In the past few days, the cryptocurrency market has recovered significantly, but Maker (MKR) though initially lagging, now appears poised for a significant rally. With bullish market sentiment, MKR has recently broken out of its bullish price action pattern resulting in an increase in interest from traders and investors.

Maker (MKR) Technical Analysis and Upcoming Levels

According to expert technical analysis, MKR appears bullish as it has broken its bullish inverted head and shoulder price action pattern on the daily time frame. However, this bullish pattern occurred at the bottom of the support level and on the 200 Exponential Moving Average (EMA) in a weekly time frame.

Support from 200 EMA and the formation and breakout of a bullish price action pattern have shifted the overall sentiment for the MKR token. With its recent breakout, if it closes a daily candle above the $1,685 level, there is a strong possibility that MKR’s price could rally by 30% to reach the $2,200 level in the coming days.

MKR Price Momentum

At press time, MKR is trading near the $1,700 level and has experienced a price surge of over 6% in the past 24 hours. During the same period, its trading volume significantly jumped by 70%, indicating rising participation from traders and investors amid the recent breakout.

Bullish On-Chain Metrics

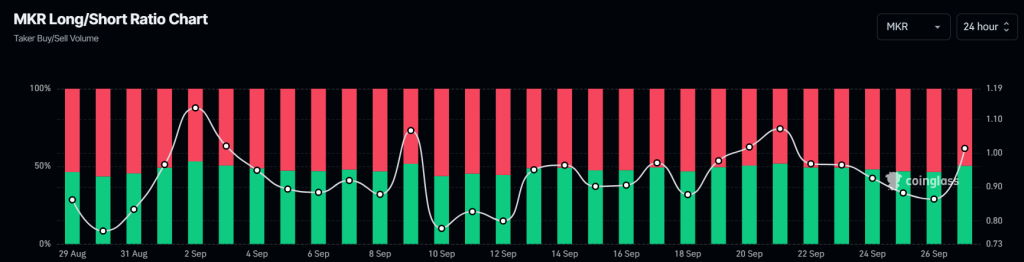

However, MKR’s bullish outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, MKR’s Long/Short ratio currently stands at 1.031, indicating bullish sentiment among traders.

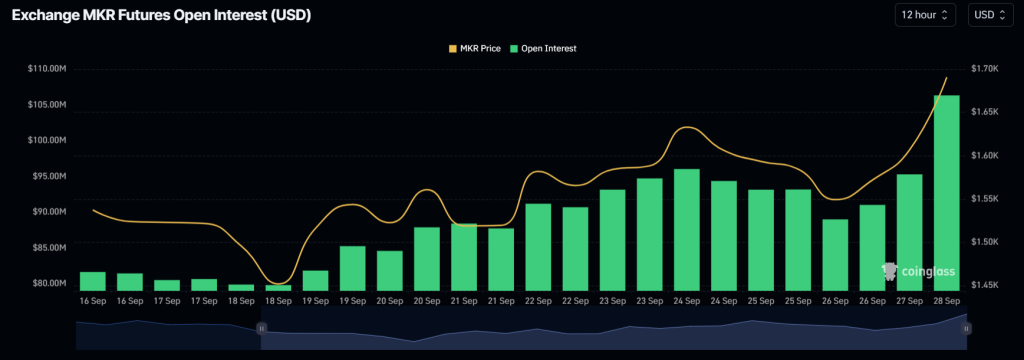

Additionally, its future open interest has jumped by 16% in the past 24 hours and has been steadily rising, indicating rising interest from traders and investors.

Typically, traders and investors use the combination of rising open interest and a long/short ratio above 1 when building long positions. Considering all these on-chain metrics, it appears that bulls are currently dominating the asset, potentially driving MKR toward a massive upside rally in the coming days.

The post appeared first on Coinpedia