Bitcoin, despite its recent sideways movement on the charts, has a very positive outlook attached to it. Hodlers of the cryptocurrency have long been optimistic about BTC’s long-term price trend. However, with the MicroStrategy, Square Inc., and Stone Ridge’s news breaking out over the past few weeks, it would seem that institutions, en-masse, are buying into the hype too. And thanks to so many parties now boarding the Bitcoin hype train, Bitcoin’s distribution trends have become diverse too.

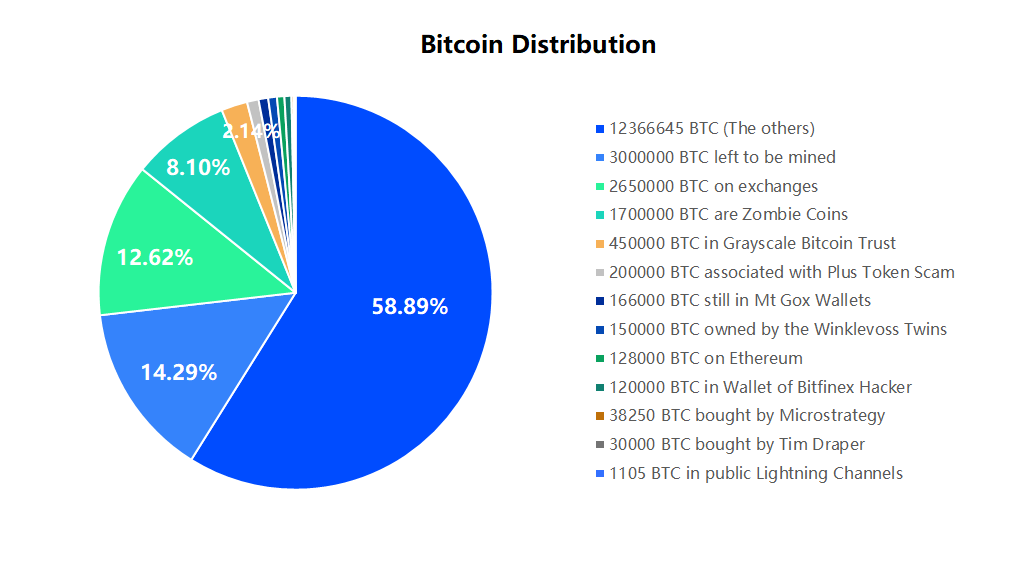

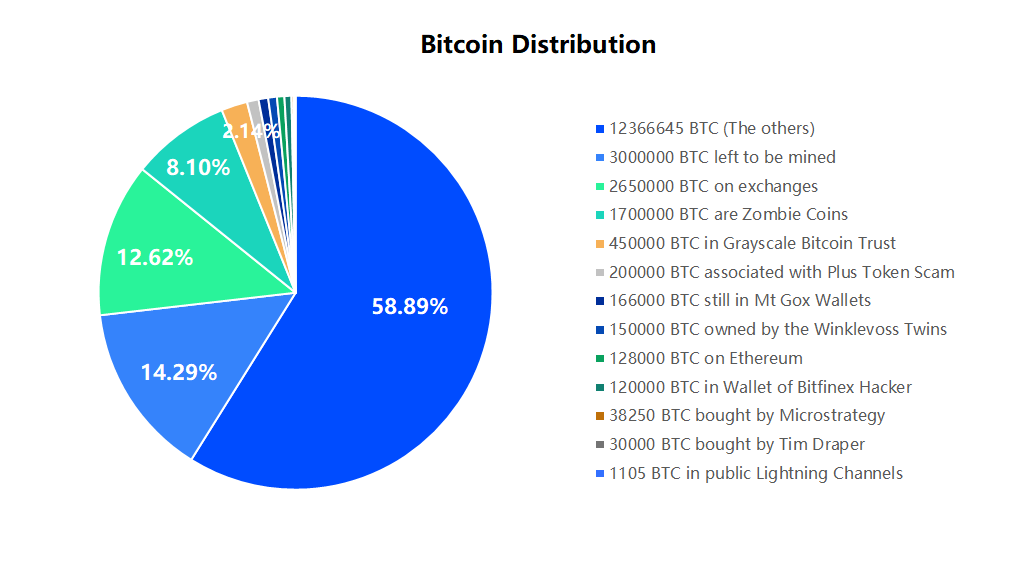

The same was highlighted by OKEx CEO Jay Hao in a recent blog post, with the exec using data sourced from BlockchainCenter.net to make his case. Hao classified and compartmentalized the distribution of Bitcoin mainly into five categories, namely, 1) Bitcoin held by exchanges, 2) Bitcoin held by giants, 3) Bitcoin held by the application ecosystem, 4) Zombie and Scam Bitcoin, and 5) Bitcoin left to mine and others. For the purpose of this article, let’s just stick to 2), or Bitcoin held by giants.

Source: LinkedIn

Getting to the “why” of it all

Now this category, as Hao highlighted, accounts for a share of 3%. Under the same, not only are publicly-traded companies like MicroStrategy, Square Inc., Grayscale Bitcoin Trust, and CoinShares included but so are individuals like Tim Draper and the Winklevii. All well and good, right? Well, not quite.

Now, the blog post in question is fairly expansive and explanatory, and at first glance, there’s not much wrong with it. However, look closely, and something feels amiss – It has failed to highlight the fact that Bitcoin, the world’s largest cryptocurrency, does not have An investment thesis. Wait, let me rephrase – Bitcoin doesn’t have just ONE investment thesis.

Think about it – Have Bitcoin distribution trends accounted for the fact that different entities have dived into Bitcoin with different rationales in mind? When the first reports about MicroStrategy and Square Inc. betting on Bitcoin broke out, how many of us looked for a rationale? While these institutions did offer a custom dictionary of adjectives to go with the announcement to say something along the lines of “Bitcoin is the next big thing” and whatnot, the “why” was overwhelmed by speculations around the impact of these announcements.

Even when institutional execs did offer a perceptive view of why they got involved with Bitcoin (As MicroStrategy’s Michael Saylor did), the “why” of it all was lost in the shuffle. And because most in the community are not interested in the “why” or the rationale behind it all, distribution trends don’t account for it either. Consequentially, these trends also perpetuate the notion that entities get into Bitcoin and cryptocurrencies for one reason only.

Singularity? Nada!

Rationale is an important aspect to consider, especially since different entities approach the crypto-market from different perspectives. The same was recently highlighted by Arca CIO Jeff Dorman in one of his recent blogs. Dorman pointed out that while Managed Futures investors claim BTC as a commodity, alternative growth investors see it as an uncorrelated growth asset. Further, while Algo/Quant funds see Bitcoin as a trading vehicle, market makers use BTC as collateral.

Here, the point is that there’s no uniformity. In rationale, nor in perspective. This is the case even when entities are supposedly clubbed together (As Jay Hao did when he put MicroStrategy and Square Inc. under the same bracket for the Bitcoin held by giants category). Fidelity Investments’ Ria Bhutoria was one of those to pick up on this as she tweeted,

$SQ rationale:

– instrument for economic empowerment

– global monetary system

– more ubiquitous currency in the future $MSTR rationale

– dependable store of value

– attractive investment assetBitcoin’s success is not predicated on serving a singular purpose https://t.co/gvoa0Y6GQu

— ria(search) (@riabhutoria) October 8, 2020

Bitcoin’s success is not predicated on serving a singular purpose. That is true, and that is something distribution trends fail to identify and account for.

That’s not all, however, as the lack of proper identification comes with its own spillover effect. Because such distribution trends don’t account for rationale, perspective, or a proper investment thesis, it’s very difficult to get some clarity on why any of these entities might want to bail themselves out or redistribute their holdings in the future. How can you know why they are getting out if you don’t know why they got in? Well, the answer is you can’t.

In fact, one can argue that incomplete distribution trends are a product of the lack of weight given to Bitcoin’s own evolution over the years. Think about it – Bitcoin evolved from an idea for a peer-to-peer electronic cash system to a predominantly store-of-value asset. Bitcoin has changed. So have perspectives, and so should distribution trends.

Epilogue

OKEx CEO Jay Hao concluded his blog post by stating that Bitcoin is becoming “more and more rare.” That is true, however, while scarcity is a value, it isn’t the sole value Bitcoin has. Every entity has a different investment thesis behind wanting to get into Bitcoin and each investment thesis gauges different values differently. It’s time the community recognizes that.

The post appeared first on AMBCrypto