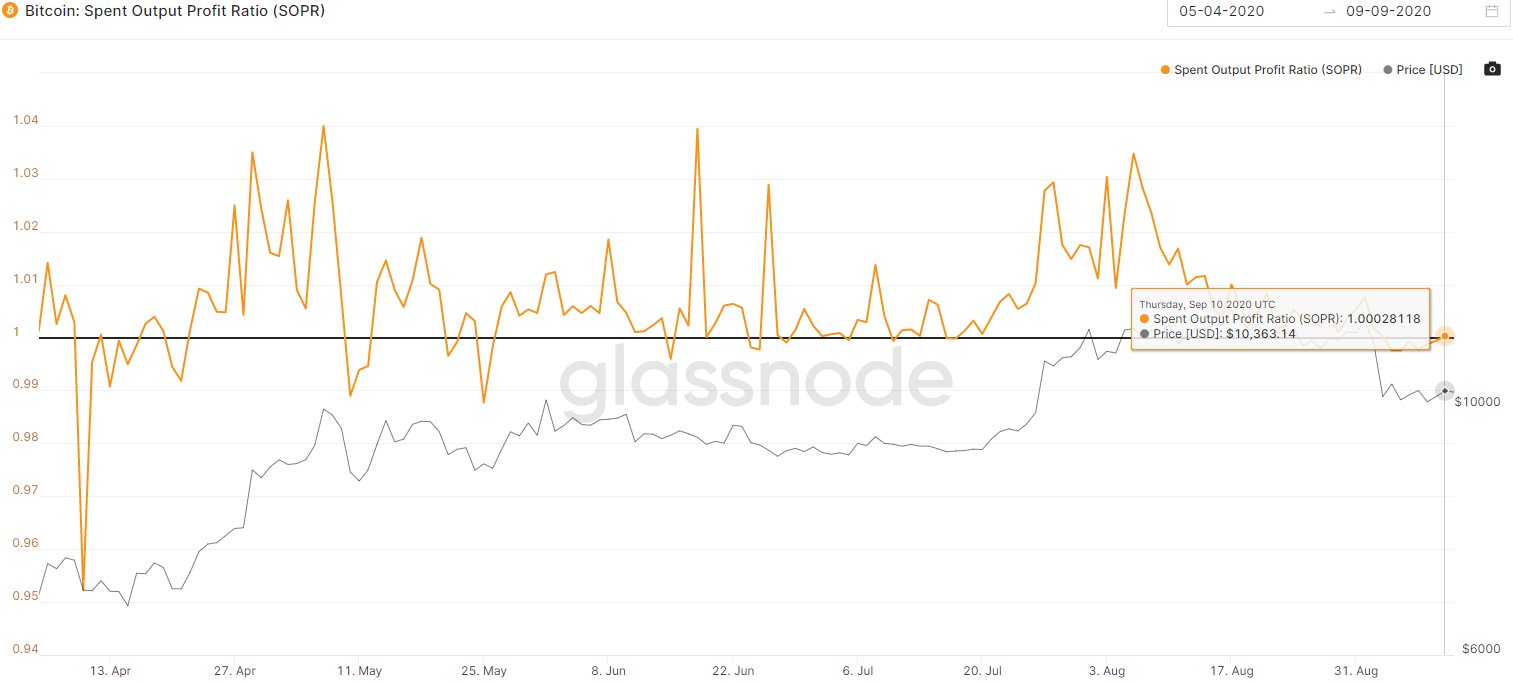

SOPR ratio

Source: Glassnode

Spent Output Profit Ration measures if Bitcoin hodlers are in profit. It is calculated by dividing ‘price sold’ by ‘price paid.’ When SOPR > 1, it means that the owners of the spent outputs are in profit at the time of the transaction; otherwise, they are at a loss. As can be observed, at the time of writing, the SOPR was well above 1.

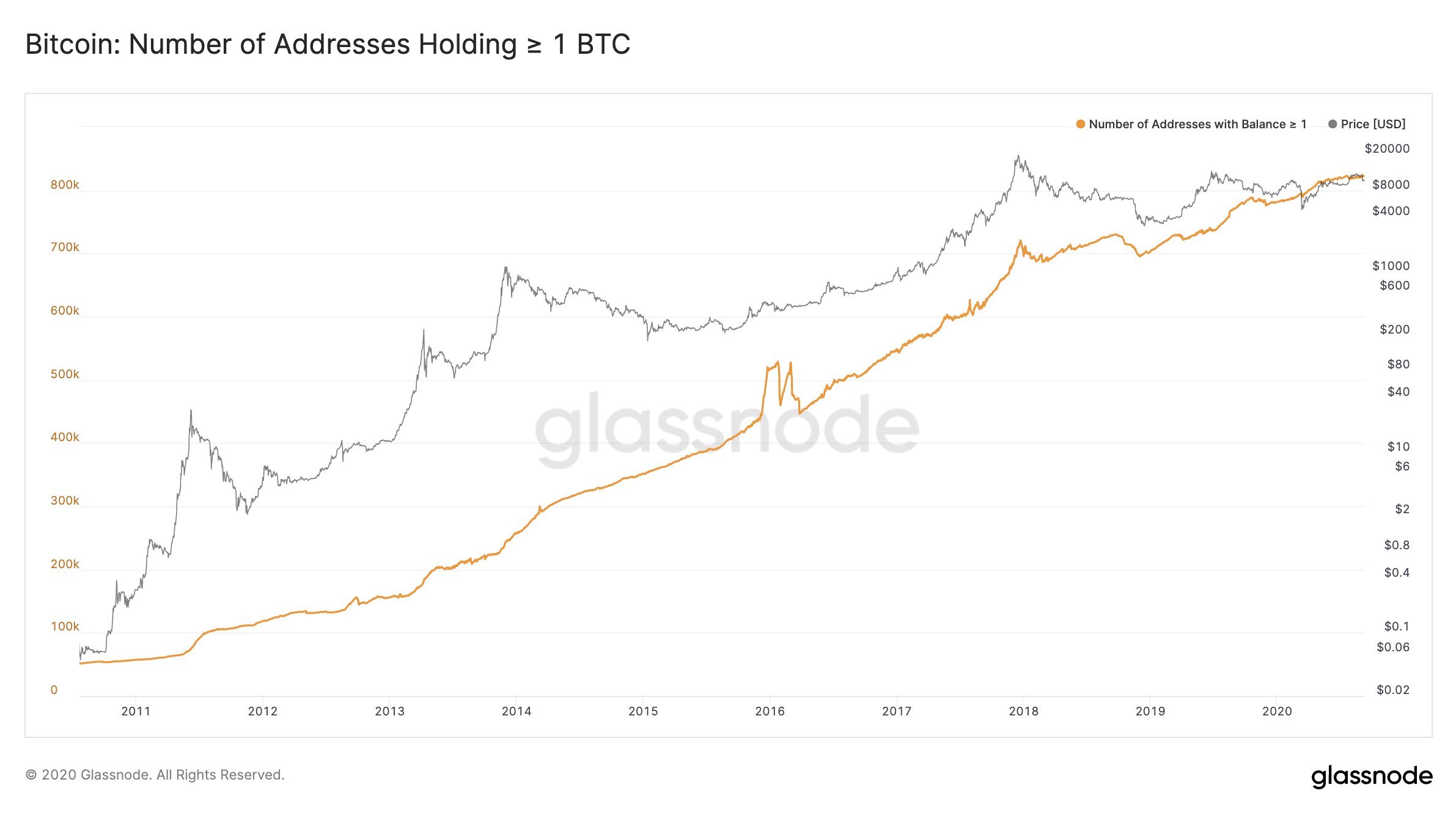

Bitcoin hodlers

Source: Glassnode

The number of Bitcoin hodlers holding more than 1 BTC have increased over the past few months. This shows that people are constantly stacking sats. Considering Bitcoin’s multiple dips below the $10,000-mark and instant retracements higher, we can conclude that this is a liquidity pocket. Breaching beyond this pocket would be bearish, however, we have managed to survive the recent crash because of this.

A growing number of hodlers stacking sats, combined with an SOPR that is greater than 1, makes it clear that Bitcoin is growing strong as a network.

The bigger picture

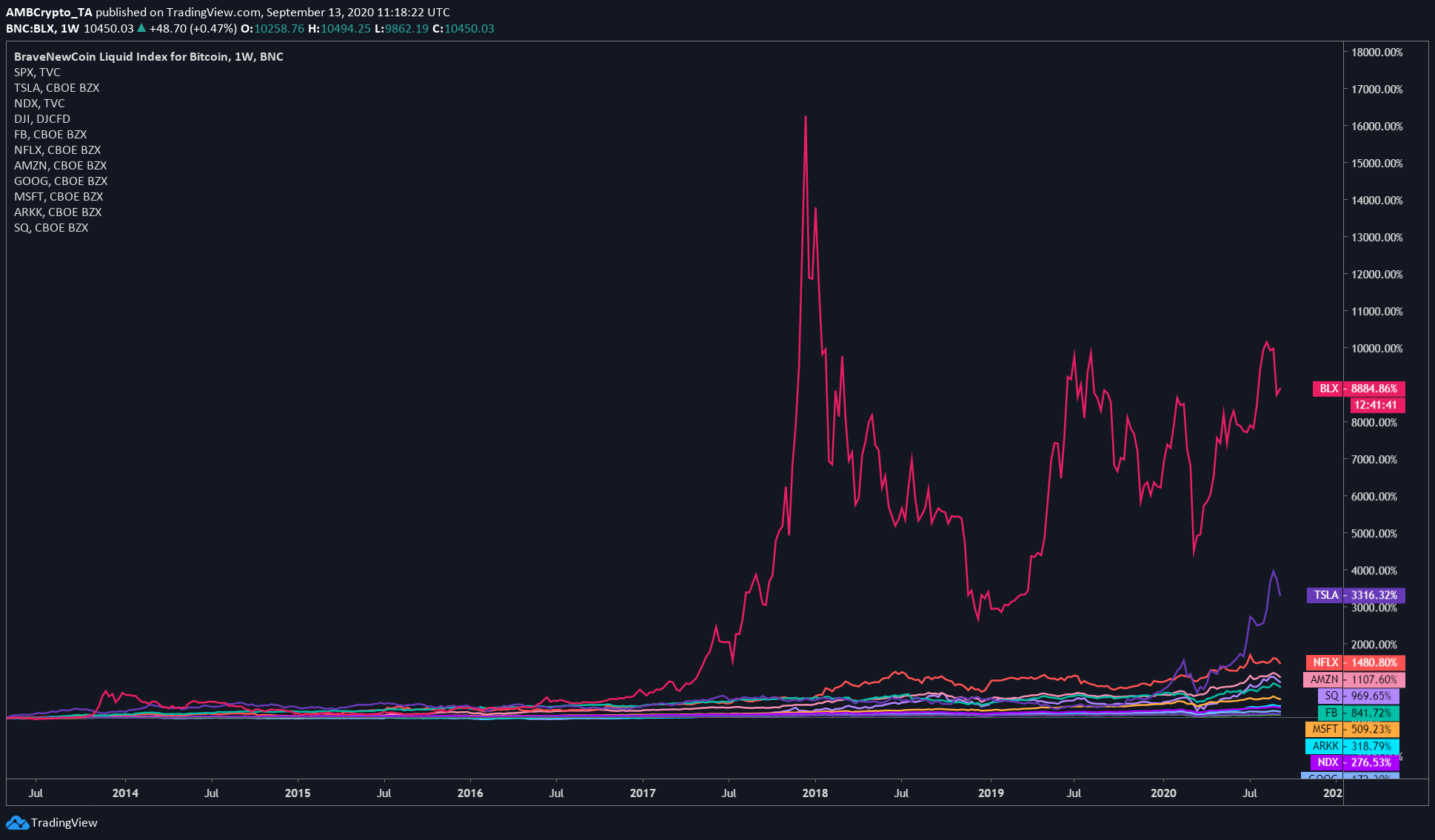

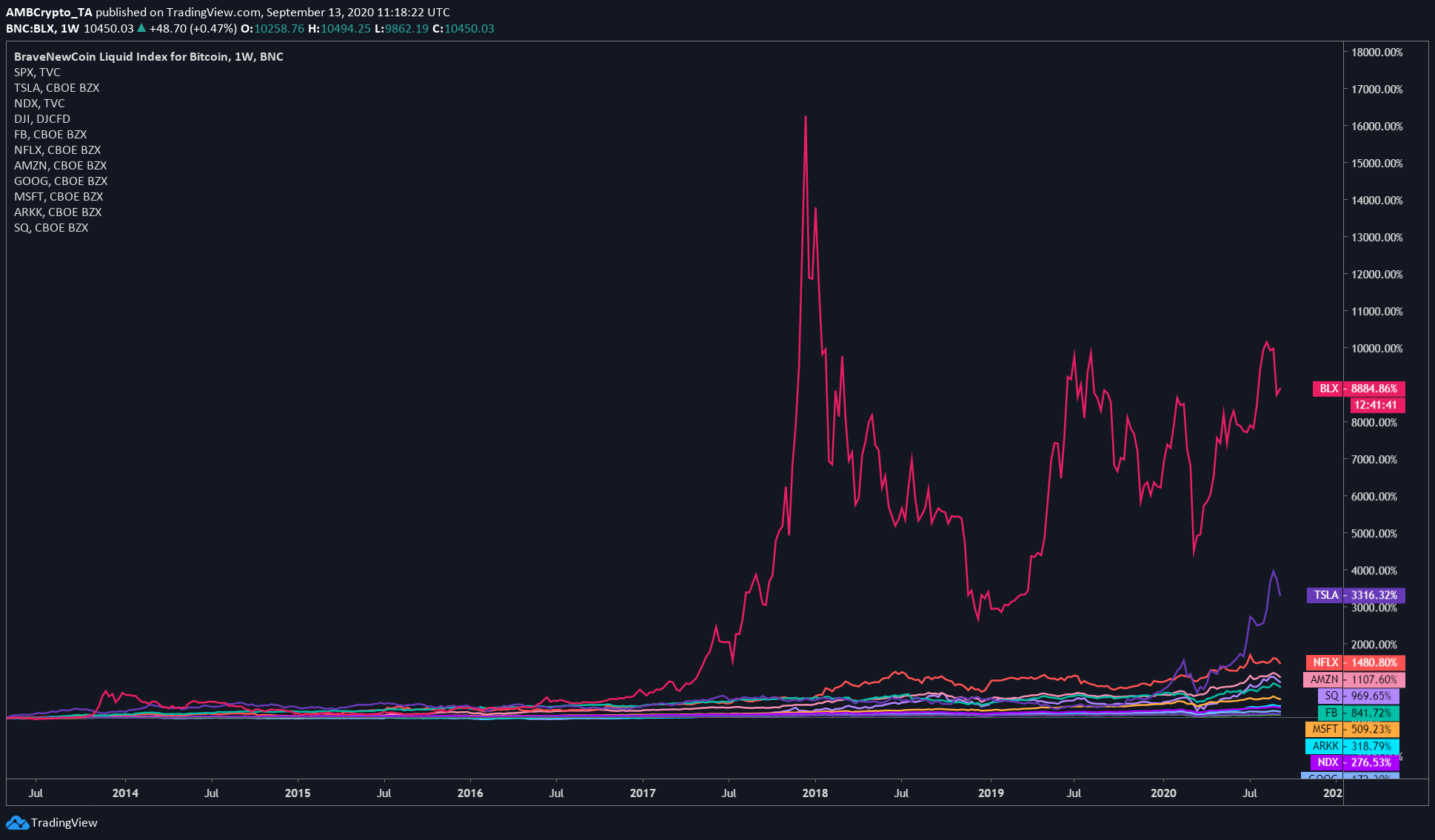

Source: TradingView

The attached chart traces the performance of assets like Google, Amazon, Microsoft, Square, Amazon, Tesla, Ark Invest, and other ETFs. As can be seen, clearly, Bitcoin is a winner, and no asset outperforms it. In fact, no asset even comes close to it.

This just goes to show what we can expect from Bitcoin, especially with the current inflation levels. We can thus look forward to hyperbitcoinization and Bitcoin in the six-digits.

The post appeared first on AMBCrypto