If I told you back in March that six months later, Bitcoin would be trading at over $13,000 while the biggest derivatives exchanges’ executives were indicted by U.S authorities and the biggest crypto-to-crypto exchange suspended withdrawals, you’d have laughed me out of the room. Yet, here we are.

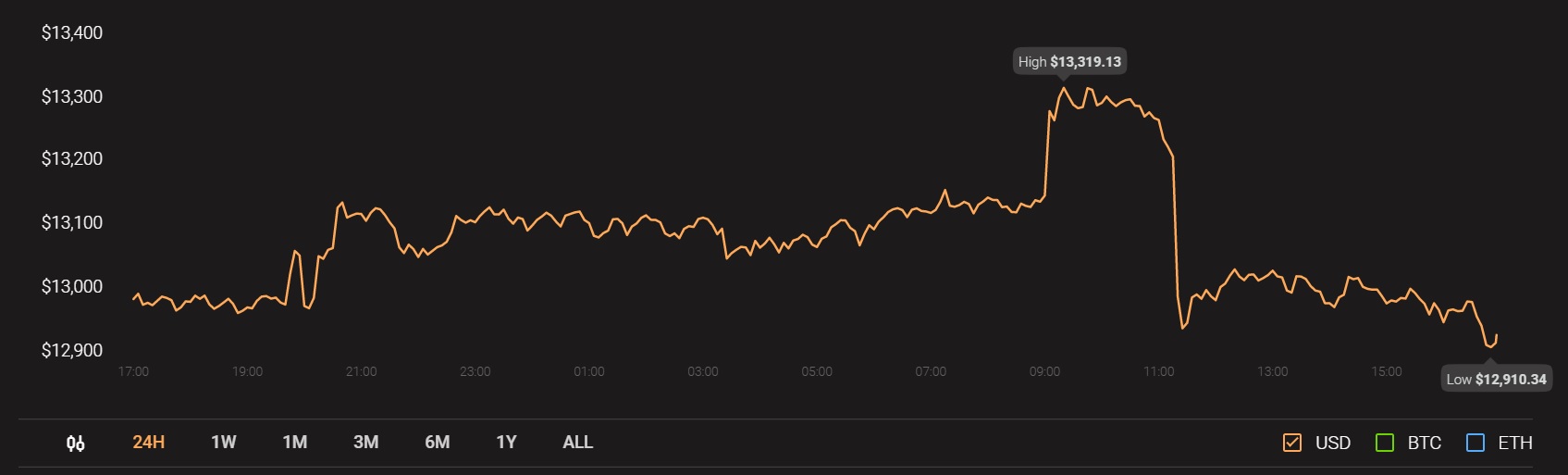

OKEx, one of the world’s largest cryptocurrency exchanges that handles over $3.5 billion in spot and derivatives trading volume, halted customers from withdrawing cryptocurrencies on 16 October. Despite this bottleneck, the cryptocurrency’s price has jumped by 18.7 percent since then, riding a bullish wave that has seen no major roadblocks.

Source: Coinstats

In the old days, the sensitive Bitcoin market would’ve crashed following the news of a major exchange blockade, but the ‘OKEx price pump’ seems to point to the maturation of the market beyond its big exchanges. However, when looked at more closely, this could also be a sign of Bitcoin’s market decoupling from its big crypto-t0-crypto exchanges.

According to a report by Chainalysis, the initial “muted market response” to the withdrawal halt was due to the “separation of the market between crypto-to-crypto exchanges and crypto-to-fiat exchanges.” Since OKEx is the market leader of the former category, its lack of material effect on the price of BTC is indicative of the movement to the latter category. The report stated,

“OKEx is a crypto-to-crypto exchange, with Tether as its primary quote currency. It is tightly interconnected with other crypto-to-crypto exchanges….the suspension of withdrawals from OKEx primarily affects liquidity within the crypto-to-crypto exchange ecosystem.”

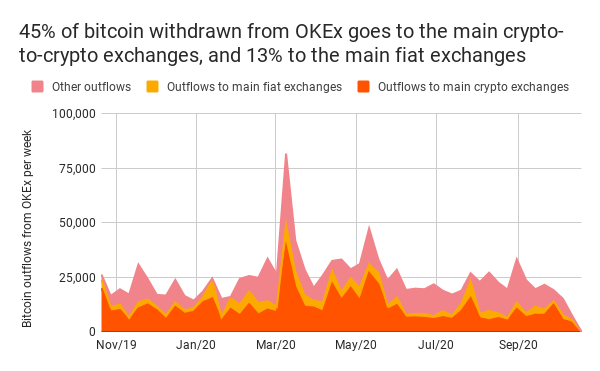

In the past year, 45 percent of BTC withdrawn from OKEx was marked mainly for other crypto-to-crypto exchanges, and just 13 percent was sent to crypto-to-fiat exchanges. This would mean that for traders looking for crypto on and off-ramps via their held fiat, OKEx was mainly an intermediary, and not a popular one at that.

OKEx Bitcoin withdrawals by source | Source: Chainalysis

Traders would either look for arbitrage or liquidity on OKEx due to its high traffic. But wouldn’t use it as a means to encash their fiat to crypto or vice versa.

Chainalysis is of the opinion that the present demand is driven by crypto-to-fiat exchanges. Hence, the OKEx halt has not affected the price yet. The present reduction in liquidity will take time to affect the market drive i.e. crypto-to-fiat exchanges. The report concluded by stating,

“It is hard to disentangle whether this bearish event did not transmit to fiat exchanges, or whether it did but was neutralised by bullish sentiment. But the lack of a significant impact at least suggests that the coupling between crypto and fiat exchanges is not very strong.”

The post appeared first on AMBCrypto