Bitcoin’s price responded positively to the new year, with the coin finally pushing the $8k mark on 8 January. However, since the price spike was unforeseen, the price underwent a correction and soon, the price was back under $8k. At press time, Bitcoin was trading at $7922, with a 24-hour trading volume of $15.3 billion.

Source: Coinstats

With Bitcoin halving approaching in May, the market has been actively discussing its implications. While a few are of the opinion that the halving is already priced-in, a few others hope to see the price rally before or after the event. In fact, there are even some who do not think BTC will react to the halving.

The fans of ‘BTC not reacting at all to the halving’ have the least support from the community, with many arguing that Bitcoin’s market is not efficient enough and fails to reflect all the information currently available. Ryan Selkis, CEO and Founder of Messari, summarized a researcher’s notes and said,

“Despite the halving being a predictable event, certain bulls believe the halving is not reflected in current prices and argue many market participants are not aware of the Bitcoin halving and its impact on Bitcoin’s price.”

However, according to the aforementioned researchers, this is a fundamentally flawed argument for the mechanics of the Efficient Market Hypothesis [EMH]. They explained that as per the investment theory, not all market participants have to be rational and be aware of the impact of Bitcoin halving. Shedding light on the EMH, the researchers claimed that all it requires is that enough rational participants are aware of the trend to sufficiently bid up the price of a given commodity.

“Since most entities trading bitcoin are aware of the halving, this is likely the case.”

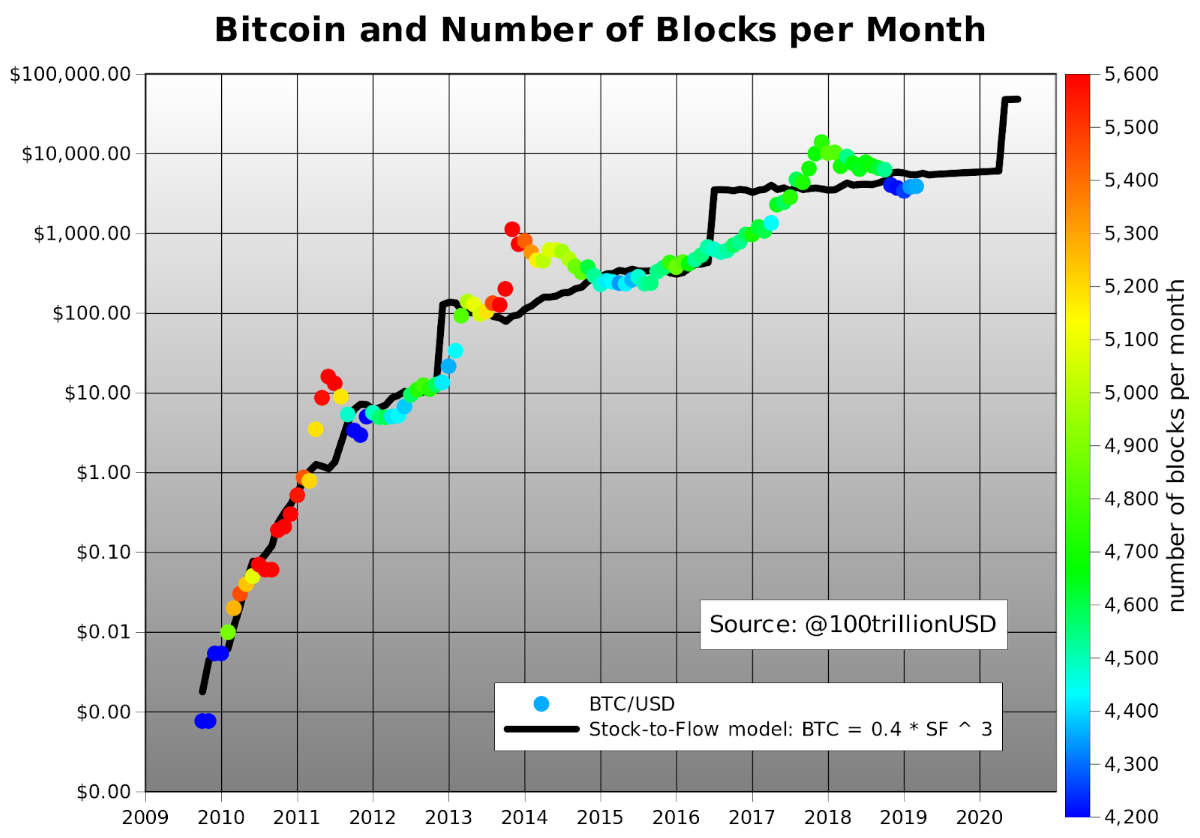

Apart from EMH, investors are also focusing on the Stock to Flow [S2F] model to establish the point that Bitcoin will rise after the halving as a function of supply dynamics. According to the theory, scarcity drives value and a reduction in supply might eventually raise BTC’s S2F, with it being predicted that the price will go over $55k after the halving.

Source: Messari

The post appeared first on AMBCrypto