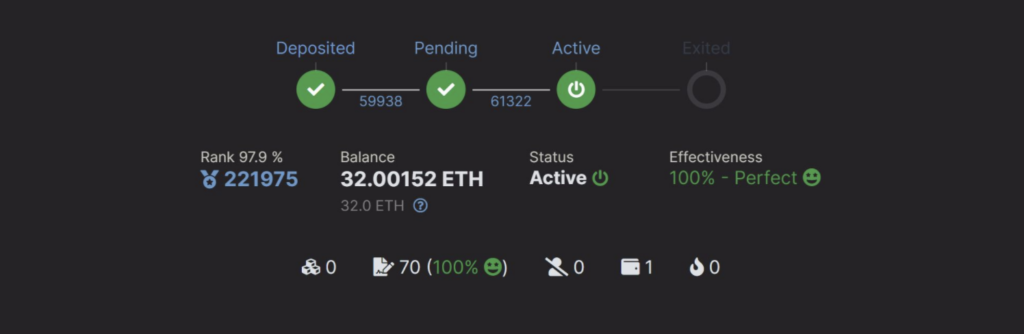

BitMEX Research is delighted to announce that as of 31 August 2021, we have become an active staker on the Ethereum Beacon chain (Eth 2.0). Our validator number is 222,424. Within a few hours we had already proposed our own block, slot 1,964,794 in Epoch 61,399. This is pretty exciting and it felt like quite a low barrier of entry before being able to produce a block.

Over the coming weeks and months we are going to take a more detailed look at Ethereum’s latest proof of stake system and the Beacon chain. We are planning on examining issues such as:

- Slashings, penalties, and rewards

- The impact of staking on Ethereum coin supply

- Hostile staking strategies

- Selfish staking strategies

- How staking may impact MEV

- Overall review of the sustainability and robustness of the system

In order to conduct the above analysis, it’s important to do more than read the PoS specification documents and look at data from the Beacon chain. It is also critical to learn from experience and actually conduct staking, while actually running both the Eth1 and Eth2 chain on a machine under our control. Therefore BitMEX Research has become a staker.

Minimum Staking Requirements

We would like to thank the trading platform (BitMEX) for providing over US$105,000 (32 ETH * $3,300), from the corporate treasury, to enable us to acquire the 32 ETH necessary to conduct the staking.

The first thing to note is that US$105,000 seems like a lot of money, perhaps too much to make staking accessible. We have noticed some in the Ethereum community complain about this and discuss the idea of lowering the minimum requirement. This large US dollar value is mostly due to Ethereum’s rapid price appreciation. However, the node running cost is also quite high, perhaps at least US$2,000 per annum when including the cost of bandwidth. The earnings from running one validator are just about likely to cover this. Therefore, one could argue this high cost is necessary to reduce the risk of stakers switching off their machines. Indeed, with all the effort and cost of validation, it is not worth it from an economic perspective to stake with significantly less than US$100,000, in our view. Therefore we see little point in lowering the minimum staking requirement.

Geographical Location

The other key difference with Bitcoin PoW, which we noticed when setting up the staking client, is the incentive to use a data center from a large cloud services provider, which is the model we chose. With PoW, block construction or mining pool services could use large third party data centre providers, but the actual hashing normally occurs in a specialised location. When conducting experiments this would normally be at home or an office, while commercial operations tend to have a site near an chosen energy source or they could take up large space in a data centre where power on the grid is cheap. The geographic diversification of PoW miners could therefore be partially determined by the geographic makeup of the energy assets. With regards to staking, the choice for us was easy, we went with a large cloud services provider, this is easier than attempting to stake from a local device. If the staker goes offline you begin to get penalties and this is not something that can be avoided with other options.

In some ways this dependence on cloud service providers could be thought of as a weakness, however in other ways staking is also potentially more flexible. The stake can be moved around to another location and the geographic distribution of the staking clients is not even a particular issue. There is no real significant physical infrastructure associated with staking and there is no significant economic link to the real world or real resources, the key factor is of course the number of coins, which exist on chain. So perhaps thinking about the geographic distribution of assets is not appropriate, as it is for PoW.

On the other hand, at the moment there does not appear to be a way to change the keys associated with a validator account, therefore if one thinks the cloud services provider has access to the private keys, moving to another provider may be a bad idea, because otherwise your account could be hacked and you wouldn’t know who is responsible. Therefore maybe stakers are stuck with the provider they chose, which is a weakness, at least until changing keys becomes easier.

Related

The post appeared first on Blog BitMex