Even with Bitcoin’s mid-week push above $9,500, the larger trend of stability has held strong. Prior to this push the largest cryptocurrency in the market had traded within a $500 margin for over a month, and in the last two months the range only as large as $1,000.

While Bitcoin for the past two months has been volatility-deprived, investors trading the cryptocurrency have seen little to no profits. However, from an investment point of view, contrary to the narrative of the fluctuation-heavy coin market, a bout of stability should be preferred, rather than feared.

According to a recent report from Ecoinometrics, a present-day investment in Bitcoin could prove to be profitable, given the current, persisting, and likely expected volatility. Prior to getting into the analysis, it should be noted that this report was published on July 22, on the eve of Bitcoin’s break over $9,500, hence the same was not considered, but its findings are nonetheless significant.

Another question that should be addressed before jumping into the findings is, just how stable is Bitcoin historically? Well, a lot. Bitcoin’s 30-day realized volatility (RV) is at 23 percent and “still trending down.” Not only is this BTC’s lowest RV of 2020, but it’s at its lowest point since March 2019. It is prudent to remember Bitcoin, in April 2019, saw a massive breakout which eventually took it to a price of $13,800 by June 2019.

Bitcoin 30-day RV | Source: Ecoinmetrics report

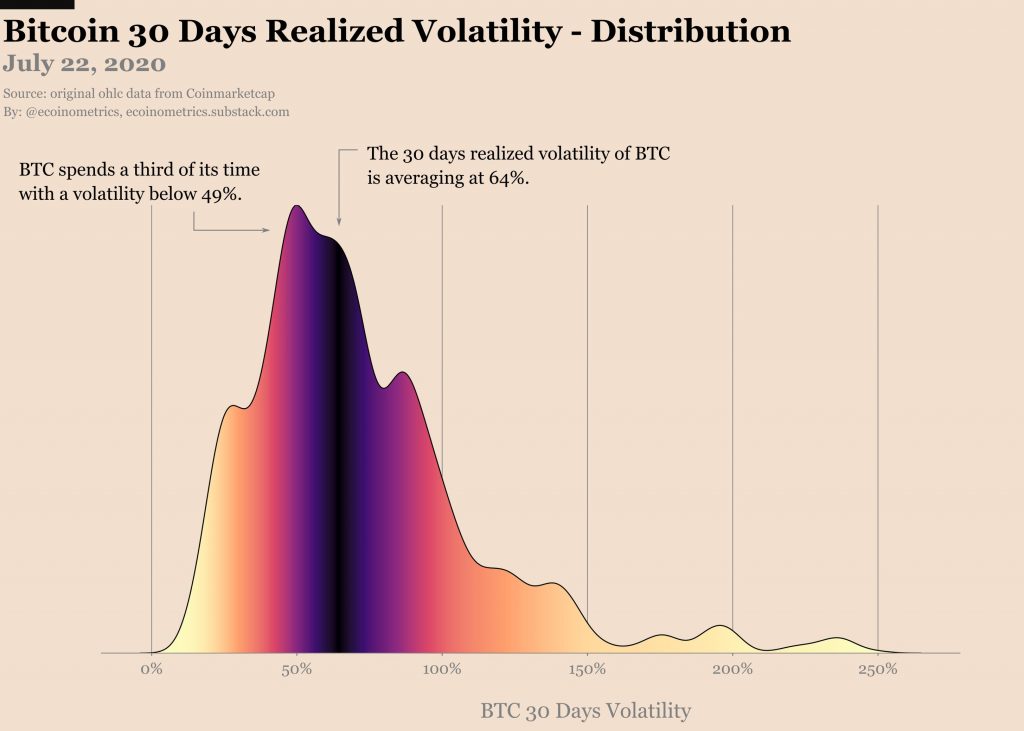

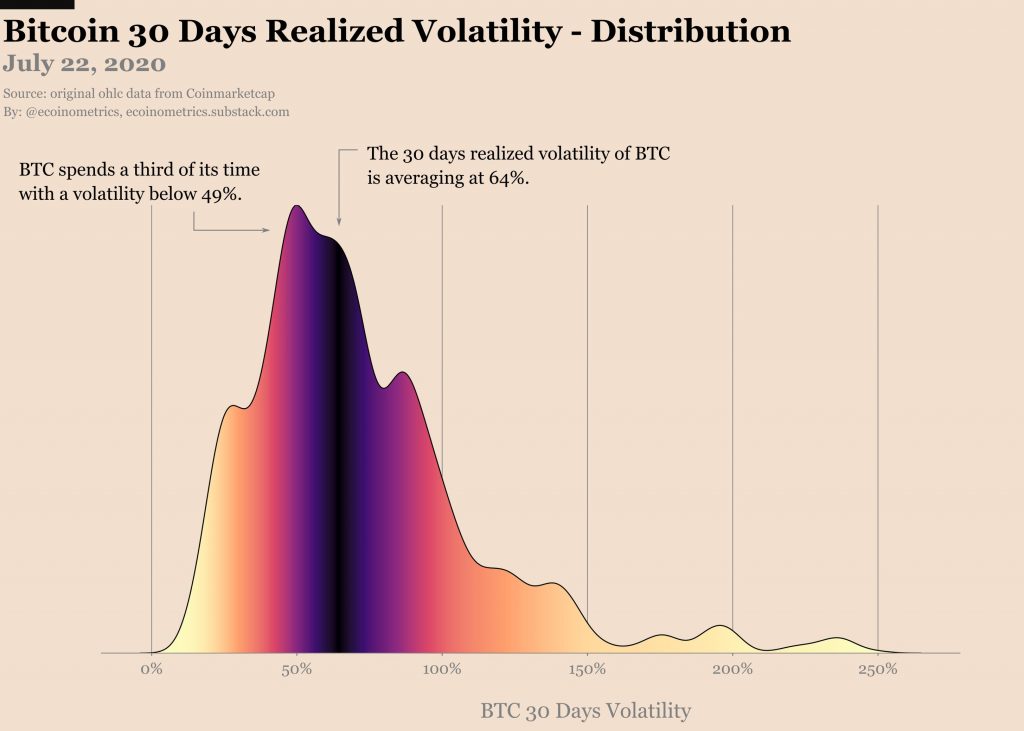

Expanding the time frame, from 2013 to 2020, the report states that “the current [low volatility] situation is abnormal.” On average Bitcoin’s 30-day RV is 64 percent, the volatility has been lower than 49 percent for only a third of the past seven years, and below 29 percent for only 10 percent of the period. Hence, Bitcoin’s volatility of 23 percent is lower than a one-in-ten event.

Based on the, rightly stated, ‘abnormal situation’ traders find themselves in, what is the best strategy? Well, according to the report it would be advisable to “play out” the long volatility, that would be the neutral go-ahead.

Wait, hold on a minute, this is the Bitcoin market we are talking about, and some of us don’t just want to sit on the sidelines waiting for something to happen, right? To those brave heart traders, who want to place directional bets, the way to profit is likely on the upside.

Before placing the trades, a few assumptions and markers. The minimum period of the trade would be 30-days as it’s a “good investment horizon,” and minimum volatility would be 49 percent because Bitcoin’s only dipped below this mark one-third of the time since 2013, and provides room for analysis.

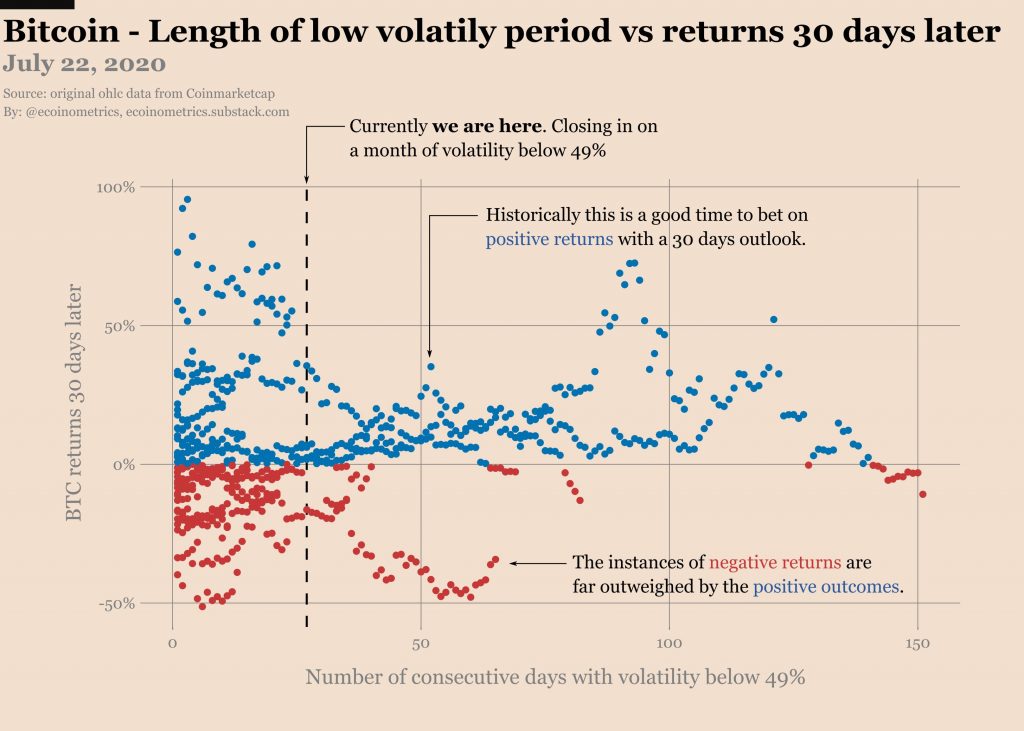

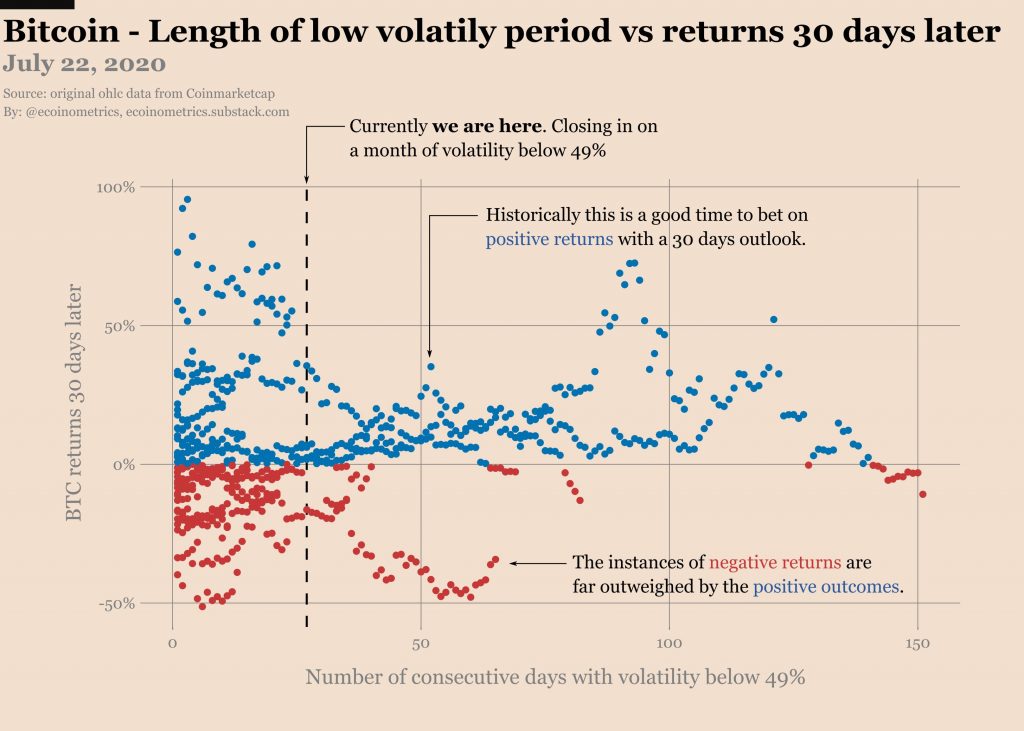

With the counts of Bitcoin’s move below 49 percent RV already available i.e. a third of the total, the report looked at return on two fronts. Firstly, the number of days in a row the volatility stayed below 49 percent i.e. no pumps or dumps, and secondly, what was the return between the current day and 30-days later. Now, we have something interesting to look at.

Bitcoin returns with RV < 49% [30-day mark indicated by the dotted line, blue dots – positive, red dots – negative]| Source: Ecoinmetrics report

The data was clear, the upside outweighs the downside, but a few caveats are in order. First, with every stable-day after the 30-day mark, positive returns are more likely than negative returns. Second, on the eventuality of a negative return [after 30-days] the lows are in the 40 percent range, compared to highs which range around 20 percent.

The report also looks at “expected volatility” depending on how long traders are amid low-volatility. The findings indicate that expected volatility is positive, and increases in proportion to Bitcoin staying stable for 3-months. In short, going long, in a market with low volatility, has an upside which increases the longer Bitcoin stays put in a tight range. On the downside, negative returns are few and far between, but if they occur, they are far larger than the upside. Make of that what you will.

The post appeared first on AMBCrypto