Bitcoin maintains its position above the $9,500 level, while some altcoins mark impressive gains. Rumors from Binance CEO CZ about an upcoming DeFi involvement send BNB upwards.

At the same time, the US stock market indexes decrease in value a bit while gold broke above the coveted level of $1,900 per ounce.

Gains In The Crypto Market

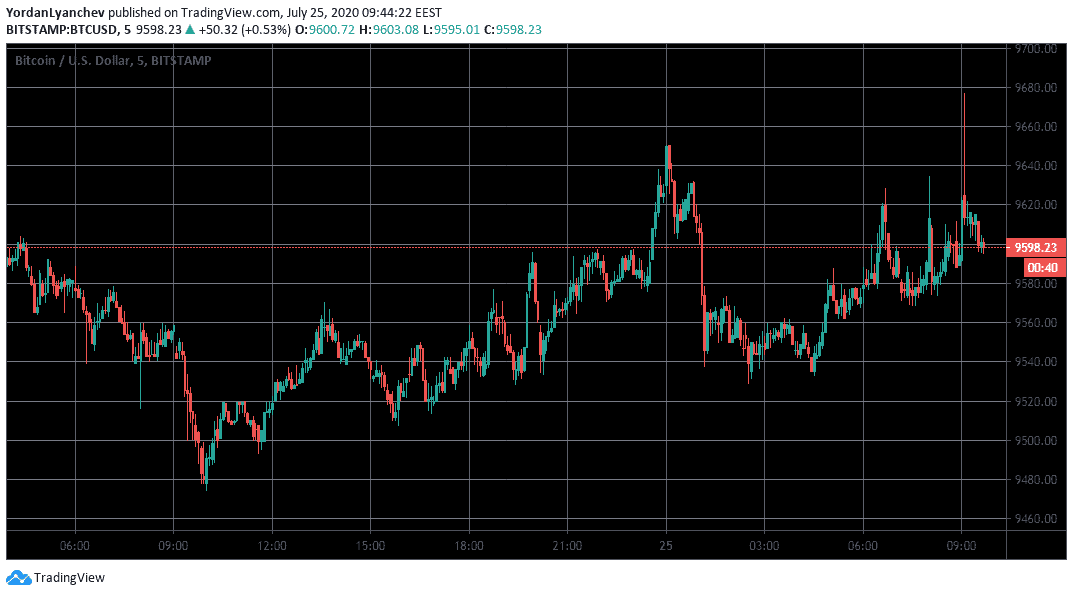

After yesterday’s sudden loss of over $4 billion for the entire cryptocurrency market cap, today’s situation appears reversed. Bitcoin’s $9,500 support line managed to hold its ground despite a few attempts to break below it. However, the bulls took charge and pushed BTC towards $9,650 on a few occasions on Bitstamp before the price retraced to its current level of $9,600.

Ethereum continued with its impressive performance. The second-largest cryptocurrency by market cap has gone up by 4.5% and reached $284. Cardano and Litecoin have also increased their respective value by 5.7% and 6%.

However, the most significant gainer in the past 24 hours from the top 20 coins is Binance Coin (BNB). The brainchild of the leading cryptocurrency exchange has surged by over 7% to nearly $20.

The latest increase could come from rumors started by Binance CEO – Changpeng Zhao (CZ). In a recent tweet, CZ hinted that his company is working on a project related to the latest trend in the cryptocurrency scene – DeFi.

Alright guys, you know who to blame… Joking

#DeFiEO soon, soon. https://t.co/saDf1Gk9xw

— CZ Binance (@cz_binance) July 24, 2020

Following news that Swipe has partnered with Travala.com to accept its native cryptocurrency as a payment method at more than two million hotels, SXP surged by more than 35%. Interestingly, just a few weeks ago, SXP was outside the top 100 coins by market cap, while it takes the 66th spot now, according to CoinMarketCap.

Ampleforth is another massive gainer today with a 21% increase after the popular derivatives exchange FTX resolved the issues it had with the AMPL perpetual contracts on its platform.

Aave heads up by 14.5%, while Verge is next with an increase of 8%. Contrary, Quant loses 9.29% of its value, while Band Protocol goes down by 6.7%.

Gold Above $1,900, Stock Markets In The Red Again

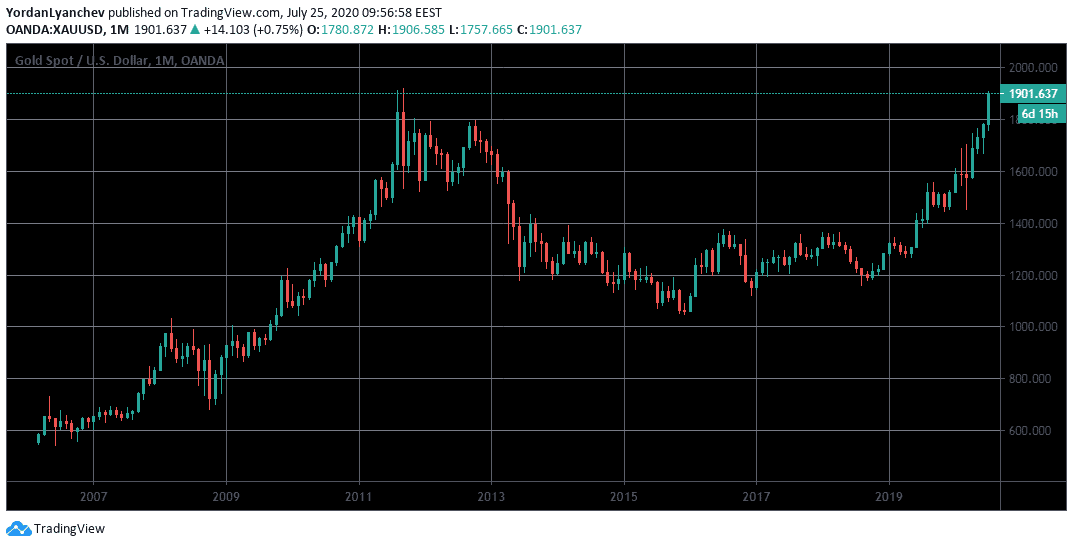

The precious metal market enjoys a bullish ride lately, with gold and silver as the most prominent representatives. During yesterday’s trading session, gold’s increase continued, and it broke above $1,900. As such, the bullion is getting closer to conquer its all-time high of approximately $1,920 registered in 2011.

And while gold’s price movements attract substantial attention, silver actually outperforms it. Silver has reached a seven-year high this week, as the falling US dollar and record low interest rates push investors to search for other safe-haven assets. The precious metal is up by 18% this week alone and is currently trading at $23.24 per ounce.

The situation with the US stock market indexes is rather different. The three most prominent ones, namely the S&P 500, Nasdaq, and Dow Jones, dropped by nearly 1% during yesterday’s trading session.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato