The digital asset industry is perhaps the only asset class that is so susceptible to market sentiments and changes in geopolitical situations between different nations.

Taking Bitcoin as a prime example; a significant part of the community attributed Bitcoin‘s price surge to the rise in tensions between the United States and Iran and the outbreak of the Coronavirus. And that’s just 2020.

However, keeping such speculations aside, it is important to note that market fundamentals may highlight key changes as well, especially when the world’s largest digital asset jumps ship from a bearish to bullish trail.

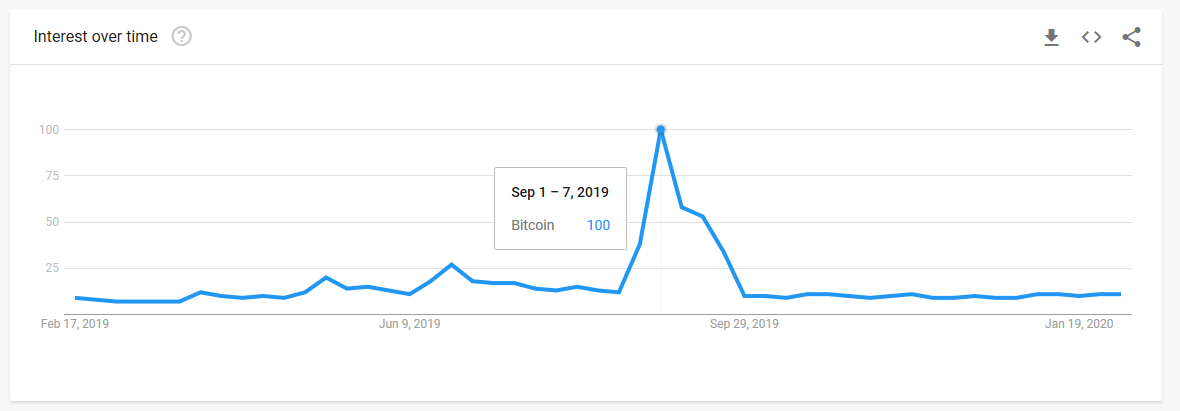

According to TokenInsight’s latest report, the bullish rally in 2019 highlighted several changes that allowed the crypto-asset to continue on a surging run. Over the same period, it was observed that the volume for ‘Bitcoin’ searches on Google had dramatically increased during the first half of 2019, before slowly cooling down in the 2nd half of the year.

Source: Google Trends

On the contrary, the search volume for Bitcoin has not reciprocated the same level of activity over the past two months, in spite of the world’s largest cryptocurrency recording a 4o percent hike in its price since 1 January 2020.

Addressing Bitcoin’s hash rate, the report found that it had risen by 79.3 percent since the start of 2018. The network hash rate went above the 100 EH/s in October 2019 and the number of Bitcoin nodes was found to be around 10,000 approx.

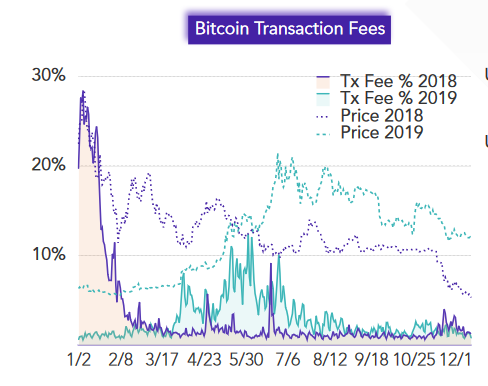

Source: Token Insight

Over the same time period, transaction fees dropped significantly from $280 million to $160 million, registering a 43 percent fall. Such a scenario may not sit well with Bitcoin miners whose income is heavily dependent on mining rewards, especially on those garnered from Coinbase.

Coinbase mining rewards refer to transactions where miners receive Bitcoin as a reward for the generation of a new block. As the imminent halving would reduce the mining reward once again to 6.25 BTC per block, it is imperative that Bitcoin’s transaction fees rise so that miners accrue profits for their efforts towards keeping the network secure.

Additionally, another issue with mining and hash rate is that an irregular distribution of hash rate can jeopardize Bitcoin’s decentralization side.

It is a known fact that 50 percent of the hash rate is concentrated in China, with AntPool, BTC.com, BTC. top, and F2Pool all based in China and controlling at least 50% of Bitcoin’s Hash Rate. According to TokenInsight’s report, the distribution of SHA-256 ASIC mining hardware manufacturers was also concentrated and the top 4 manufacturers in 2019 accounted for 95 percent of the total market. Bitmain, despite a turbulent year in 2019, accounted for around 55-58 percent of the total SHA-256 hardware sold and its market hold has been predicted to rise to 63 percent in 2020.

The post appeared first on AMBCrypto