Gold is one of the world’s most precious metals, one often stored in large vaults to ensure its security. Many cryptocurrency users have often drawn parallels between Bitcoin and Gold, going on to term it a Store of Value [SoV]. Despite its stagnated price, however, many of its users are holding on to the digital asset, not just in expectation of a bull run, but because many of them have been treating Bitcoin as an actual SoV.

Like the use of vaults, the use of multsig addresses to protect Bitcoin has been a recently emerging trend. In fact, reports have suggested that despite being in existence for years, multisig addresses have noted significant growth only in the past 30 months. Tracking the adoption of multisig address provides a proxy as to what portion of the supply is held by secure custodians, and by extension, as an SoV.

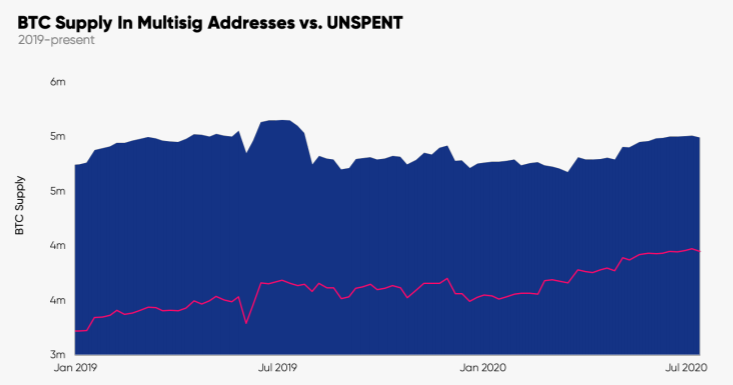

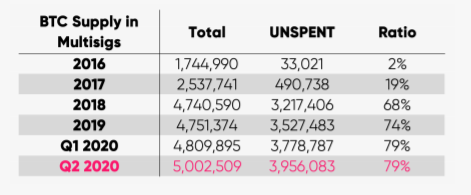

Interestingly, data from Glassnode suggests that even though multisig addresses have noted tremendous growth, the Bitcoin supply held in multisig addresses has fallen by 3% since its peak.

It must be noted here that the falling value does not question the rate of adoption, but highlights something larger at play. As BTC supply in multisig addresses dropped, the Unspent category saw the BTC supply continue to rise in 2020.

The UNSPENT is a type of multisig as the hashed script and the arguments needed for execution are only revealed once output has been spent. This provides a greater degree of security, one preferred by users who wish to hold on to the digital asset and not trade. In fact, it was recently known that Liquid network developed and owned by Blockstream was using multisig addresses to move nearly 870 BTC, with such actions apparently a common practice in the crypto-space.

A rising number in this category implied that these users may have moved more BTC to their multisig and could be in for the long-term. Further, data suggested that at the beginning of 2019, 68% of the potential total supply of BTC was in the UNSPENT category, while 2020 noted the ratio to have increased to 79%.

Source: Glassnode

That is a significant increase, with a large chunk of it sitting in the UNSPENT category. This indicated the growing adoption of a custodial service to protect the Store of Value asset – Bitcoin.

The post appeared first on AMBCrypto