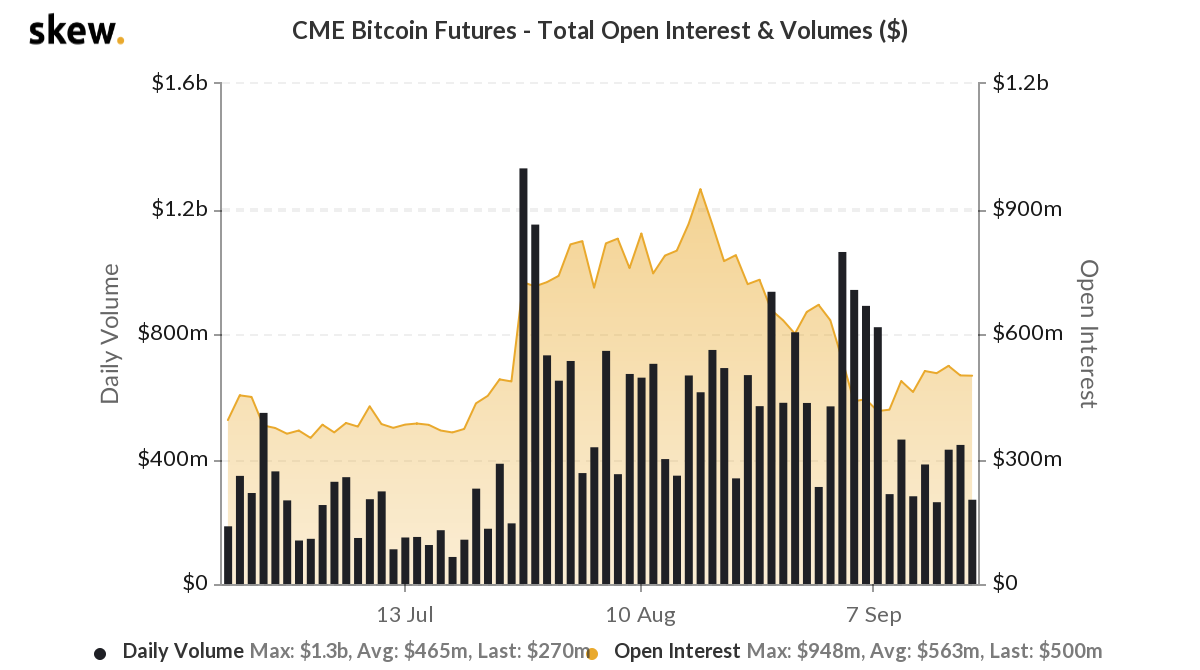

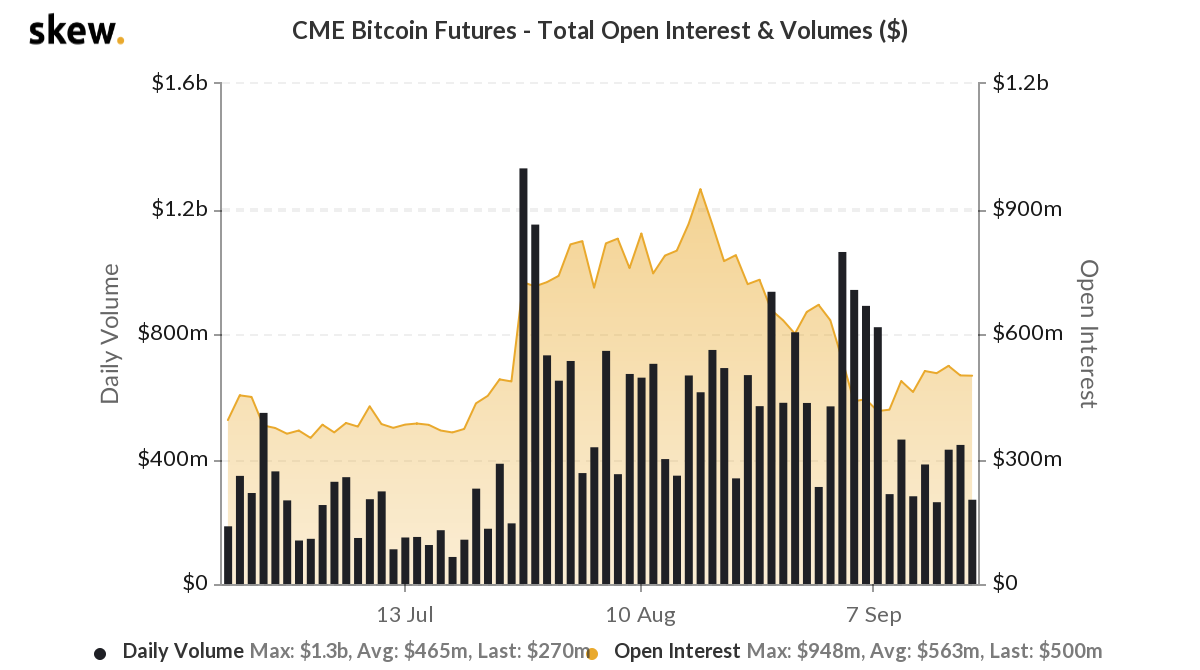

What’s the tipping point for Bitcoin Futures on top derivatives exchanges like the CME, an exchange that has recorded a daily trading volume of over $300M and Open Interest of over $400M, consistently, for the past 3 months.

Source: Skew

Well, a small shift in Open Interest or trading volume can have a cascading effect on Bitcoin Futures’ performance in the next 180 days. Such a shift will be influenced by several factors, and it begins at the tipping point. Three factors, to be more specific.

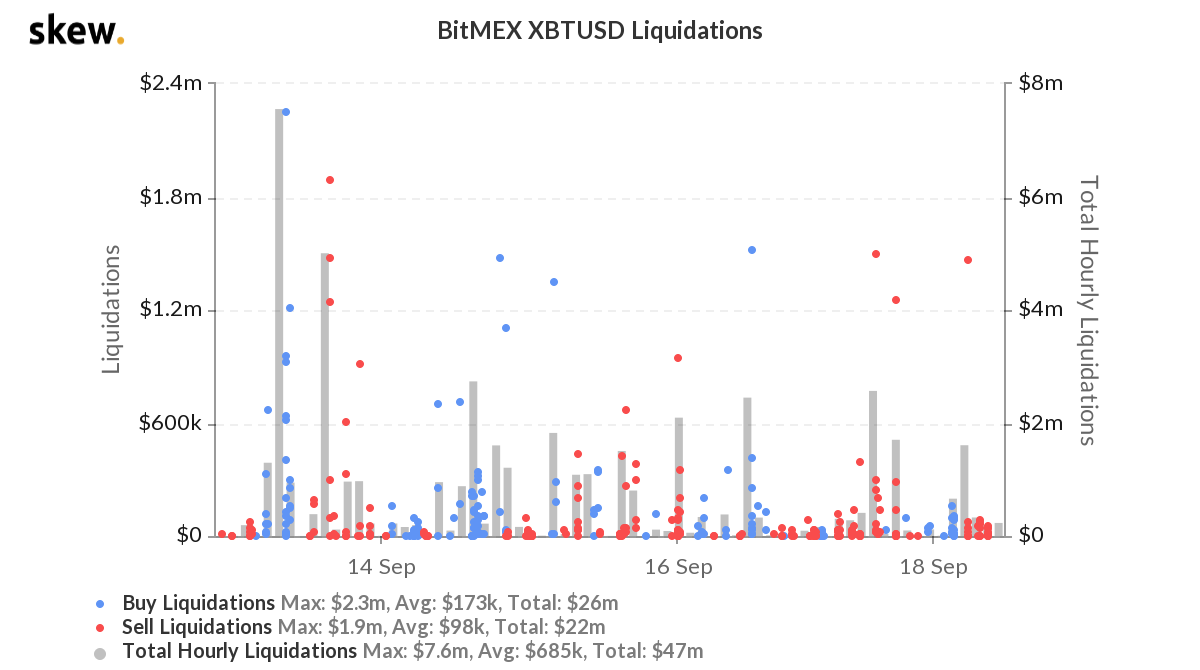

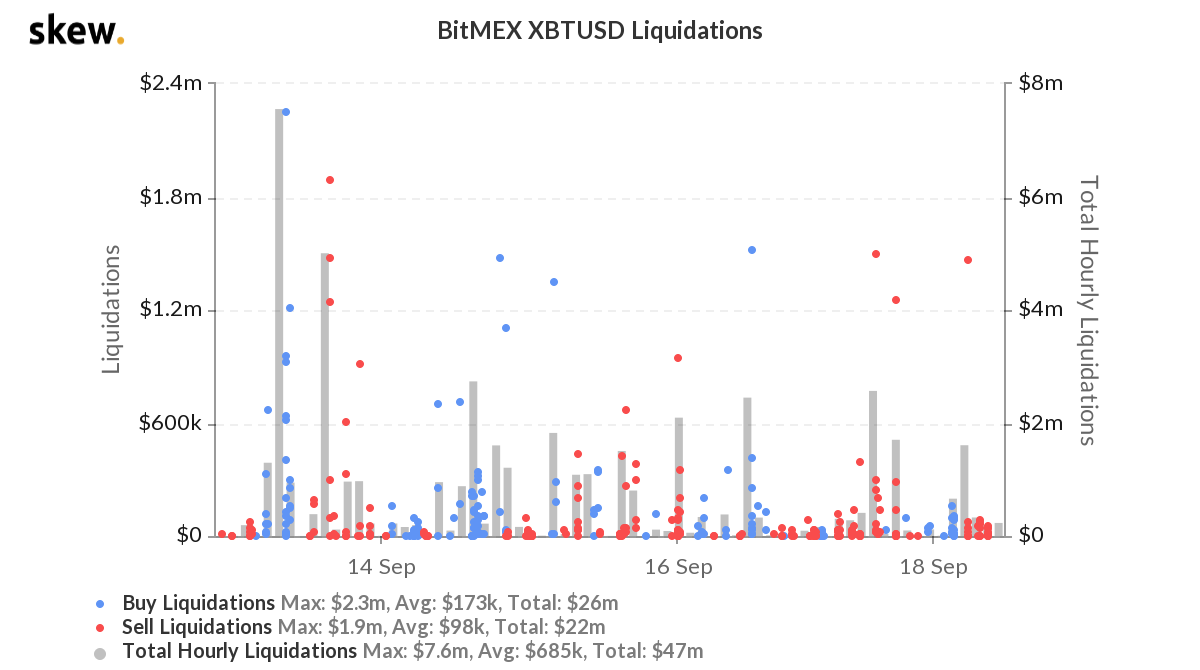

In the current phase of Bitcoin’s market cycle, these factors are more relevant for traders on derivative exchanges. This becomes more evident when the Liquidations chart for BitMEX is observed. Over the past 3 months, sell liquidations have paid for buy liquidations. However, over the last few days, this trend has been reversed, and buy liquidations have covered for sell liquidations on BitMEX.

Source: Skew

The point here is to detect the source of the domino effect before the dominoes start falling. In the case of Bitcoin Futures, the tipping point may be closer than anticipated.

One of the top factors influencing the tipping point is the Law of the Few.

The Law of the Few states that “the success of any kind of social epidemic is heavily dependent on the involvement of people with a particular and rare set of social gifts.”

In the case of Bitcoin, institutional investors, derivatives traders, and whales fit the bill. The success of Bitcoin Futures in the global trading community heavily relies on institutional investors trading on CME. In fact, the daily trade volume and Open Interest on CME influence the trading sentiment across spot exchanges as well.

The last time a cascading effect was witnessed was when BTC Futures’ Daily Trading Volume hit $445M on CME and there was a rally all the way up to $614M. At the time of writing, the Daily Trading Volume was up 63.3%, when compared to the figures 6 months ago, and it has the potential to hit $614M with one move in the right direction.

This effect heavily relies on another key factor – The Stickiness Factor.

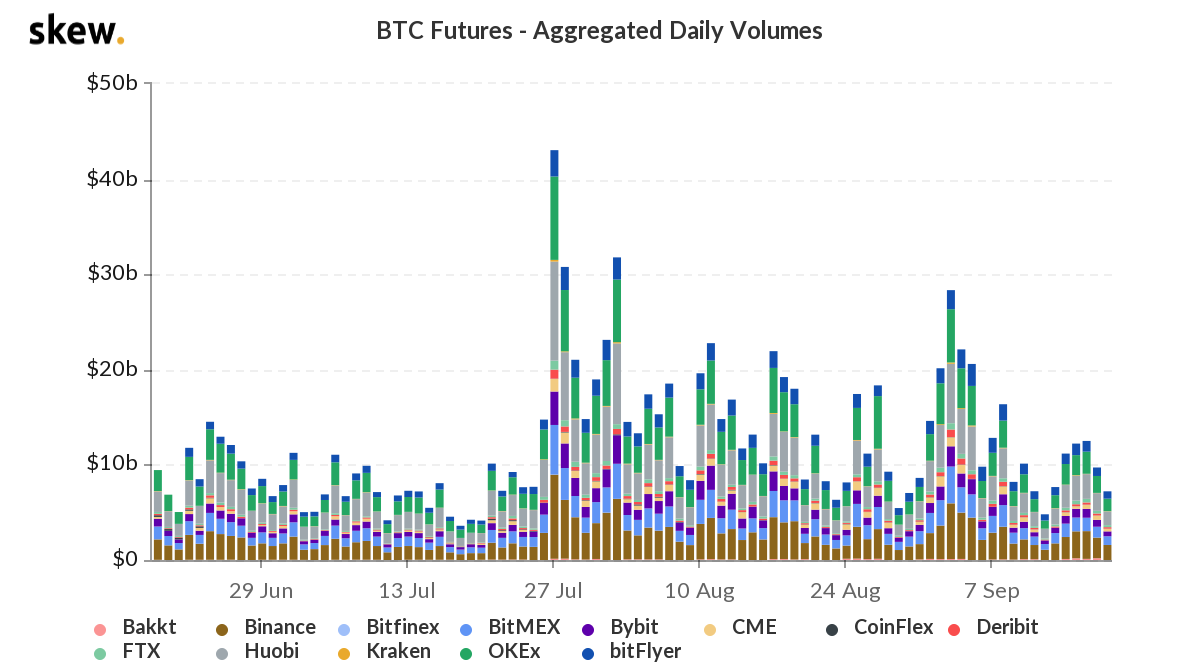

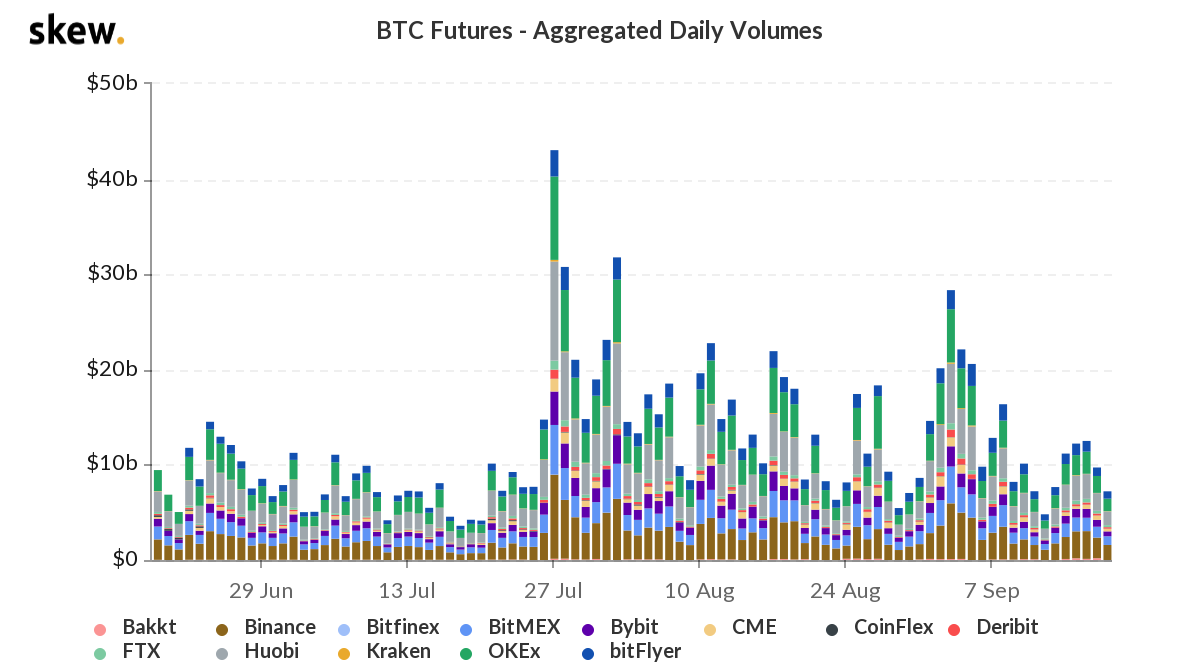

Back in 2017, when Google search results for “Bitcoin” and “Crypto” broke the record, the trading community witnessed a historic Bitcoin bull run and altcoin rally. Institutional interest and growth of Bitcoin derivative products ensued. A similar event transpired when Bitcoin Futures’ aggregated daily volume hit $184B on 27 July 2020. This event was a unique occurrence, and it made Bitcoin Futures stick in the portfolio of the average institutional investor and the derivatives trader.

Source: Skew

The aggregate trade volume hasn’t dropped to pre-July 2020 levels since then. Despite drops in Bitcoin’s price on spot exchanges, Futures contracts continue to trade at a premium and there is more optimism. Volume is not directly impacted by Bitcoin’s price and when the spot market is riddled with bearish sentiment, long contracts continue feeding shorts on BitMEX. This stickiness is a driver of the aforementioned tipping point.

Inching closer to the tipping point, the powerful context is the rise of stablecoins and their instrumental role in lowering the barrier to entry on spot and fiat-crypto exchanges.

Over the past three months, stablecoins like USDT have added $100M in volume every day and their market capitalization and dominance have risen tremendously. In fact, Tether has also crossed a market capitalization of $15B.

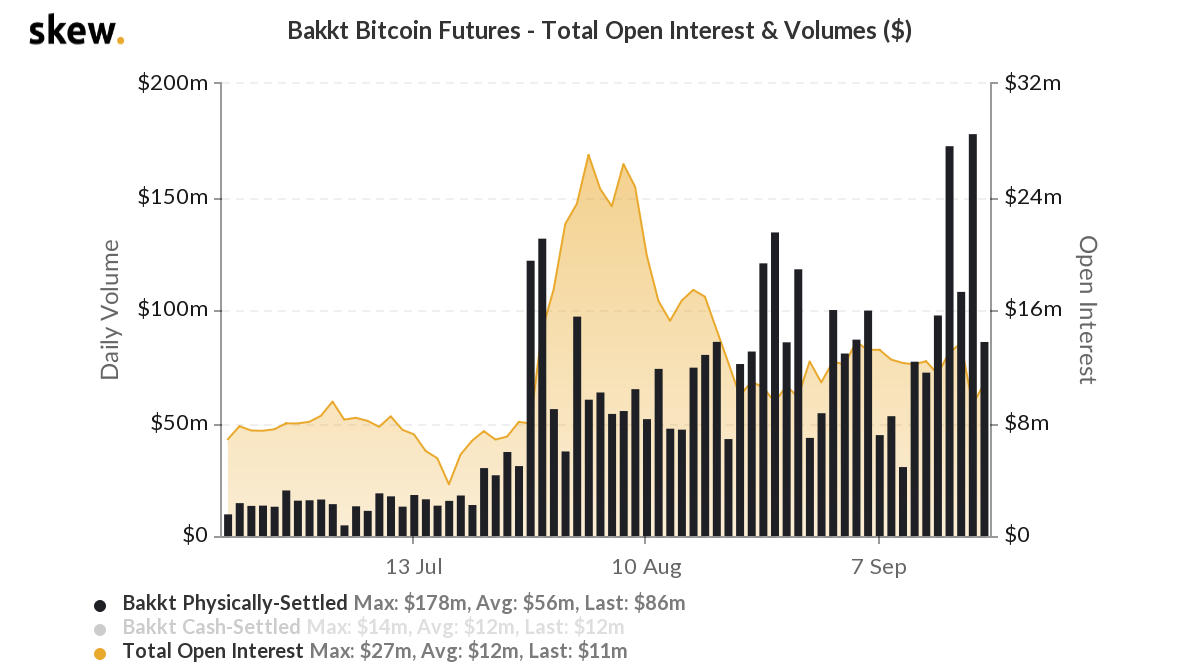

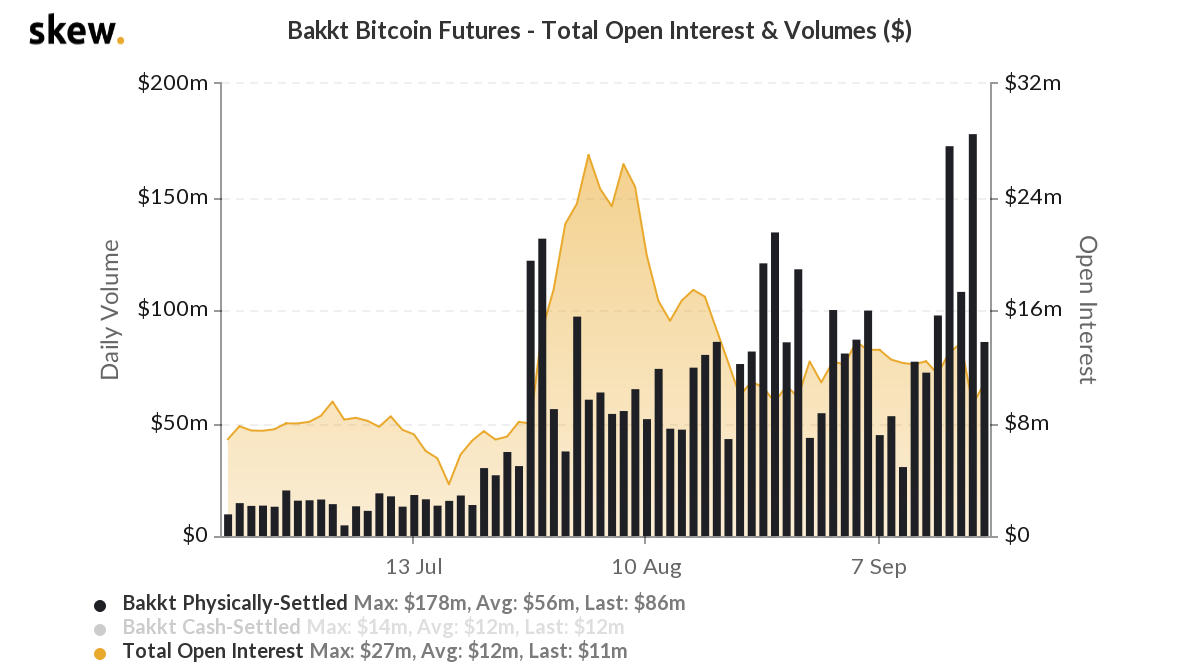

This directly influences the tipping point for Bitcoin Futures as it makes Futures trading more accessible to traders. Bitcoin held on exchanges has nearly doubled over the past month, corresponding to an increase in Tether’s market capitalization and circulation. This resonates with derivatives traders who opt for physically-settled Bitcoin Futures contracts on exchanges like Bakkt. In fact, on Bakkt, the daily trade volume was upwards of $80M for the past week, while the Open Interest has been consistently above $10M.

Source: Skew

All of these factors are highlighting a shift in derivatives traders’ strategy, while also underlining increased activity on derivatives exchanges. The race to the tipping point has begun – An increase in aggregate trading volume on physically-settled Futures contracts or CME may trigger the much-awaited domino effect.

The post appeared first on AMBCrypto