Bitcoin’s price has been increasingly volatile over the past few days. However, despite its most recent fall, the cryptocurrency has been able to maintain its position above the key $10,000-mark. While growing uncertainty in the global markets has followed the fiat printing spree governments undertook to keep the economy alive, Bitcoin’s value proposition as a store of value asset seems to be holding strong.

During a recent discussion on the What Bitcoin Did podcast, Bitcoin analyst, PlanB, and author & commentator Jeff Booth and host of The Investor Podcast, Preston Pysh, discussed Bitcoin’s performance with respect to the present macro-economic scenario. According to Booth, a lot of importance is being given to assets like Bitcoin in today’s macro-economic conditions, with the podcaster adding that the deflationary world requires a deflationary currency.

Over the past few years, PlanB’s Stock to Flow model has been widely used as an example to illustrate how Bitcoin’s value is only likely to increase as the scarcity narrative kicks in. This has led to a growing number of people seeing Bitcoin as a long-term asset, one rivaling the likes of monetary metals like gold and other assets like real estate.

PlanB went on to add that even if there was less government printing of fiat currencies and a massive economic depression, a model like S2F was likely to hold true. He said that while quantitative easing has helped, Bitcoin’s portability and its ability to retain value has enabled it to maintain its rightful position against assets like gold.

“The fact is that Bitcoin is taking its natural place within gold, silver diamonds, real estate etc that all serve as a store value and is one of the few assets that have a high stock to flow value… I think that even if they didn’t print Bitcoin has advantages over gold, for example, its easily verifiable and portable.”

This was seconded by Pysch, claiming that as Bitcoin’s value propositions hold strong, it will continue to remain better than any other currency that exists today. Further, he also highlighted Bitcoin’s value propositions when it comes to its security being examined by taking a look at the increased hash power the coin has been able to maintain.

In fact, Bitcoin’s mean hash rate over the past two years has increased substantially to over 120E, according to data provided by Glassnode.

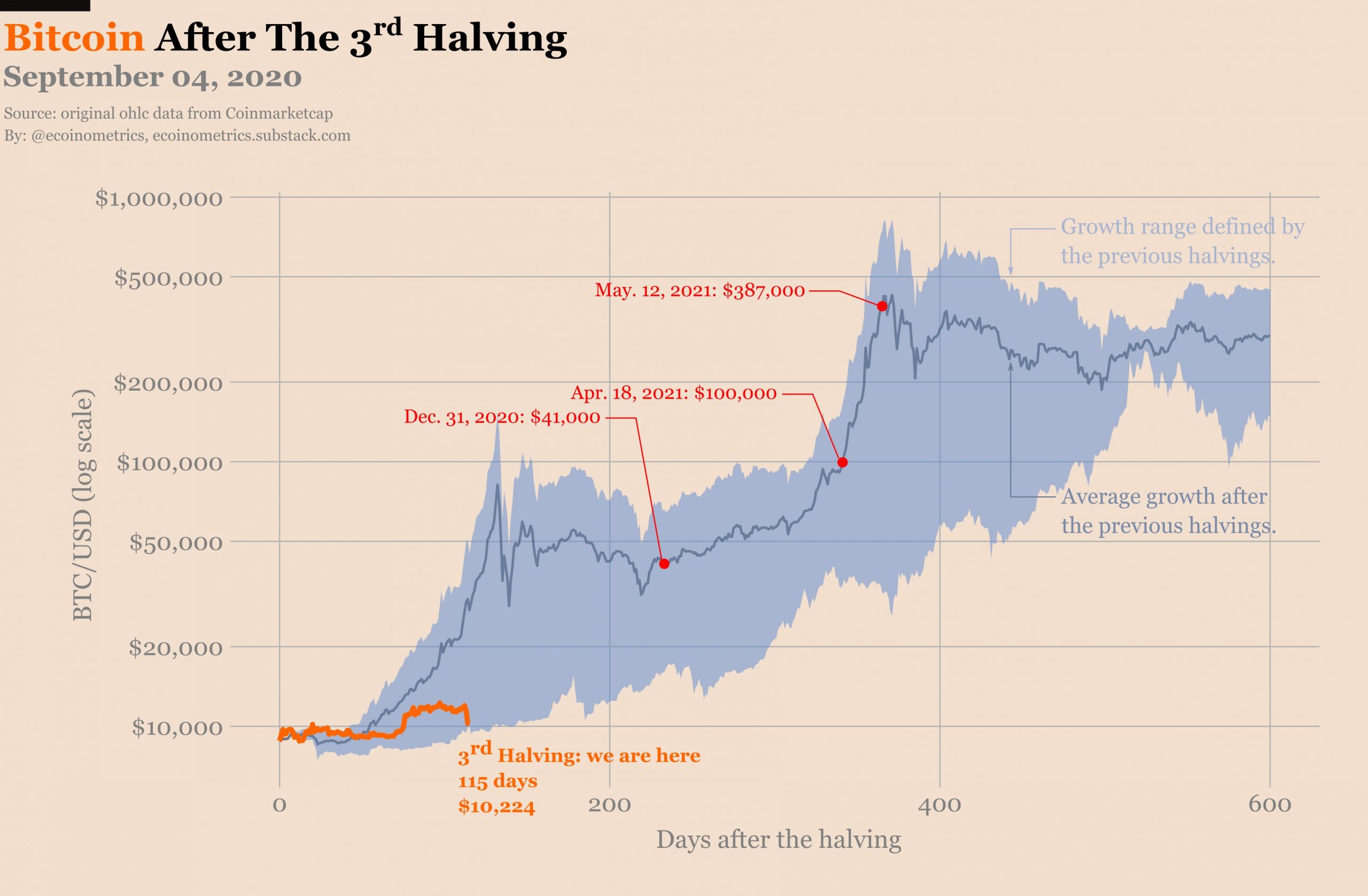

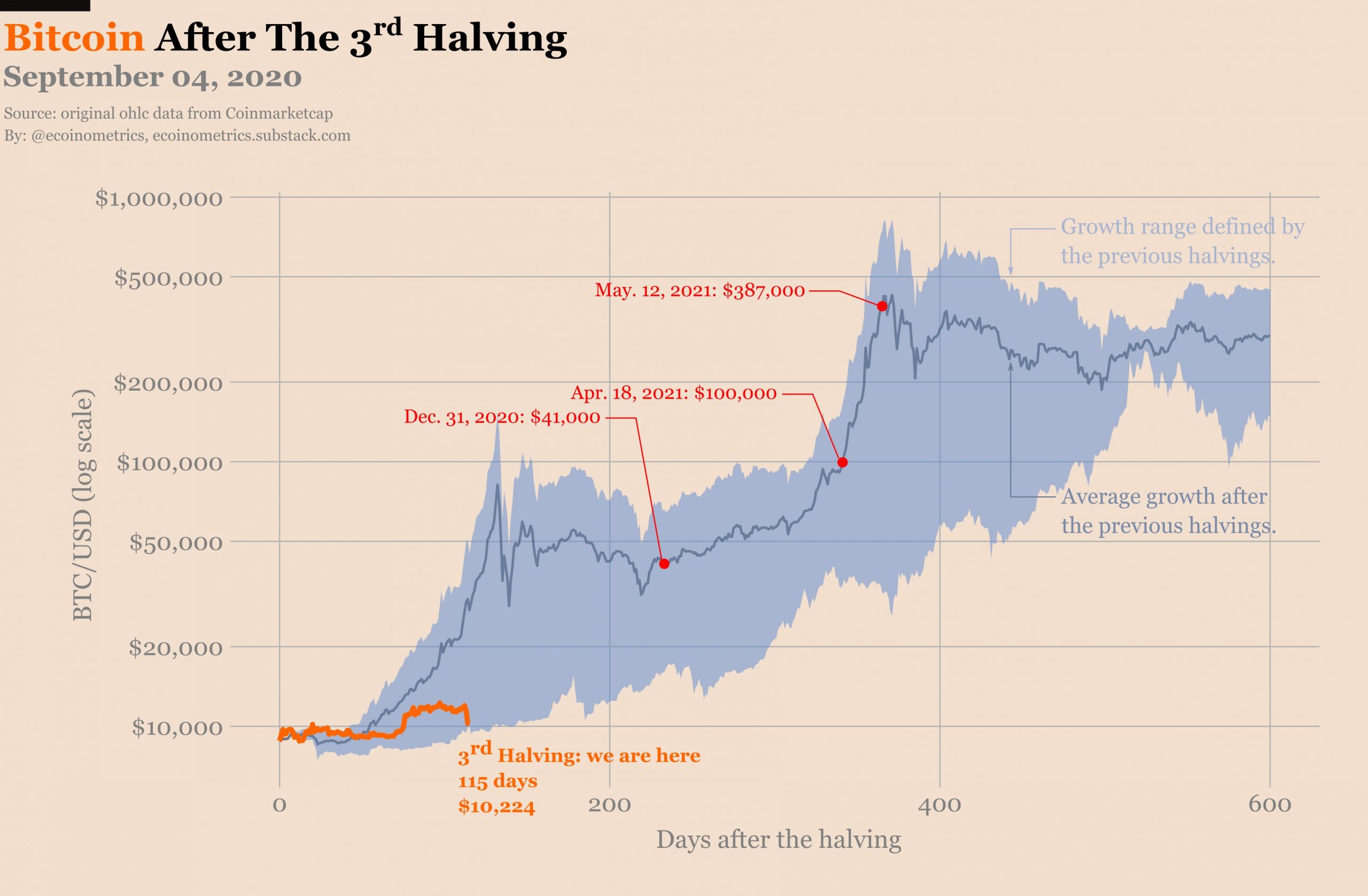

Source: Ecoinometrics

Interestingly, while Bitcoin’s long-term prospects seem strong, a recent Ecoinometrics chart noted that there is a very strong buying opportunity for new investors entering the market. Looking at the growth trajectory of Bitcoin, its latest price drop has pushed the metric to the bottom of the range since the third halving, making it an optimal price point of entry for long-term investors.

The post appeared first on AMBCrypto