Bitcoin price has finally broken bullish out of a 3-day channel (orange) and making good progress towards the psychological $11,000 level above.

The return of $9 billion to the global crypto market today has allowed BTC to return above $10,900 for the first time in 7 days and caused over $9 million worth of short liquidations on BitMEX – according to Datamish figures.

Avast majority of altcoins are also enjoying positive returns as Bitcoin lifts the rest of the market.

Despite the breakout, bearish traders are still putting up a strong fight right now. The $10,900 price point is seeing a lot of selling pressure bear down on the uptrend and is hindering Bitcoin’s current throwback rally attempt.

Price Levels to Watch in the Short-term

On the weekly BTC/USD, we can see that bulls are battling to break above the previous weekly open at $10,920. This is the first major resistance standing in the way of bitcoin’s progress towards $11K. Above this price point, we also have the $10,970 level which should create some friction in the uptrend.

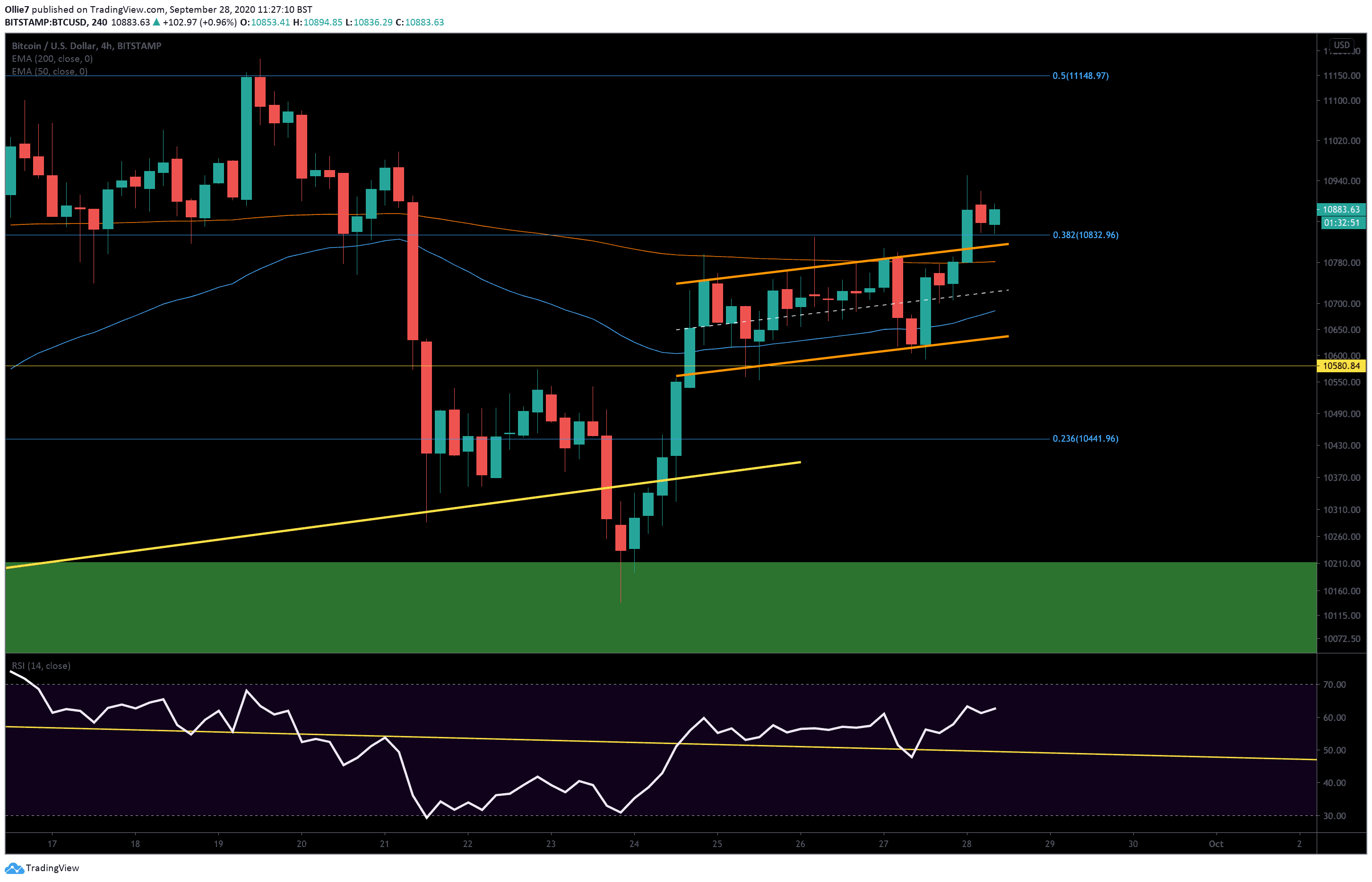

Looking at the price action more closely on the 4-hour timeframe, we can see that bulls are trying to launch off from the 0.382 Fibonacci level at $10,832, which recently flipped from resistance to support. This is our first major support as BTC tries to reclaim $11K. If bears succeed in overcoming this key level, then we should expect to see prices fall back on the former channel resistance at around $10,810, and potentially dip back inside on to the 200 EMA (red) at $10,780.

Beneath that, we have the channel median line (dashed line) at $10,730 and the 50 EMA (blue) at $10,695 as additional supports.

Should bulls manage to break the $11,000 mark and maintain momentum, then the next test will be to conquer the 0.5 Fibonacci level at $11,150. With BTC already at 63 on the 4-hour RSI indicator, it’s possible that reaching this area will push the leading crypto into the overbought region and cause a sharp correction – be aware.

Total market capital: $353 billion

Bitcoin market capital: $201 billion

Bitcoin dominance: 57.0%

*Data by Coingecko

Bitstamp BTC/USD Weekly Chart

Bitstamp BTC/USD 4-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato