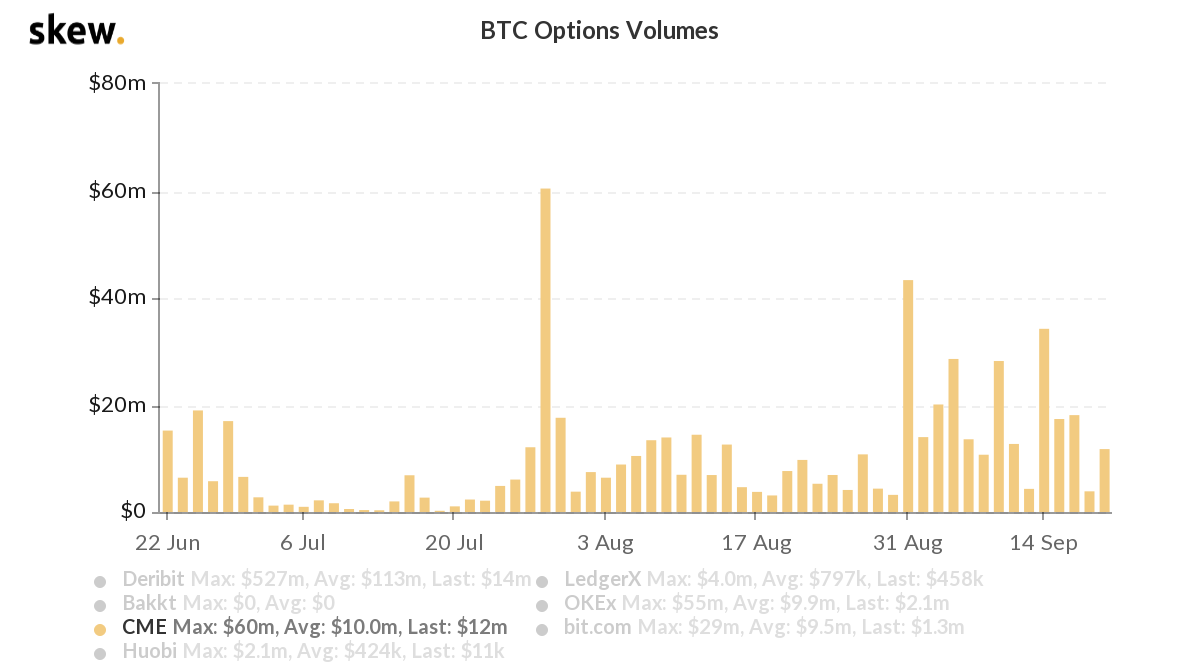

Bitcoin Options trading volume on the CME has consistently been higher than $7M over the past 3 months. In fact, the figure in question has even gone past $30M on quite a few occasions over the last 30 days.

Source: Skew

Such consistent trading volume is an indication of steady institutional interest and investment in trading. And because the trade volume has been consistently high since 31 August, the upcoming Options expiry on 25 September may turn out to be a non-event, a damp squib, if such interest continues to sustain itself.

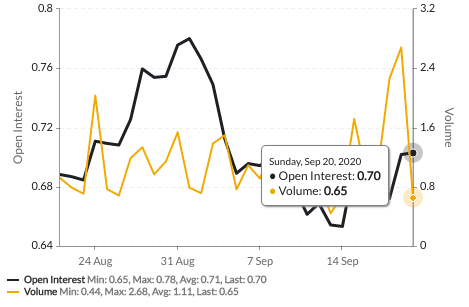

The Put-Call ratio, for instance, was 0.70 for Open Interest yesterday. While a trader would read this chart and note bearish sentiment across the board, a contrarian would read it and conclude that a drop is close, and recovery is closer than that.

Source: Skew

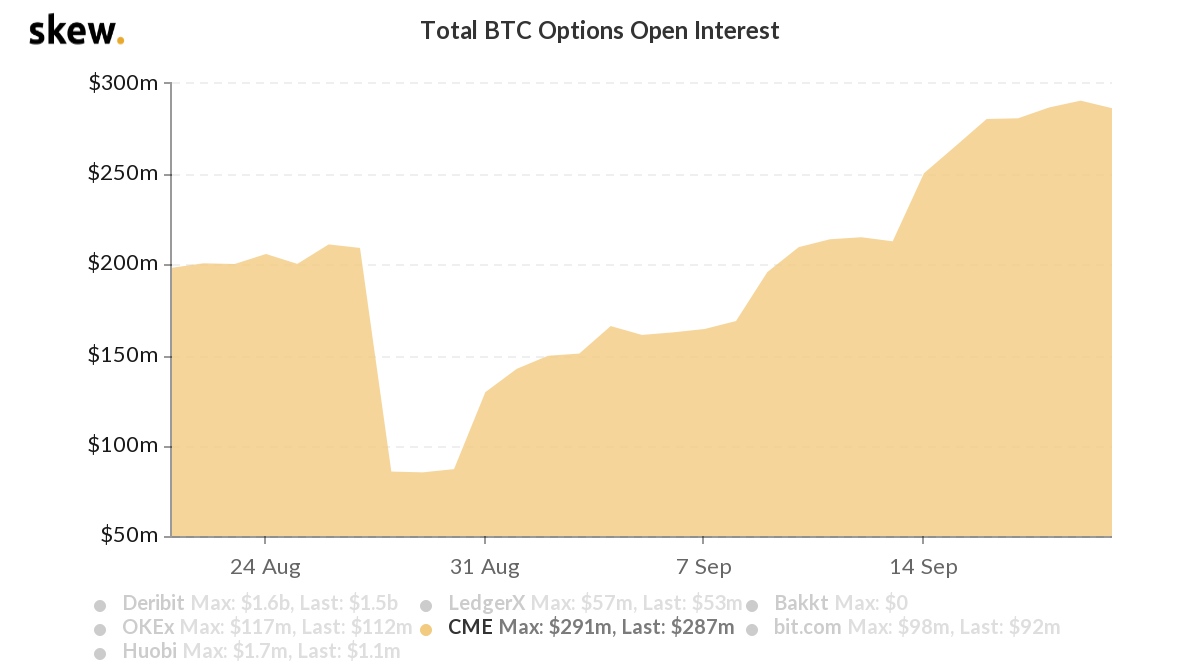

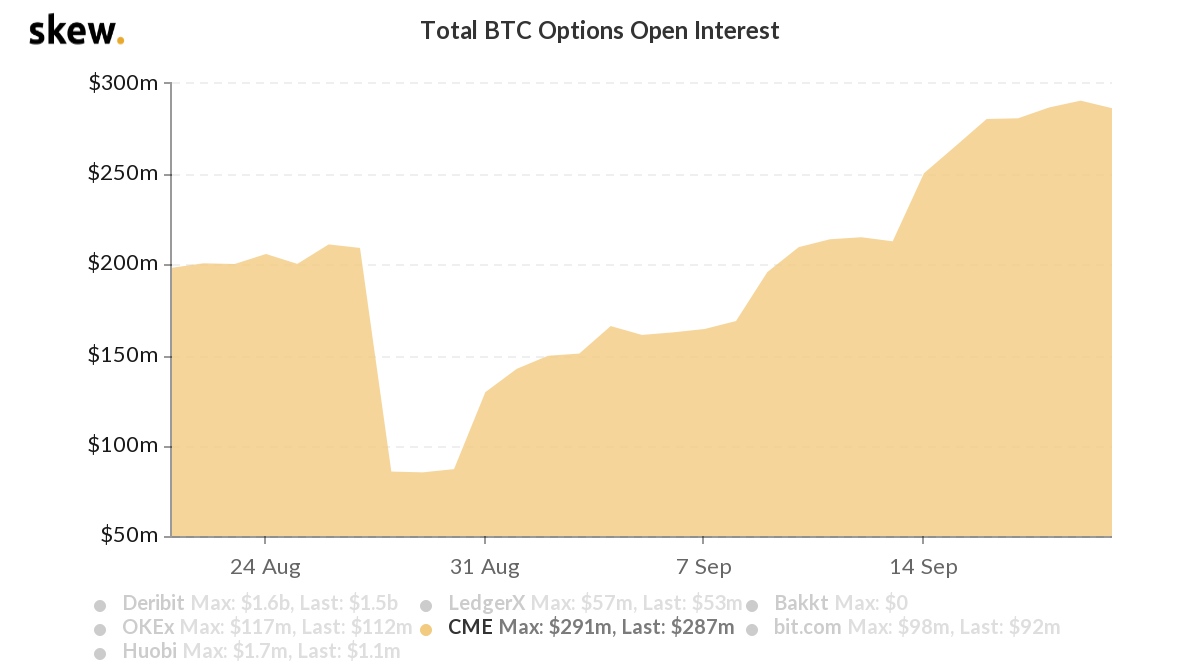

The contrarian angle here is a result of the prevailing market conditions that are very unique in nature. Institutions like MicroStrategy are betting big on Bitcoin. In fact, so significant is their bet that Bitcoin is now their reserve asset, with $500M invested in the cryptocurrency, straight out of the company’s balance sheet. The same is made evident by the fact that Open Interest for Bitcoin Options has been surging over the past two weeks.

Source: Skew

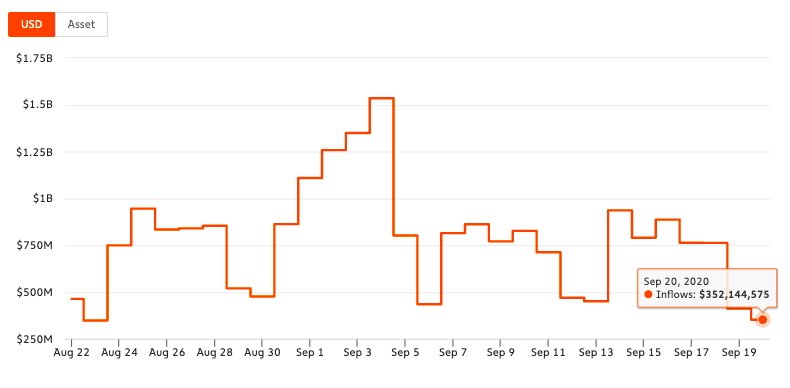

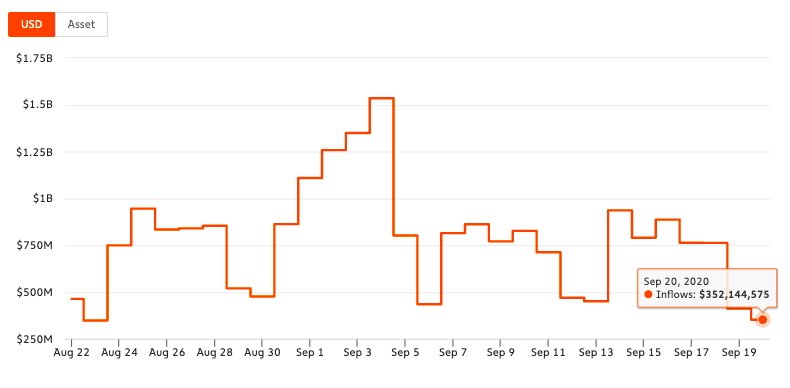

The contrarian view applies here as the inflow of Bitcoin to exchanges has been choked lately. The usual increase in supply and the lack of demand are no longer the case. Instead, the supply has dwindled while demand across the market hasn’t dropped proportionately.

Source: Chainalysis

In fact, the supply on spot exchanges has dropped to its lowest point in a month. There aren’t enough traders liquidating positions or transferring their Bitcoin to sell. Even if there is an instant drop in prices due to Options expiry, the recovery will be fast, especially if the supply continues to drop.

The current Options expiry may look like a significant event on the charts. However, the impact may be different from what has been anticipated. All said and done, it may just turn out to be a smokescreen. If a drop in the price on spot exchanges follows the Options expiry, it may not be as significant and the recovery may be faster.

The post appeared first on AMBCrypto