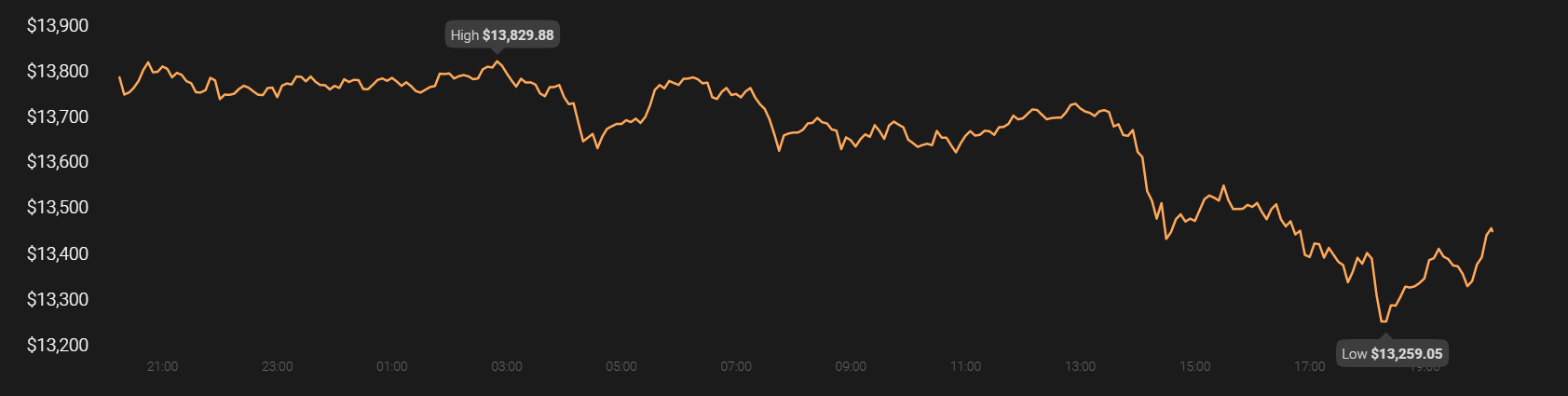

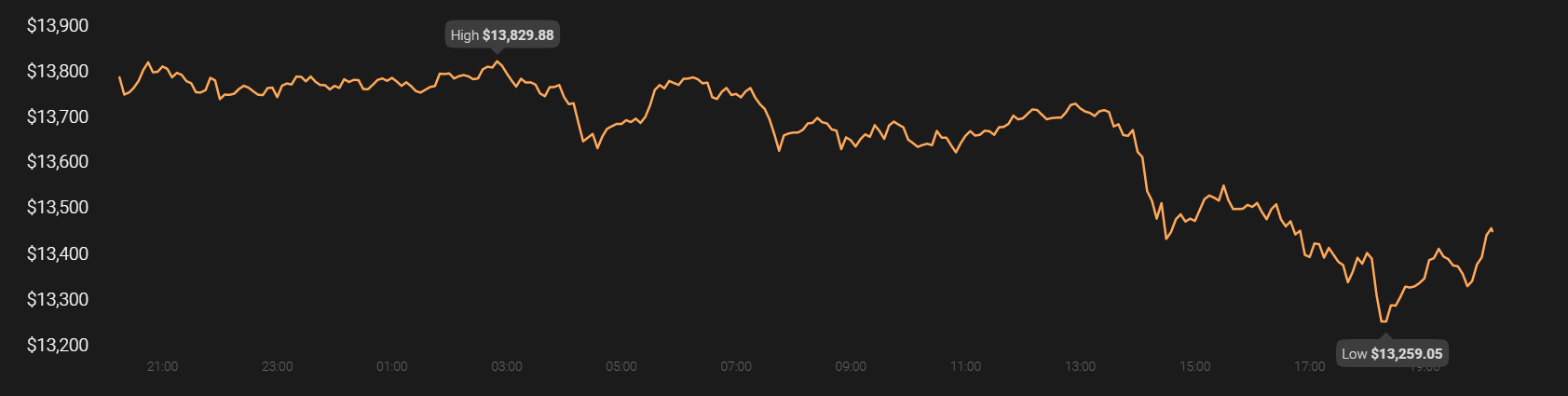

With Bitcoin’s price rallying above $13,700, the Bitcoin market has captivated all institutional investors, more than it did in 2017. Institutional money is pouring into Bitcoin and it can be argued that the present stage of the price rally is like an institutional macro stage.

Bitcoin’s spot and derivatives markets have differentiated themselves from other cryptocurrency assets and markets. Though implied volatility forecasts for top altcoins like Ethereum suggest that the volatility spread with Bitcoin is dropping, it may hold true only until a breakout in Bitcoin’s price rally.

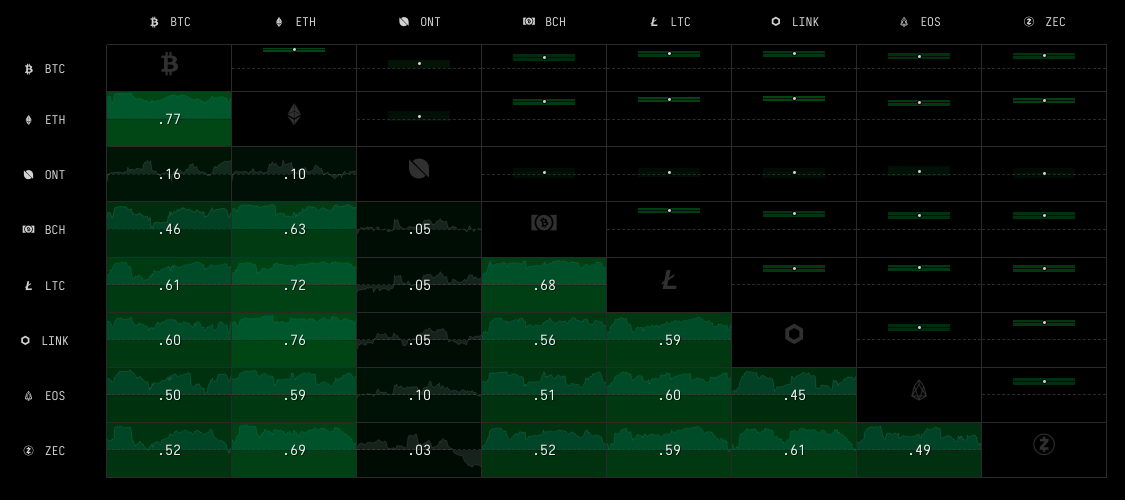

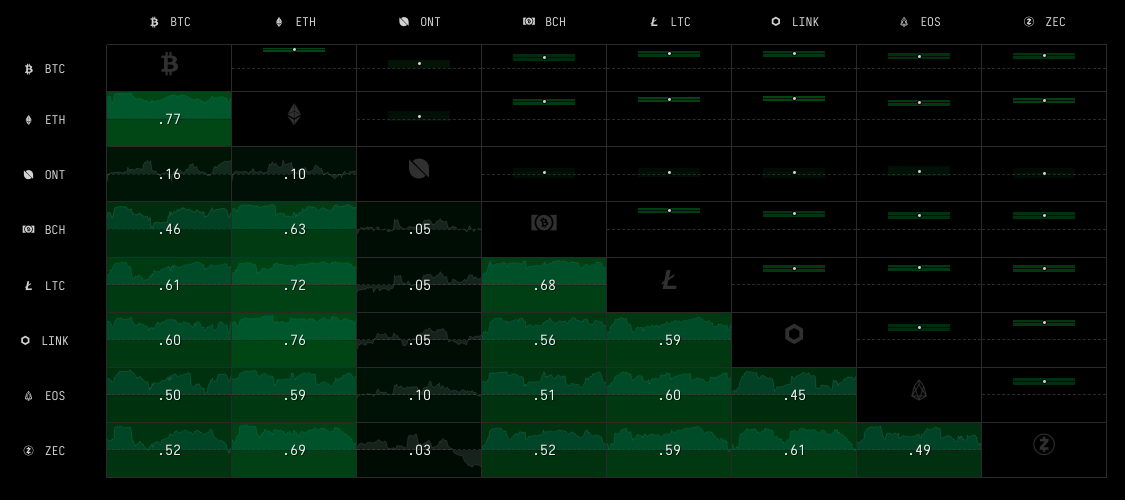

Over the past week, Bitcoin has gained by 5.89% while no other altcoin has held its position on the price charts. In fact, many of the alts in the top-10 have been at the end of a bloodbath. In light of these recent developments, it is pertinent to check out the correlation of different altcoins with Bitcoin, the world’s largest cryptocurrency, and its correlations with each other.

Correlation of altcoins || Source: Cryptowatch

As can be observed, the spread in correlation stats is widening. Such an increasing spread in correlation with Bitcoin is usually considered to be a sign of a mature market. However, that’s not all, as this spread further introduces a clear distinction between a Bitcoin market and everything else. This differentiation is critical to the retail trader as info on correlations is crucial to making informed trading decisions.

Looks like we’re at the “institutional/macro” stage. Thing I got wrong here is that ETH was more connected to DeFi rally than the current one, which makes sense in hindsight. It’s a “btc market” and an “everything else” market. https://t.co/z2qe09HZAT

— Ceteris Paribus (@ceterispar1bus) October 31, 2020

As has been observed by @ceterispar1bus, ETH’s correlation with DeFi right now is more than its correlation with Bitcoin. This is an observation that, in hindsight, holds true as Ethereum’s price hasn’t necessarily rallied whenever Bitcoin has.

In fact, Ethereum’s price is mostly dependent on developments relating to ETH 2.0. The rest of the market’s altcoins aren’t exactly the focus of smart money and despite new deals and partnerships going through, the larger altcoin market hasn’t rallied yet. The infamous altseason narrative is centered around the idea that Bitcoin’s market will see a flurry of activity, and while investments pour into it, some may trickle down to the altcoin market. However, even in the altcoin market, DeFi has its own league, and one can argue that top DeFi projects are small enough in market size to sustain on recycled user funds, unlike top altcoin projects like Ethereum.

Bitcoin’s market capitalization and its volatility make it difficult for the asset to sustain on recycled funds and there is a rather huge dependence on generating new demand and maintaining trade volume and reserves on spot exchanges. This distinction is also a top reason why Bitcoin’s risk-adjusted returns are higher than most other assets over the past 5-7 years.

If Bitcoin’s price rally continues, the Bitcoin market, as we know it, stands to grow bigger in terms of market capitalization and user acquisition. If the price is to rally even more, further new demand will be generated and the cycle will continue. The cogs in this wheel are the aspects of limited supply and scarcity as HODLers continue to HODL, even at a point when 97% of them are profitable. Ergo, one can argue that there truly is a Bitcoin market and an everything else market.

Source: Coinstats

The post appeared first on AMBCrypto