The last few days have been nothing but sloppy in terms of Bitcoin’s price action. The cryptocurrency dipped below $10,000, recovered, and, most recently, failed to conquer $10,500.

According to a popular Bitcoin analyst, there’s an important level that should hold if we are, indeed, in a bull market.

This Level Should Hold Bitcoin’s Price

Commenting on the recent BTC price activity was the popular trader and market analyst going by the Twitter handle BTC_JackSparrow.

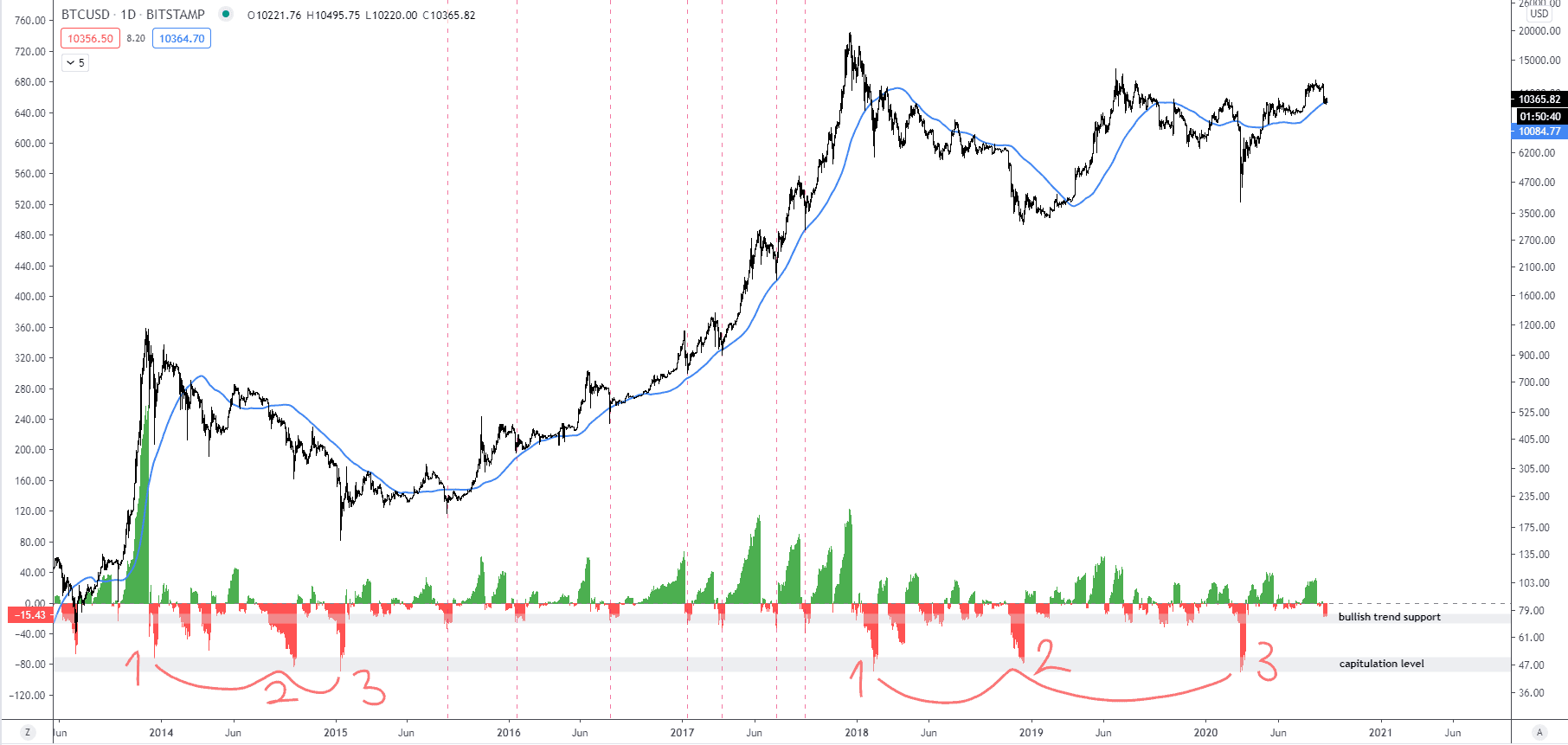

If BTC is in a bullish trend, this is a level of support that should hold. Historically at pullback levels that – in a bullish market – always held. If not – we are in for far more trouble, but I think the odds for holding support and bouncing are good. – He tweeted.

The level he’s talking about is the 128 days moving average, that, at the time of this writing, sits at around $10,100, whereas Bitcoin is trading just shy of $10,300.

As per the chart he shared, on a macro level, whenever Bitcoin goes below the 128 DMA for a more extended period of time, there’s a steep decline. A case in point is the March selloff, as well as the decline last summer, at the beginning of 2018, and all the way back in 2014 and 2015.

Bullish Bias Somewhat Prevalent

In light of the above observation, the analyst’s prediction skews in favor of a bullish outcome. This appears to be the prevailing sentiment among many analysts.

As CryptoPotato reported, the current price action fits inside a 134-day rising channel while the price is currently resting along with the channel’s support.

Looking at the first bullish target, the 100-EMA line has created strong resistance against a breakout to the upside at around $10,380, and Bitcoin failed to close above it on its most recent attempt.

From below, however, there’s still the heavily discussed CME gap down at $9,665, which didn’t get filled on the recent legs down. Some analysts think that Bitcoin will close this gap before continuing further to the upside.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato