The cryptocurrency market went through a turbulent week, as the price of all major digital assets went on a rollercoaster. One thing, however, is making an impression and it’s the fact that Bitcoin is once again claiming the majority of the market share as its dominance spikes up notably.

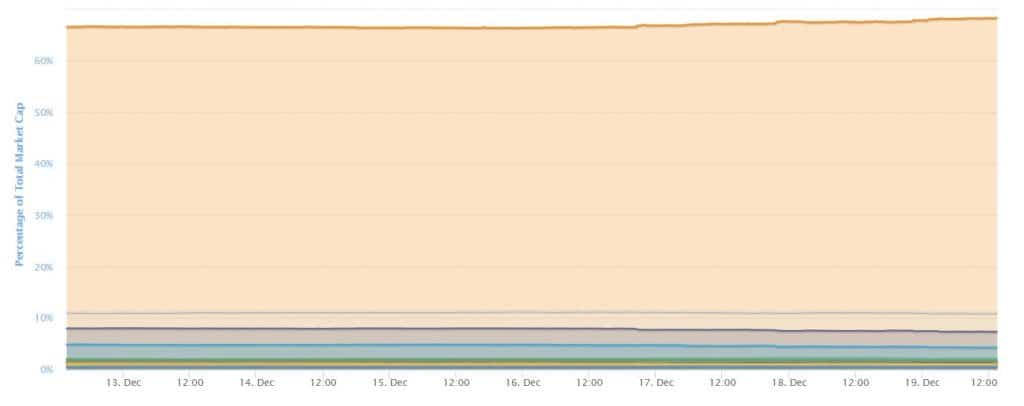

Bitcoin Dominance At 68.3%

BTC dominance is an index that measures the relative share of Bitcoin in the entire market capitalization. At the time of this writing, it stands at 68.3%, which is an increase of more than 1.7% in the past 7 days alone.

BTC Dominance. Source: CoinMarketCap

One of the things that can be drawn as a conclusion from the fact that BTC’s dominance is increasing is that the altcoin market is going through a decline. It means that alternative cryptocurrencies struggle to keep up with Bitcoin and its price.

Indeed, BTC went through a lot over the past couple of days. Yesterday, it lost a serious chunk of its dollar value, going down to $6,500. This completed a prolonged period of decrease, as, over the past 10 days, Bitcoin had lost over $1,100 or about 15% of its price.

However, the price bounced back and it’s currently trading at around $7,100. Nevertheless, as Cryptopotato reported, Bitcoin is not out of danger yet, as it would have to break above $7,700 to be considered bullish once again.

Altcoins Paint Red Against Bitcoin

As mentioned above, increasing BTC dominance suggests that altcoins are struggling. While almost all of them managed to mark a slight recovery when trading against the USD, the majority is bleeding out against Bitcoin.

Cryptocurrency Market Overview. Source: Coin360

Some of the most notable losses include ETH, which is down about 5.3%, XRP, down 4%, Litecoin, Binance Coin, TRON, Tezos, and so forth. In other words, every single cryptocurrency from the top 20 besides EOS and ATOM are in the red when trading against Bitcoin.

In any case, it remains particularly interesting to see which way the market will head, especially now that we are a week before Christmas and the end of this century.

You might also like:

The post appeared first on CryptoPotato