A recent report suggests that the amount of Bitcoin stored on exchanges is declining while BTC whales increase their holdings and that’s bullish for Bitcoin’s price.

The paper also highlighted that investors have a much larger time horizon for their holdings now compared to previous years.

Bitcoin Stored On Exchanges Drop

In its latest report shared with CryptoPotato on Bitcoin investors’ behavior, the popular research company Digital Delphi explored the number of bitcoins stored on cryptocurrency exchanges. The document indicated that if the BTC stock on platforms increases, it could put sell pressure.

However, this isn’t necessarily the case during bull runs, as retail investors often “leave BTC on exchanges and traders use BTC as margin collateral.” Alternatively, in case the asset price rises while the stock on exchange decreases, this typically implies an accumulation trend.

The report indicated that Bitcoin stored on exchanges marked an all-time high of 2.96 million in mid-February. Since then, the trend has reversed, and the number has dropped to below 2.6 million.

Digital Delphi argued that the reason behind this decrease of BTC on exchanges is because investors are most likely preparing for a longer-term holding period. More importantly, though, the paper highlighted a substantial decline in speculative trading interest in Bitcoin, while the HODLing mentality has increased.

“Unlike the 2019 price uptrend, which coincided with BTC stock increasing, this current trend has seen a divergence between BTC stock and price. This suggests a more sustainable move upwards for BTC, in comparison to that of 2019, as data indicates a holder base with longer time horizons.”

Bitcoin Whales Haven’t Slowed Down Accumulating

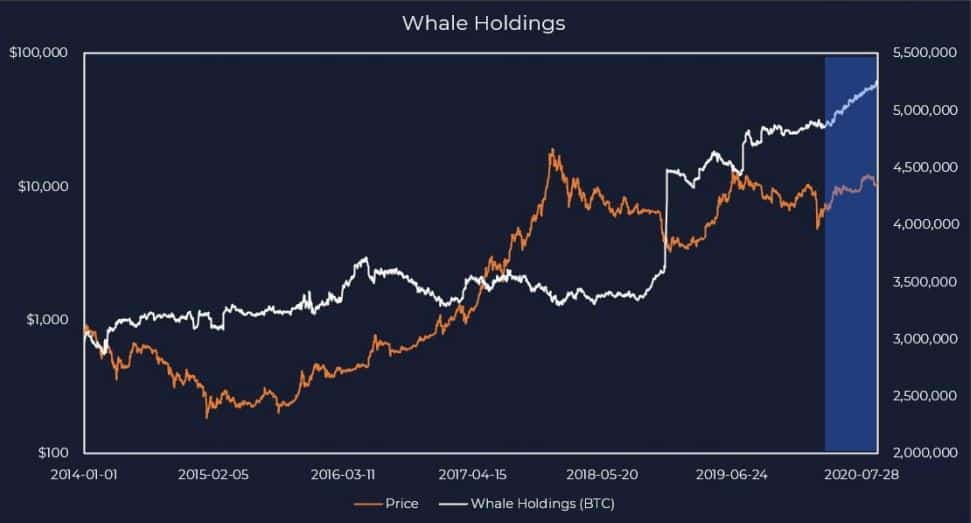

Digital Delphi’s data reaffirmed previous reports that Bitcoin whales, meaning addresses containing between 1,000 and 10,000 BTC, continue to accumulate large portions. The company outlined that whales have been on a shopping spree since the start of 2020, as their holdings have increased by 9% YTD.

Moreover, the US Federal Reserve’s actions to print extensive amounts of dollars since the start of the COVID-19 pandemic have accelerated whales’ accumulations.

“Since the USD M2 supply expansion in March, there has been a 7% increase in whale holdings.”

According to the document, this only emphasizes the narrative that Bitcoin serves as a hedge against dollar inflation, and “the smart money is clearly betting on this.” It’s worth noting that prominent US investor Paul Tudor Jones III purchased BTC earlier this year to protect himself against precisely the rising inflation.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato