FOMO or not Bitcoin’s second rally above the critical $10,000-mark has reignited interest among the retail investors. The king coin has been consolidating above $9,700 mark. Following this, strong rallies were also seen in the altcoin space. A surge was also noted in terms of search volume of Bitcoin which recorded a spike following Bitcoin’s second breakout.

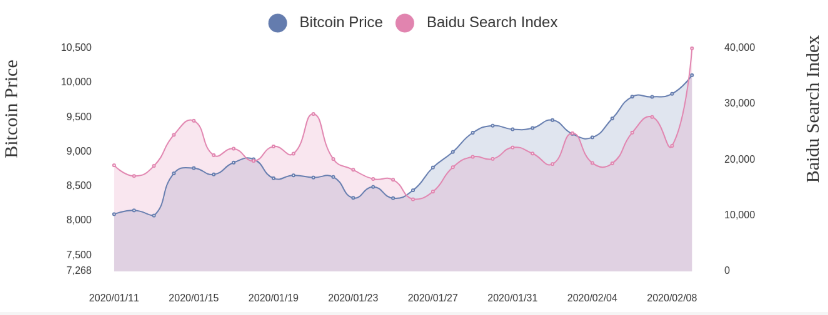

While China might reiterate the famous adage ‘Blockchain, not Bitcoin’, Baidu’s search volume tells a different story.

Despite an overall rise in Baidu’s search volume for Bitcoin, it did not go in tandem with its price for the most part. The search volume on the search engine gained traction after Bitcoin’s price recovery following a minor dip on 26th January. Bitcoin search volume has since followed closely and reached a new high on 8th February as the price neared the $10k key level.

Source: LongHash | Bitcoin Price and Baidu Search Index

To top that, Bitcoin hitting $10k became the fourth hottest topic on the Chinese microblogging website, Weibo on 9th February.

Bitcoin searches on Google trends has been on a steady rise as well with a minor spike on the 9th of February. This was a potential indicator of revival in interest among the retail investors for the king coin.

Another positive development for the asset’s instability was noted by Skew’s chart which exhibited low volatility despite the coin’s upward price action. This suggested a more mature market phase as opposed to the highly volatile period of crypto market frenzy during the 2017 bull run.

As the scheduled halving nears, there was speculation regarding a FOMO fueled-price pump. But the steady decline in volatility poses a good argument why this might not be the case.

Source: Skew | BTCUSD Realized Volatility

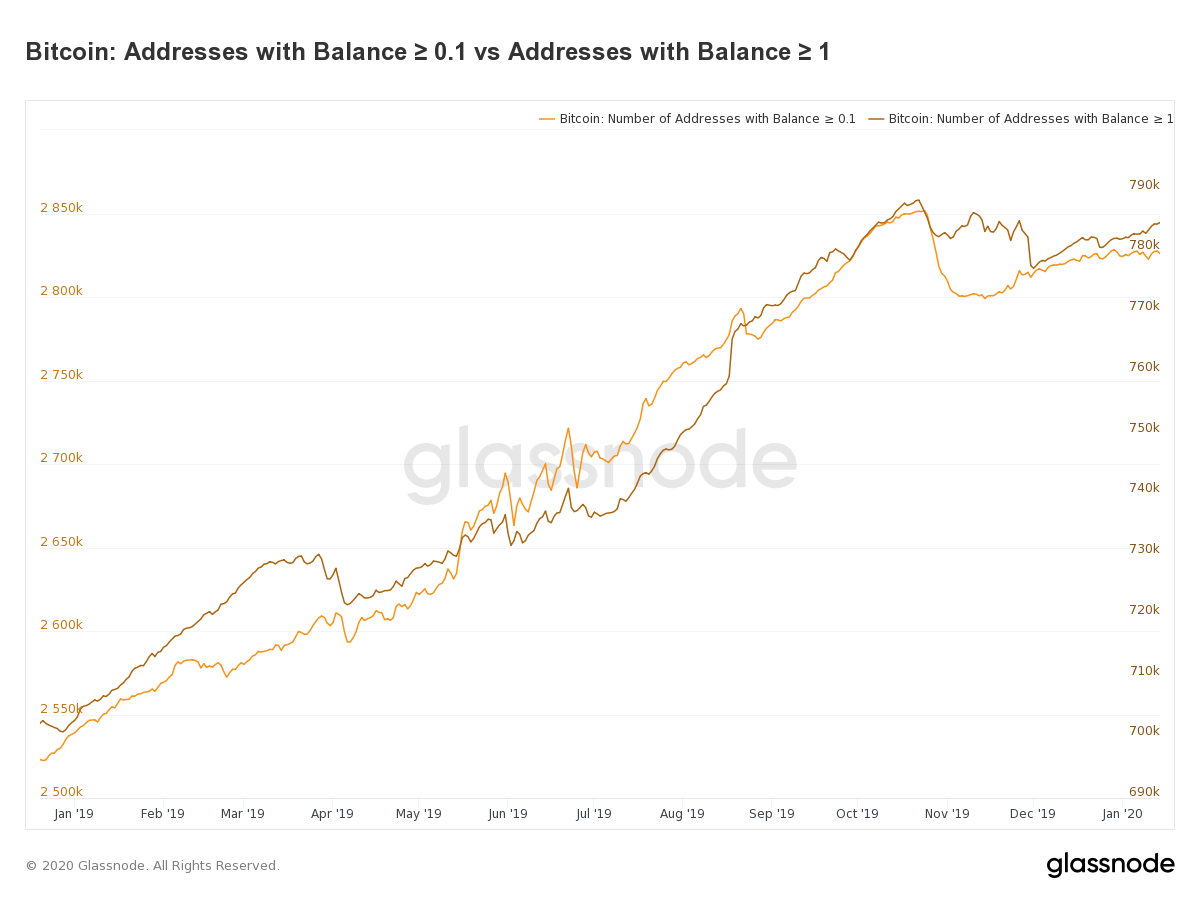

There has been a growing accumulation or Hodling trend as well. Blockchain analytics firm Glassnode charted evidence of the growing number of Bitcoin addresses holding equal or more than 1BTC. As of January 14th, the figures amounted to 784,789, a level unseen since October 2019.

Additionally, Bitcoin addresses with a balance equal to or more than 0.1 BTC had also increased considerably after dropping during the latter part of 2019. This sizeable increase could be due to the accumulation by the retail investors.

Source: Glassnode

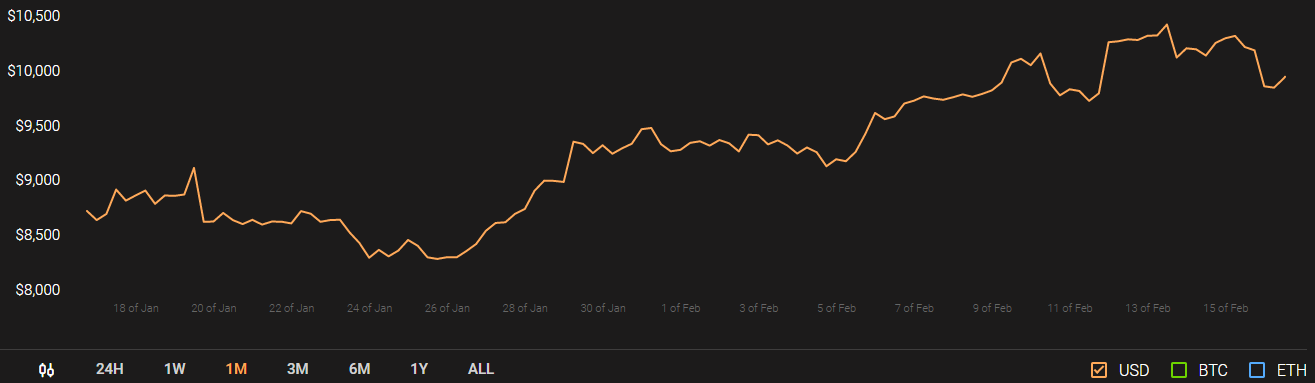

Taking a cursory glance at the price, Bitcoin was up by 38% since 1st January. However, it fell to $9,973 as it held a market cap of $181.7 billion at press time. Moreover, the king coin registered a 24-hour trading volume of $44.14 billion.

Source: CoinStats | Bitcoin

The post appeared first on AMBCrypto