In the last 950+ days, bitcoin has encountered the $9,000 level a few hundred times. Undoubtedly, this level seems like the one that matters the most, not just for its “Vegeta memes” but also due to the technical reasons behind it.

More often than not, the most popular reason given for “why bitcoin tests this level?” is because “it is a psychological level”. However, that is just one part of the bigger picture. Breaking down why this level is important might give an edge for the most-awaited bull run yet and perhaps, another chance to accumulate bitcoin in the $9,000-range.

Why is $9,000-level important for Bitcoin?

Reason 1

The first reason is that it is a psychological level. Both in stocks and cryptocurrencies, whole numbers like $5,000, $9,000, $10,000, $20,000, etc are the levels that attract buyers and sellers.

Reason 2

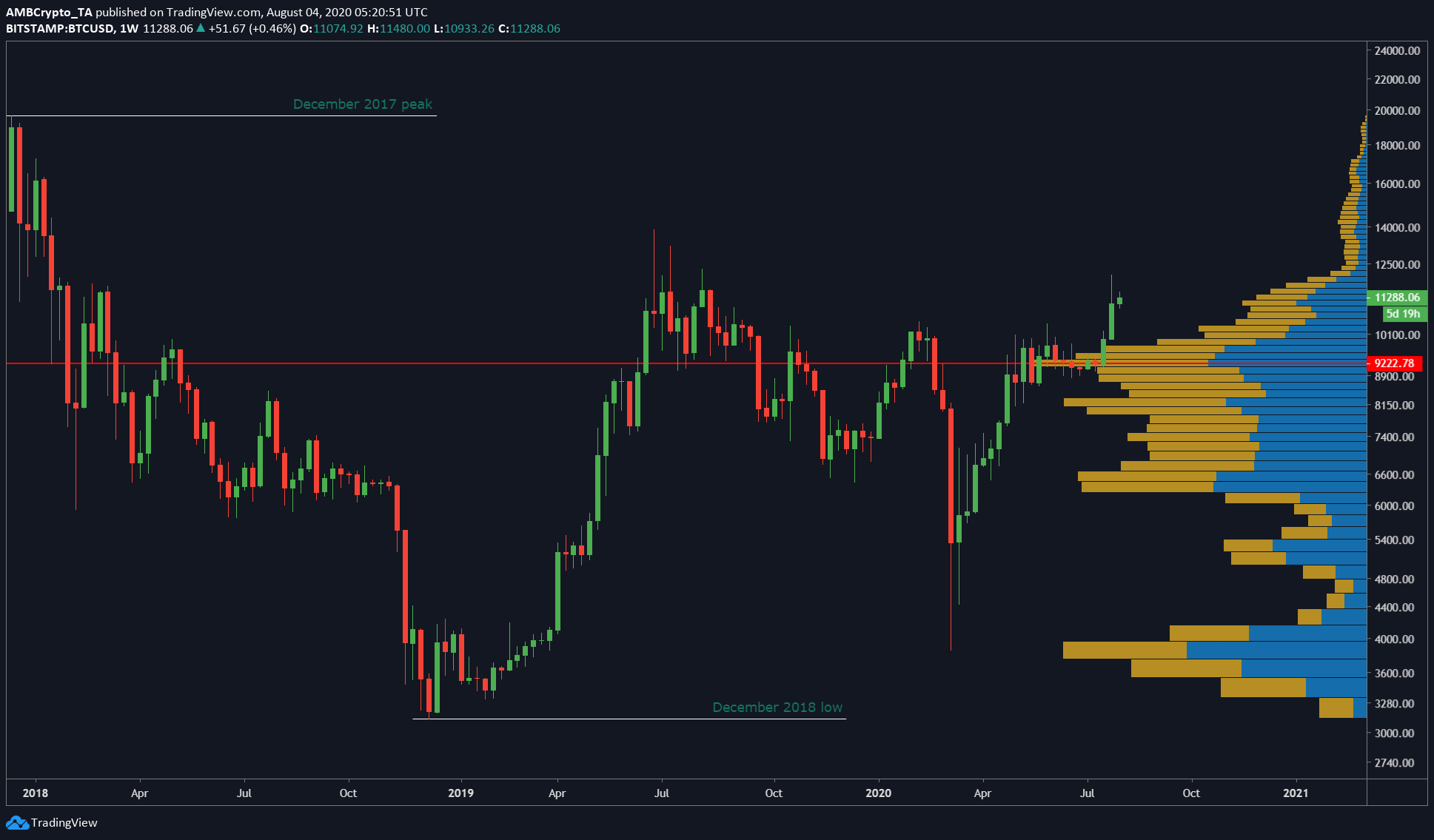

Reason two is perhaps the most important; to understand this, we need to look back at the 2017 bull run and the eventual bear market, in cumulation. In the above chart, it can be observed that the $9,000 level was first achieved on November 26, 2017, and this level was tested by 2 daily candles and that was it… there wasn’t any sort of commotion. Perhaps, the first instances of Vegeta memes were observed in November 2017.

Regardless, the importance of this level was seen during the eventual decline of bitcoin’s price as bears took control. Between 01 February, and 11 May, bitcoin contested with the $9,000-level 42 times.

Fast forward to the current day, “Volume profile” indicator showed that the most trading activity has taken place in the $9,000-range. To be precise, $9,222.78 is the PoC [Point of Control], where the most trading activity has taken place since December 11, 2017, to-date.

Reason 3

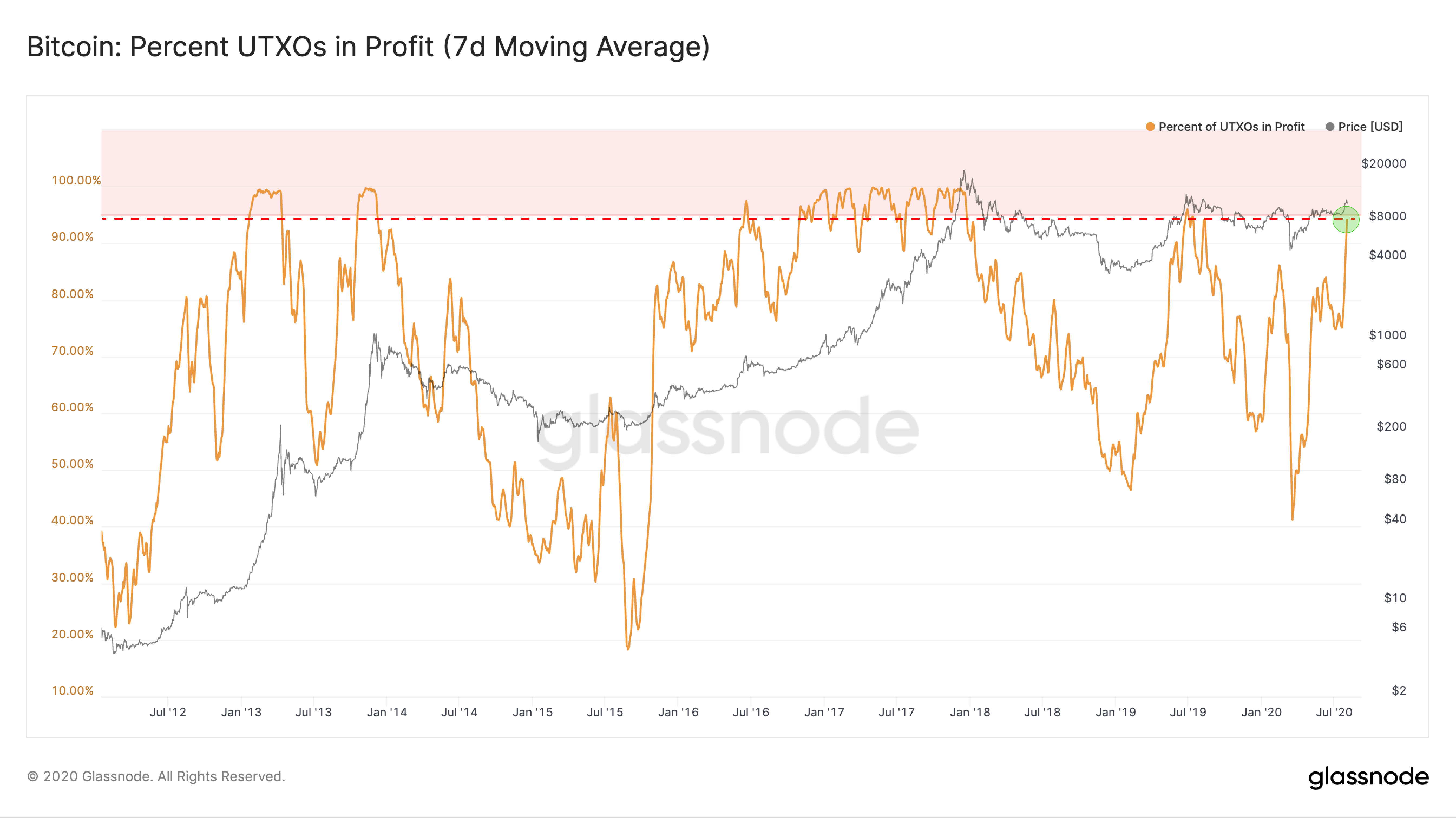

Source: Glassnode

The third and final reason is a little more technical and takes into account the bitcoin UTXOs. Glassnode’s UTXO Realized Price Distribution chart showed the distribution of UTXOs created above and below the current price; and most of these UTXOs [95% of bitcoin UTXOs] were in profit.

If not anything, the UTXOs support the importance of the $9,000 level.

There is a chance that bitcoin might retest this level yet again before the bull run begins. And the reason for this is as simple as the self-fulling CME gap prophecy, which currently ranges from $9,925 to $9,665.

The post appeared first on AMBCrypto