The cryptocurrency market in 2019 underwent a rough journey, with major cryptos riding the tides one moment, and collapsing the other. Bitcoin, that noted triple digits YTD returns until earlier this year, remained profitable with 86% yield, at press time, to the investors. The price of the coin peaked in 2019 at $13,880 on 26 June, after which it started shrinking in value, but with the 2020 halving approaching, most analysts remain optimistic about the price.

A recent report from Coin Metrics highlighted similar speculation:

“The few historical instances of block reward reductions have been associated with increases in price in Bitcoin and Ethereum within the first 1.5 years of the halving. For this reason, an upcoming block reward reduction is often cited as a reason to be bullish about an asset’s future price appreciation.”

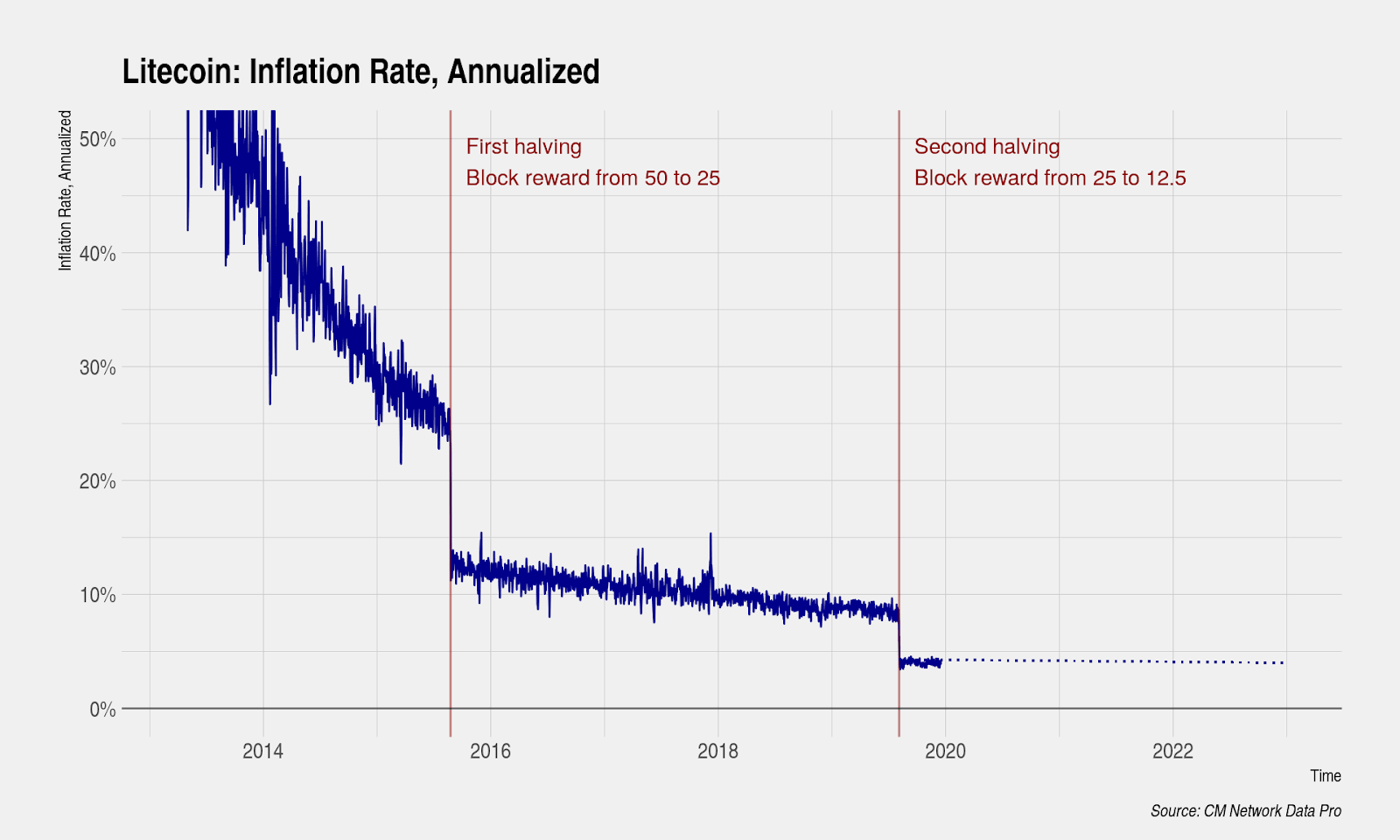

Meanwhile, Litecoin, initially launched as a Bitcoin fork, experienced the second halving event in August 2019, but unlike the predictions of a spiking price, LTC lost 62.14% of its value since the beginning of the halving month. Its second halving divided the block reward from 25 LTC to 12.5 LTC and there has been a discussion of whether or not block reward halvings are priced in.

While the efficient market hypothesis [EMH] stated that:

“…block reward halvings are mandated in the protocol and are well-known to all market participants far in advance. Since all information regarding halvings is already known, any impact that halvings have on supply-side dynamics or price should be fully reflected in the cryptoasset’s price.”

However, detractors of this theory were of the opinion that not all market participants are aware of the existence or significance of halvings, and they will act on this phenomenon when halving date nears. Counter-arguments were not compatible with the ‘halvings are priced in’ theory.

“The EMH does not require all market participants or even a majority of market participants to be aware of information for prices to fully reflect that information. “

A small fraction with enough control over the capital can act upon this information to force the price to swing, noted the report. Even though empirical data supported the interpretation of EMH, the halving might take months to indicate a price fluctuation and may take place due to the market’s understanding of the impact of a reduction in miner-led selling. As per the theory, miner-led selling pressure is significant and small perturbations in the amount miners- sell can impact the price.

Source: Coin Metrics

Although critics assume the number of miners to be far less compared to all the trading volume occurring within exchanges and on-chain, there was no data available on capital inflows and outflows into a cryptocurrency, raising the likelihood that the majority of trading taking place did not represent a net inflow or outflow of fiat.

“Under this perspective, miner-led selling pressure may represent a large amount of net capital outflow of a cryptoasset.”

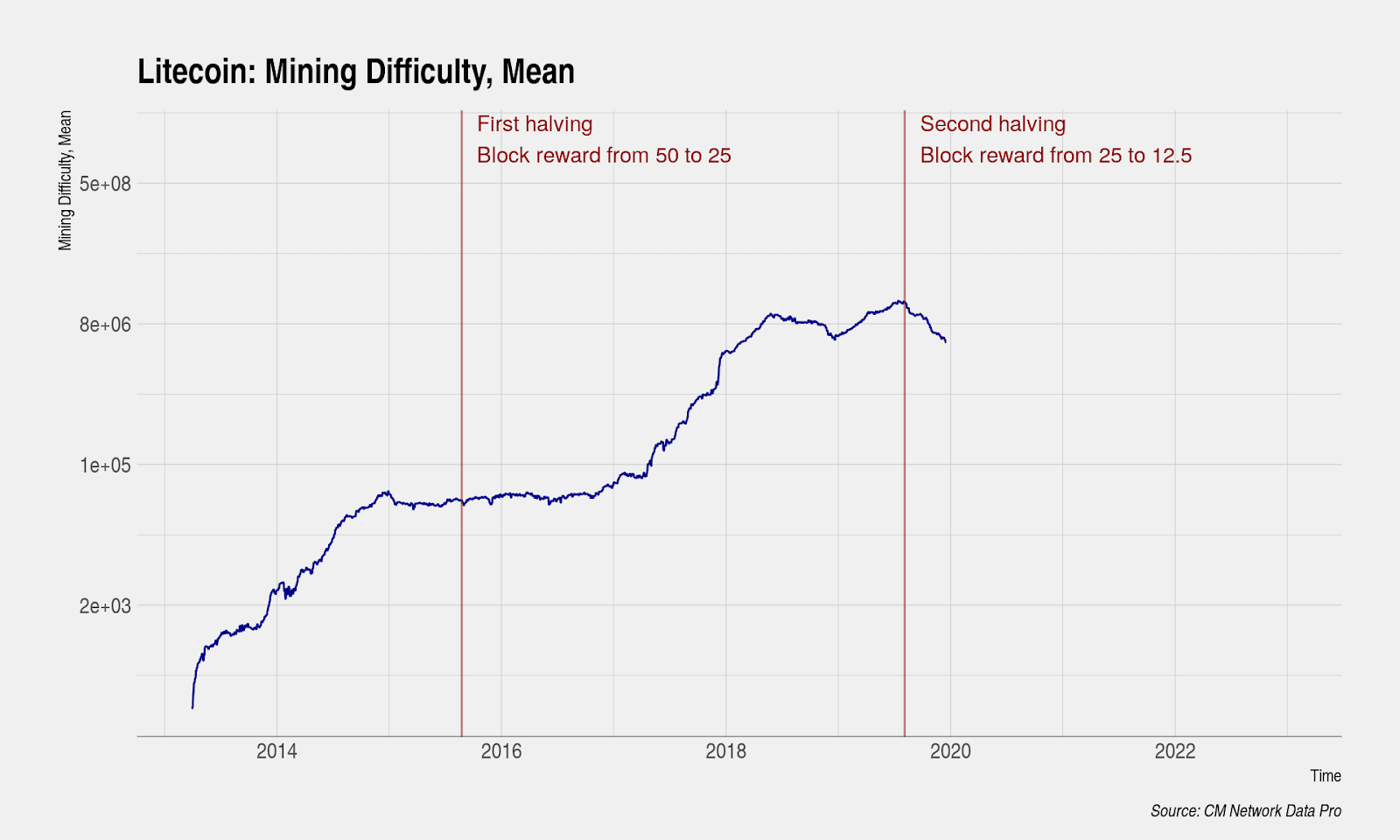

Litecoin‘s price started to climb before the halving due to “anticipation trade” causing sell-off in advance of the event, but has been negative ever since reflecting an unwinding of the “anticipation trade.” This decline in price caused a sharp decline in mining difficulty and is estimated to approach two-year lows.

Source: Coin Metrics

Apart from Bitcoin halving in 2020, other crypto-assets like Bitcoin Cash [BCH], Bitcoin Cash SV [BSV], and Zcash [ZEC] will undergo block reward halving and put these theories to test.

Source: CoinStats

The post appeared first on AMBCrypto