BitMEX offers a wide range of order types to help you buy, sell, or trade crypto. Whether you’re a seasoned trader or a new one venturing into crypto, understanding the different order types is key to starting your trading journey – across spot, derivatives, and more.

To learn more about the different order types available on BitMEX, read on.

If you haven’t signed up for a BitMEX account yet, we’re currently offering up to $5,000 in BMEX Tokens for verified users- you can register here.

What Order Types Are Available on BitMEX?

Before diving in, let’s cover the two topics that will be discussed – order types and advanced order functions (which are functions that can be used on top of existing order types).

Here are the order types available on BitMEX:

- Market orders

- Limit orders

- Stop Loss orders

- Take Profit orders

As well as some advanced order functions available on BitMEX:

- Hidden orders

- Iceberg orders

- Post Only orders

- Close on Trigger orders

- Pegged orders (Best Bid Offer/BBO)

Order Types on BitMEX

Market orders

Need to enter the market in a split-second? Then Market orders are for you, as they allow you to enter the market immediately at current market prices.

They can be used when urgency is key, but it’s important to be mindful of sudden price changes as large orders might incur market-impact costs.

Example: You want to buy 1 Bitcoin at the current market price (e.g. $65,000).

Limit orders

Limit orders give you control over the price you’re willing to buy or sell an asset at. As the trader, you specify your desired price to buy/sell and the trade size to minimise costs.

However, keep in mind that execution isn’t guaranteed if your price is too far from the market price.

Example: You want to sell 1 Bitcoin at $67,000 or higher.

Stop Loss orders

Stop Loss orders are orders that activate only when the market hits a specific Trigger Price. Trigger Price is the predetermined price at which the Stop Loss order becomes active and is executed to limit losses on the position.

Stop Loss orders are used for two main reasons: to manage risk by limiting losses on existing positions or to automate their entry to the market at a predefined entry point (eliminating the need to manually place an order).

BitMEX offers three types of Stop Loss orders:

1. Stop Loss Market order: Executes a Market order when the Trigger Price is reached.

Example: Sell 1 Bitcoin if the price drops to $60,000.

- Stop Loss Limit order: Executes a Limit order when the Trigger Price is reached.

Example: Sell 1 Bitcoin if the price drops to $60,000, but not below $59,500.

- Trailing Stop order: Triggers a Market Order if the price reverts by a set Trailing Value*. It’s designed to protect your profits while limiting losses by dynamically adjusting the stop price as the market price moves in your favour. If the market reverses, the stop price remains fixed.

Example: Sell 1 Bitcoin if the price drops $1,000 from its peak.

*A positive Trail Value indicates a trailing buy whilst a negative Trail Value indicates a trailing sell.

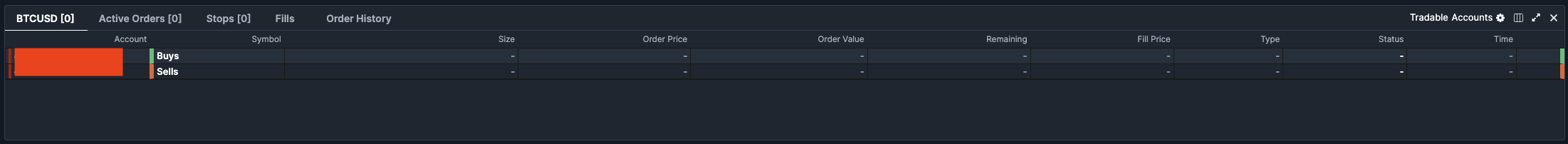

If you’ve placed Stop Loss orders on BitMEX, you can find your orders in the dropdown menu (shown below) to track their status.

The dropdown menu allows you to see details like the Limit Price, Trigger Price, and the current status of your order. It’s where you can overview all your active Stop Loss orders and access important details like the Stop Price, which is the price at which your order will be triggered, the current Status of your order (active, filled, or cancelled), and any other relevant information.

There are three states of Stop Loss orders, as listed below:

- Untriggered: Trigger Price has not reached.

- Triggered: Trigger Price has reached, but no order filled.

- Filled: Stop Loss order was executed.

To cancel Stop Loss orders, you can do so manually. However, Stop Loss orders that have been triggered aren’t guaranteed immediate execution and may experience slippage in fast markets.

Take Profit orders

Similar to Stop Loss orders, Take Profit orders get executed once a specified level is reached. Whereas Stop Loss orders are to mitigate your losses, Take Profit orders execute at the best available market price – when the market moves in a favourable direction for you to secure profit.

BitMEX has two types of Take Profit orders:

- Take Profit Market order: Executes a Market order when the Trigger Price is reached. It is designed to secure profits by selling the asset once it reaches a certain price level.

Example: Sell 1 Bitcoin if the price rises to $70,000.

- Take Profit Limit order: Executes a Limit order when the Trigger Price is reached. It is designed to secure profits by selling the asset at a pre-set or better price once the market reaches the trigger price.

Example: Sell 1 Bitcoin at $70,000 or higher if the price reaches $70,000.

When placing a Take Profit order, you can specify the Trigger Price based on the Last Price, Mark Price, or underlying Index Price of an asset. Take Profit orders can be managed in the dropdown menu (same as Stop Loss orders), which displays the Limit Price, Triggering Price, and Status.

Same as Stop Loss orders, there are three states to Take Profit orders:

- Untriggered: Trigger Price not reached.

- Triggered: Trigger Price reached, but no order filled.

- Filled: Take Profit Order executed.

You can monitor and manage your Take Profit orders the same way as Stop Loss orders – via the dropdown menu.

Users have the flexibility to cancel Take Profit orders manually. However, like Stop Loss orders, triggered Take Profit orders aren’t guaranteed immediate execution and may encounter slippage in fast-paced markets.

Advanced Order Functions on BitMEX

Hidden orders

Hidden orders let you place orders without showing them on the public order book. Traders who wish to keep their trades private can look to Hidden orders.

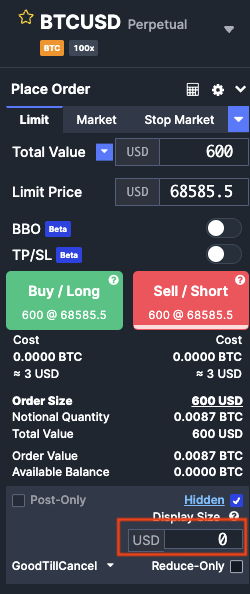

You can start using Hidden orders via the order form on your trading UI. It’s available for Limit orders, Stop Limit orders, or Take Profit Limit orders – simply tick the “Hidden” box option on the order form as shown below.

Iceberg orders

Iceberg orders only show part of your order on the public order book. If you’re a smart trader who wishes to blend in with others who keep refilling their orders, you can look to Iceberg orders.

Like Hidden orders, you can access Iceberg orders by ticking the “Hidden” box on your order form. From there, you input how much of the order you wish to display on the orderbook in the slot, as shown below.

Post-Only orders

Post-Only orders make sure your limit orders only get added to the order book if it doesn’t match an existing order at the same price. In the event it does match, the order will be rejected but can still match with Hidden orders. These are always counted as Maker orders when considering fees.

You can access Post-Only orders by ticking the “Post-Only” box on your order form.

Close On Trigger orders

Close On Trigger orders are considered high-priority orders and may only be used to reduce a position. Traders can use Close On Trigger orders during market reversals.

An important note here is to check that you have enough margin to execute the Close On Trigger order. If there isn’t enough margin to execute a Close On Trigger order, try to cancel any other open orders for the same asset. These orders automatically cancel if they increase the position.

Pegged orders

Pegged orders let you set a limit price based on the current market price. The limit price stays fixed when the order is placed and doesn’t change with the market, meaning they shouldn’t be used for speculating on future price changes.

*BitMEX offers two types of Pegged orders: PrimaryPeg, which sets the price near the best bid or ask, and MarketPeg, which sets the price further from the best bid or ask.

*Refer to the API Explorer for complete documentation on the Pegged order type.

Like what you’ve read? For more educational resources on trading on BitMEX as well as trading crypto derivatives, visit this page.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

Related

The post appeared first on Blog BitMex