In light of the short-term memory span of most people in the cryptocurrency space, it’s easy to forget just how bullish Bitcoin has been, despite its drop from $12,000. For over a month, Bitcoin has been trading in five-digits, and most of that time was spent over $11,000. The largest cryptocurrency in the world was trading in the red by around 7 percent on a 24-hour basis, at press time, but this was still 52 percent higher on a YTD basis and over 160 percent higher than its lowest point all year.

In the six weeks that Bitcoin has been trading over $10,000, a few key changes have been seen in the market, especially in the retail segment. Speaking to AMBCrypto, Michelle O’Connor, VP of Marketing and Community at Uphold, the crypto-wallet and transacting platform for retail investors, said that they have seen “exponential growth” in Bitcoin purchases since the rally began.

Interestingly, this growth has been emanating from Latin America and the United Kingdom, among others, two regions that aren’t front and center in the larger global cryptocurrency market.

Further, O’Connor said that just one-time lump sum purchases of the cryptocurrency aren’t popular, “recurring transactions” are in the vogue now too. Looking at the price movement of the crypto-markets over the past few months, the case for systematic investments over direct orders can be made and retail investors are operating on the same principle.

Since March 2020, Bitcoin has been rising, or rather, recovering. Between March to May, the price rose from below $4,000 to over $9,000. Between May, prior to the halving and late-July, the price traded tightly within the $9,000 – $10,000 range, rarely breaking out. From 23 July to 2 August, the price surged past $10,000 and over $12,000, which it hovered over until the last few days.

Looking at this larger picture, the price has been on a consistent incline, and market participants are responding by easing into the market making systematic and less speculative purchases, rather than going all in. O’Connor added,

” Our customers have shown increased interest in recurring transactions, looking at their wallets less speculative and more as an arm of their portfolio, starting in early 2020.”

This contrasts the haphazard buying and selling of Bitcoin and other cryptocurrencies during large price movements, like the one the market saw in March, and to smaller degrees, in August, and this past week as well. What this points to is a more gradual and mature way of purchasing cryptocurrencies, keeping in mind this is the only asset class which has reached [and stayed over] its yearly all-time high.

Commodities, led by gold, are still recovering from its early-August drop. Further, stocks are rising, but their valuation is questionable, to say the least, and yields on government-issued bonds are sinking.

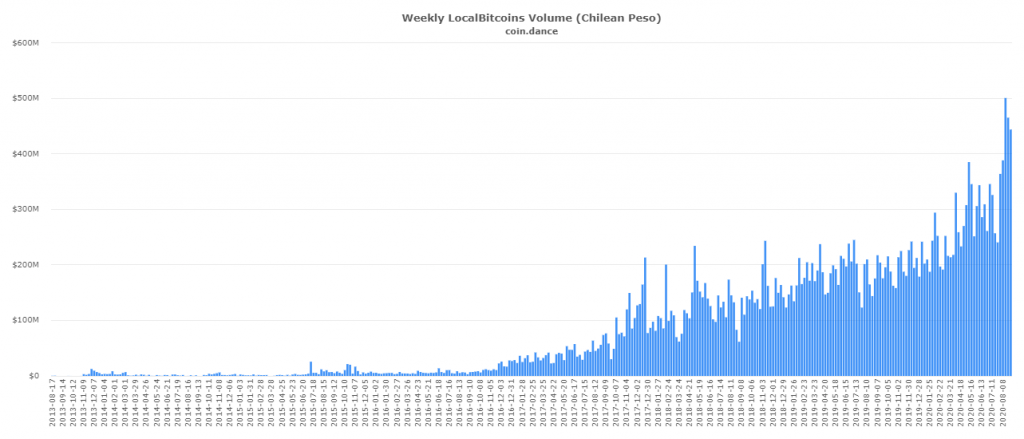

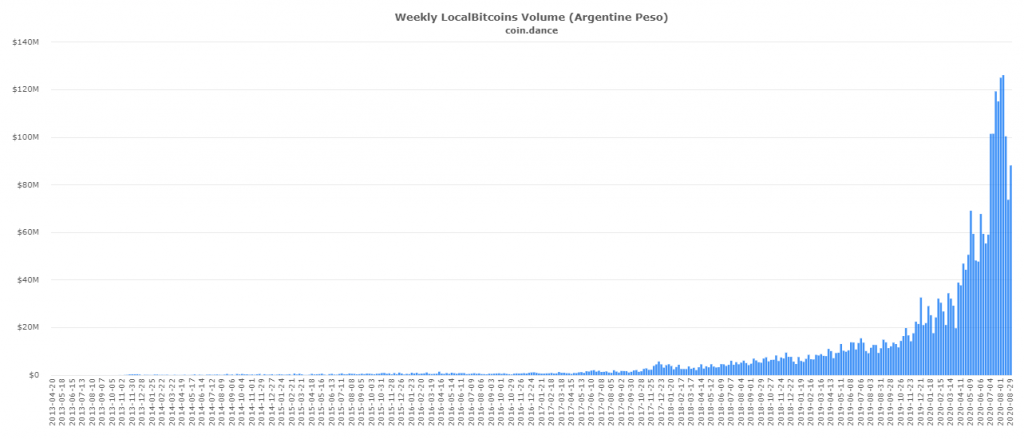

Weekly Bitcoin volume in Chilean peso and Argentine peso | Source: Coin.dance

Retail traders are not just relying on retail platforms like Uphold to buy [or sell] their cryptocurrencies, they are also relying on each other. As O’Connor mentioned, Latin America is buoyant on Bitcoin and P2P reiterates the same since the average weekly trading volumes for Bitcoin in countries like Argentina, Chile, Venezuela, and Columbia are rising, with several countries reaching their all-time highs [ Including the data from December 2017 when Bitcoin traded close to $20,000].

Not only are Bitcoin markets changing, but its sentiments are shifting from maniacal to measured.

The post appeared first on AMBCrypto