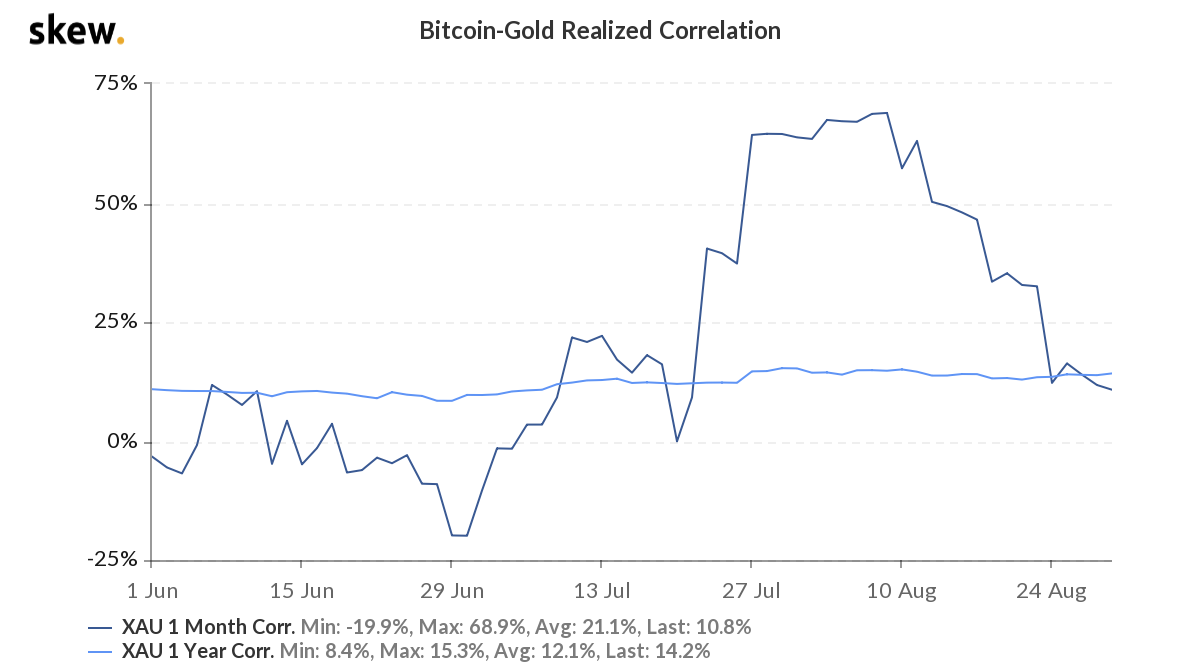

Bitcoin wasn’t created as a normal equity investment. However, analysts have correlated it with Gold and S&P 500 every cycle. This is drawing speculative traders in, and Bitcoin is being purchased for its investment value. However is the store of value narrative is dying a slow death, with this week’s Bitcoin Gold correlation at 10% – the lowest since June 2020.

Source: Skew

Many investors look out for correlation and other signs due to Bitcoin’s lack of guaranteed RoI. However, comparing Bitcoin with traditional assets gives insights into its effect on a portfolio that is a mix of traditional and new age assets. Stock day traders considering entering into substantial investments in Bitcoin are watching correlation for the impact that it will have on their passively managed portfolio. They are curious whether exposure to Bitcoin is replicated using a combination of existing financial assets? The reasoning is that there are still substantial risks to owning Bitcoin.

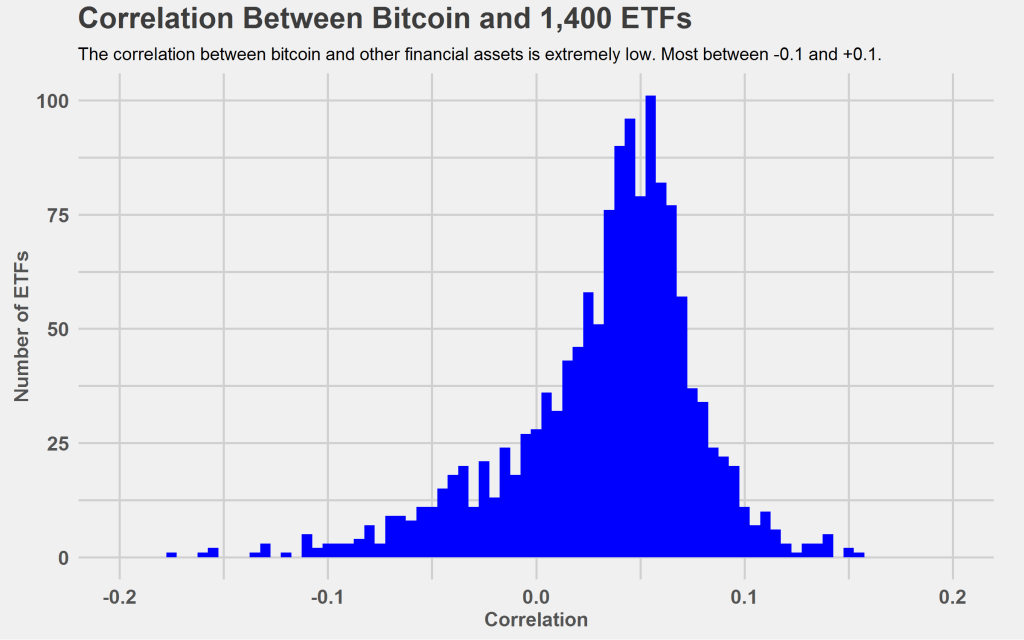

To answer this question, Bitcoin’s correlation with gold and the S&P 500 has been very popular. However, it varies close to zero on both positive and negative sides in the 1-year chart by Skew. It may be one of the many ways of predicting Bitcoin price movements, but not the only one. To test Bitcoin’s correlation with other assets, the brute force method is applied. Weekly returns of all major ETF offerings of the past 5 years (1500+) have been considered here.

Source: Signalplot

All ETFs with over $10 M AUM have been considered here. The best interpretation here is that the correlation between Bitcoin and other financial assets is low, between -0.1 and +0.1. It is lower than gold and the S&P 500 if compared for the past 90 days.

This weak correlation can be attributed to the fact that Bitcoin’s price action is similar to that of gold and S&P 500 in scenarios such as a global market crash or geopolitical unrest. However, this does not reflect in correlation with ETFs. Bitcoin makes an ideal addition to a portfolio that holds risky assets from global markets. Adding a highly correlated asset to a portfolio makes it a hedge against risks from other assets. Its weak correlation with over 1500 ETFs makes it the best bet for diversification of portfolios.

The post appeared first on AMBCrypto