This entire week, Bitcoin has been climbing higher, one step at a time.

We started on the weekend on Sept. 1, only to jump above the $10,000 level the next day. Now we are really close to crossing above $11,000 mark, last seen on August 13.

At the time of writing, BTC/USD has been trading at $10,890 — going as high as $10,949 today — while managing the daily trading volume of $943.6 million.

Source: Coin360

Interestingly, Bakkt starts offering the customers’ access to its secure Bitcoin storage warehouse, Bakkt Warehouse from today ahead of the launch of its physically delivered Bitcoin daily and monthly Bitcoin futures on September 23.

Bitcoin Open Interest on BitMEX hits $1 Billion Mark

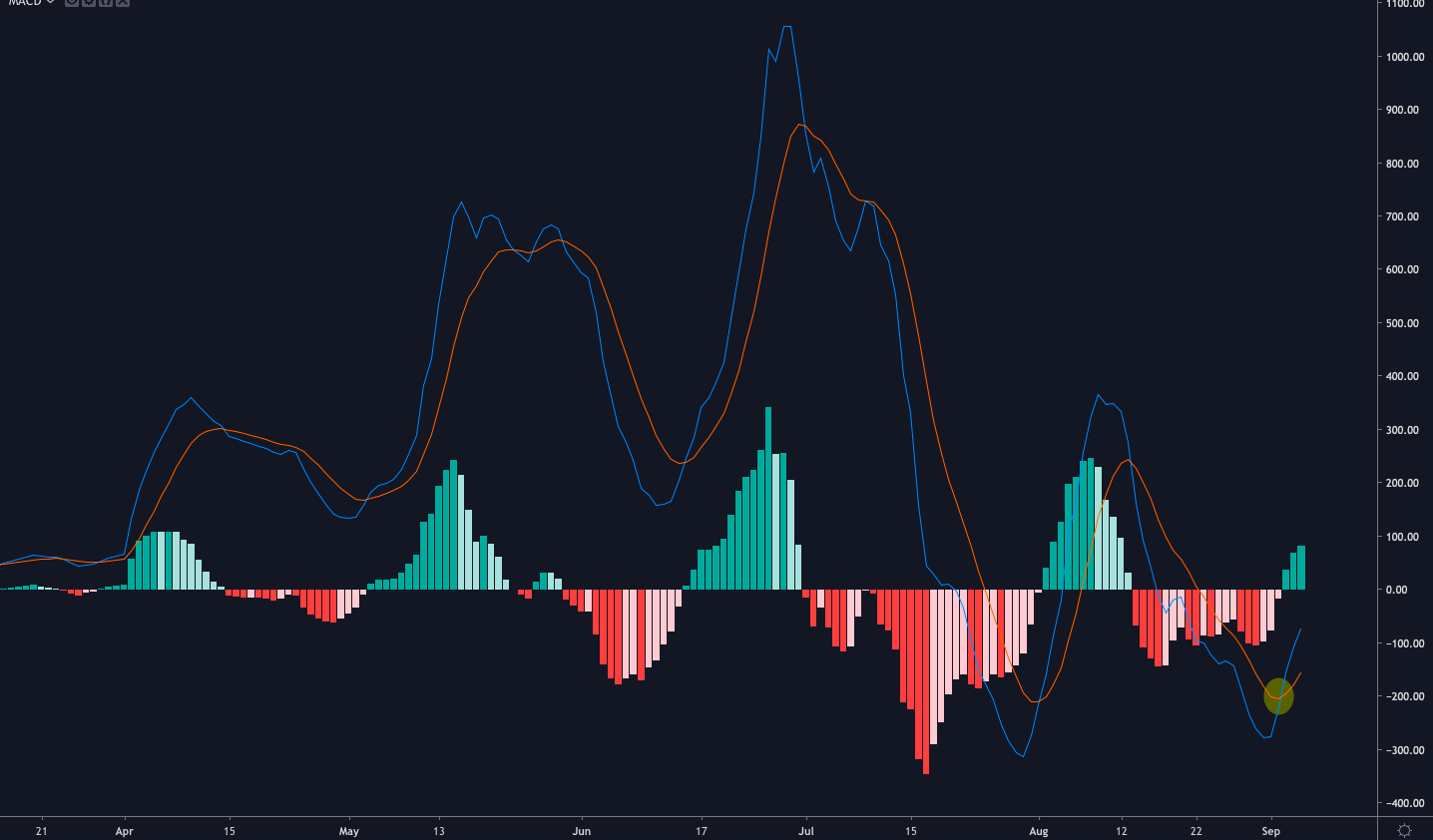

A new development seen in the market is $1 billion in open interest on BitMEX.

Open interest is the total number of outstanding derivative contracts that provides pictures of the trading activity and whether money flows into the market is increasing or decreasing.

Increasing open interest indicates new or additional money coming into the market while decreasing represents money flowing out of the market.

This $1 billion level is not the first time we jumped this year, we had 4 such attempts this past summer and each time, “we sold off.”

“But more generally it can be a good indication a move (up or down) is building,”

said Skew Markets.

All eyes on the ~$11,000 level. It’s led to strong rejection previously.

Until we get a daily close above, I’d exercise caution. Once we do, I think we tap $11,500.

Also note the previous instances of OI > $1B. pic.twitter.com/9JFBxCx3sT

— Hsaka (@HsakaTrades) September 6, 2019

“This area is either going to be one hell of a base or one hell of a trap,”

said Cantering Clark, a hedge fund manager and co-founder of Blockroots. He is expecting the market to go “down.”

Bitcoin Bears Might still be Alive

Meanwhile,

The current Bitcoin price structure, Crypto trader and investor Josh Rager notes is looking very similar to the one seen during the bull run of 2015-2016.

At that time, Bitcoin surged 2.5x from the bottom followed by six months of sideways movement. This led to an almost 2x increase in price “out of nowhere” as Bitcoin slowly makes its way up to new highs.

Based on this structure, Bitcoin could be expected to trade sideways up until the end of this year and then surge higher next year to break into a new all-time high (ATH).

However,

“One thing is for sure, I don’t want to see that $9k support break,”

Rager added.

But even if BTC breaks $9,000 mark, he said that isn’t a reason to panic as many buyers will step in by high $7ks.

Moreover, as Skew Markets notes, the most problematic chart in crypto markets right now is ETH-BTC realized correlation which says bears might still be here.

“Sustained high correlation level between bitcoin and ether indicates bear market might still be alive,”

Skew Markets added.

BitMEX Open Interest Hits $1 Billion Mark; Past Performances Have Not Been Good For BTC Price

The post appeared first on Crypto Asset Home