Bitcoin trading is not for the faint of heart. Traders in the cryptocurrency market have to contend with $1,000 hourly movements, while negotiating an array of exchanges to arbitrage, many of which pump fake volumes and have individual premiums and can employ leverages in triple-digits, opening the floodgates for liquidations.

Given the above backdrop, the present trading atmosphere is downright absurd. Bitcoin, now going on three months, has seen a bout of low volatility. Since early-May, the king coin has been trading in a tight channel, unable to break out. At this time, with Bitcoin trading out of character, how are traders handling the still waters? Well, not very well.

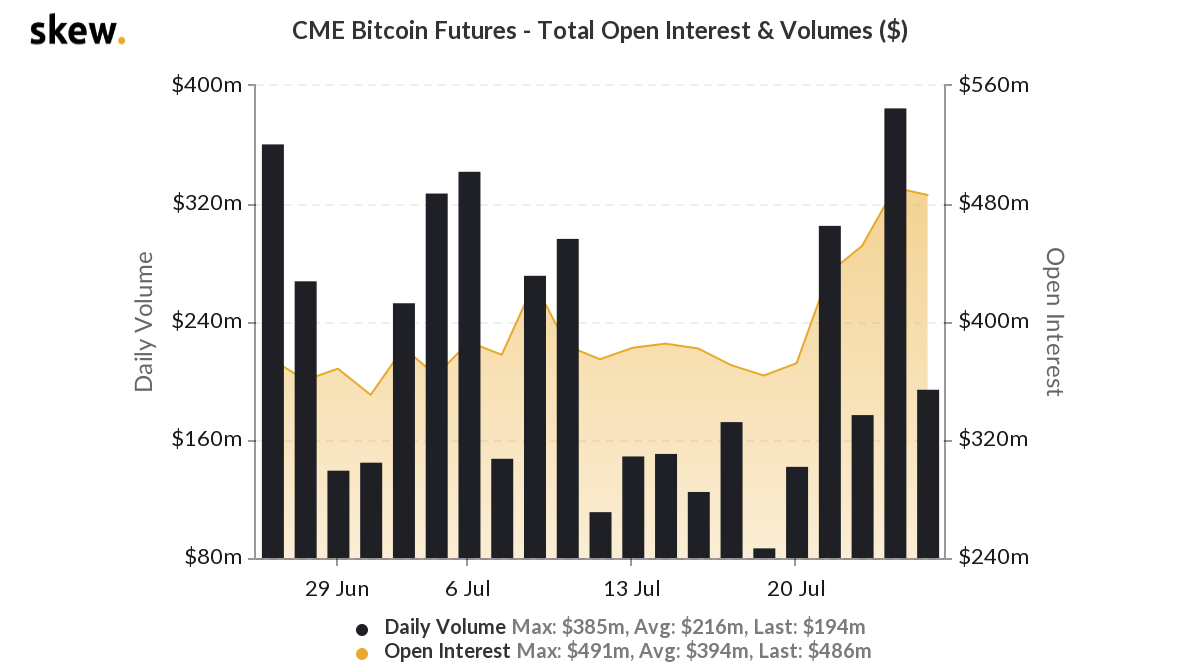

According to a recent report by Ecoinmetrics, Bitcoin derivatives traders are keen for price action. So much so that a small movement in the price of the cryptocurrency drives the creation of open positions or open traders. Take the CME Bitcoin Futures market, for instance – Earlier this week as Bitcoin rose to $9,500 [the first big move in a month], the market’s open interest jumped by 31.3 percent from $372 million to $491 million. The volume also saw a jump from $177 million on 22 July to $385 million on 23 July.

With the report cautioning that this might just be “short time traders,” referring to duration, not position, it is also indicative of their sensitivity to small Bitcoin movements. The report read,

” Bitcoin looks like it is on the move, traders jump in, nothing happens, they liquidate the positions.

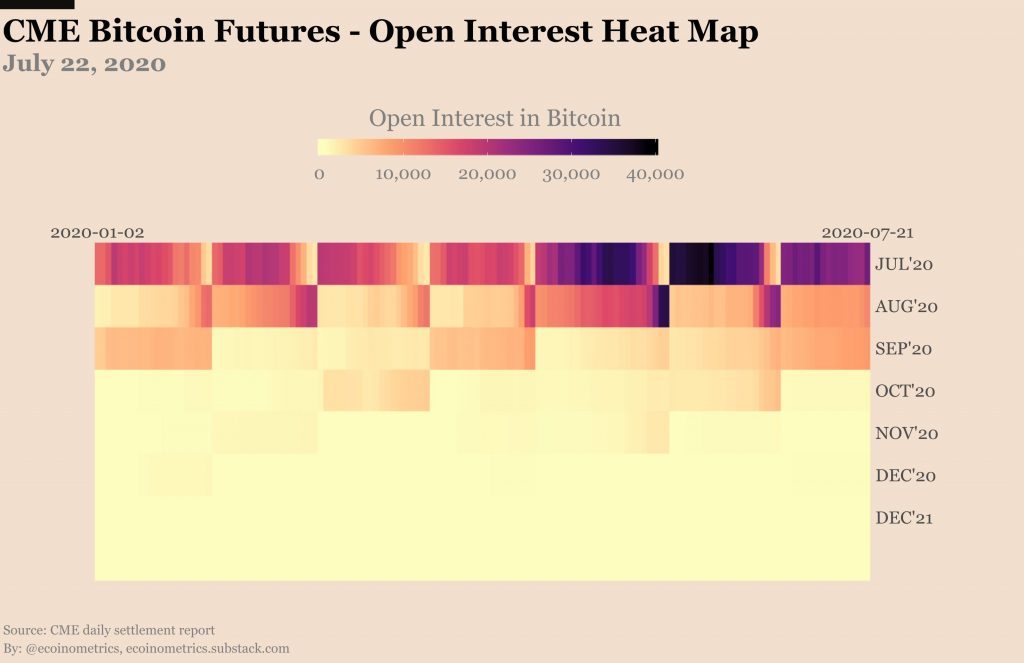

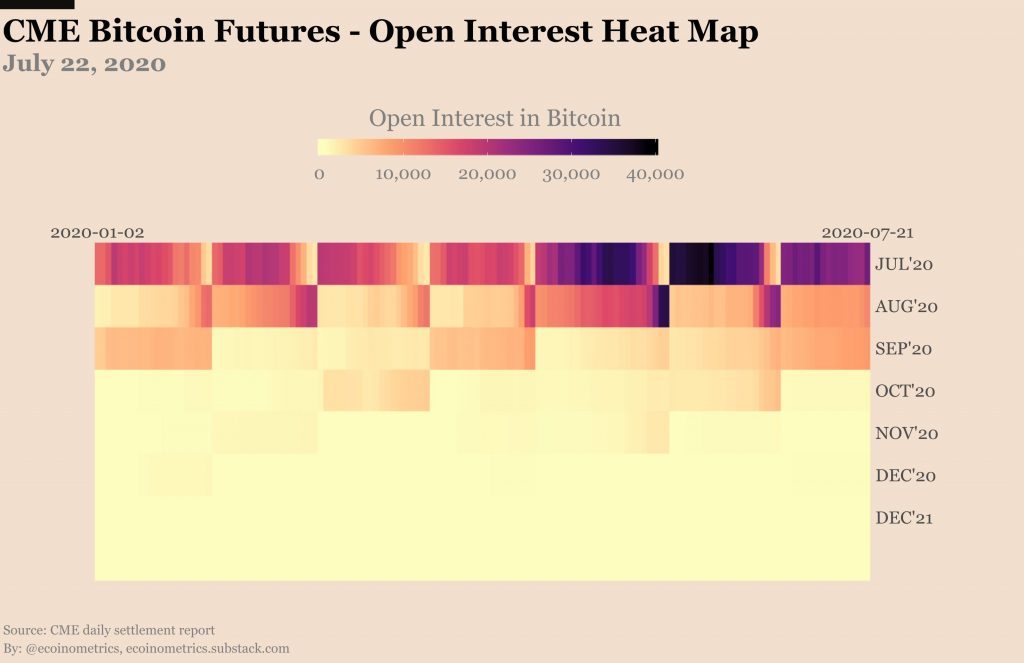

To take this argument further, the report looked at the period of expiries of most of these trades and found them to be tightly-packed. BTC Futures’ traders on CME are distributing their trades closer to the first quarter since opening them. Hence, most of the trades opened in July have maximum expiries in September i.e. three months or one quarter later.

CME Bitcoin Futures head map | Source: Ecoinmetrics report

Now, what does this tell us? And does it have significance? Well, for derivatives trading it does, and in so far as the derivatives expiry affects the spot market, it does as well.

Over the past few months, as derivatives trading saw a massive increase by exchange entering the market and customers increasing trading, expiries have become important. When a huge number of Bitcoin Futures or Options expire with a specific direction i.e. long or short or call or put, the degree of its expiry has an effect on the derivatives market, larger market sentiment, and the direction of future positions.

This was seen in the June expiry. On 26 June, over 115,000 BTC Options contracts were shelved, expecting the price to rise after a month of low volatility. Traders accumulated their positions on one date, expecting a price move around the last week of June, one that did not manifest.

Looking at the lack of movement and low volatility, the next set of monthly expiries i.e. for 31 July have substantially decreased. At press time, 62,300 contracts were set to expire at the end of the month. The low Bitcoin volatility and high traders’ sensitivity is causing monthly expiries to decrease on a month-on-month basis. The trend is set to continue for August,

“If Bitcoin doesn’t break out of this range it is very likely that the number of open positions will come down dramatically in August.”

The post appeared first on AMBCrypto