‘Buy the dip’ is a popular strategy among traders and investors and especially within the cryptocurrency field, especially for Bitcoin trading.

As Bitcoin approaches what seems like a begging of another bull-run, and based on the past real bull-run of 2017, buying dips might be a very wise and profitable strategy for trading the current market conditions.

What Is Buy The Dip In Bitcoin?

The financial markets, especially the cryptocurrency ones, tend to fluctuate in price actions. Even if there’s an apparent trend, whether bullish or bearish, the prices don’t just head straight in that corresponding direction. Instead, they chart corrections, which could be a potentially beneficial entry spot for traders.

This is where the popular “buy the dip” strategy comes into play: In theory, it means that traders should enter a position when the price dives if they believe that the current trend will endure.

It sounds logical and straightforward, but in practice, it’s not as easy to apply when that asset heads south, and the trader sees his position in the red, or if not in a position, can easily think that the price will go even lower.

While the opportunity for buying the dip is indeed presenting itself, this is the tricky part of overcoming basic human emotion and of proceeding with it, regardless of the currently negative trading position.

Buy The Bitcoin Dip In 2020

Following the most recent Bitcoin price developments, after heading from the dip of $9,000 to nearly $12,000 in less than one month, the community believes that there’s indeed an ongoing bull market, which makes the strategy particularly efficient.

Even from the relatively short period of a few weeks and apparent bullish trend, BTC briefly dipped several times before heading higher.

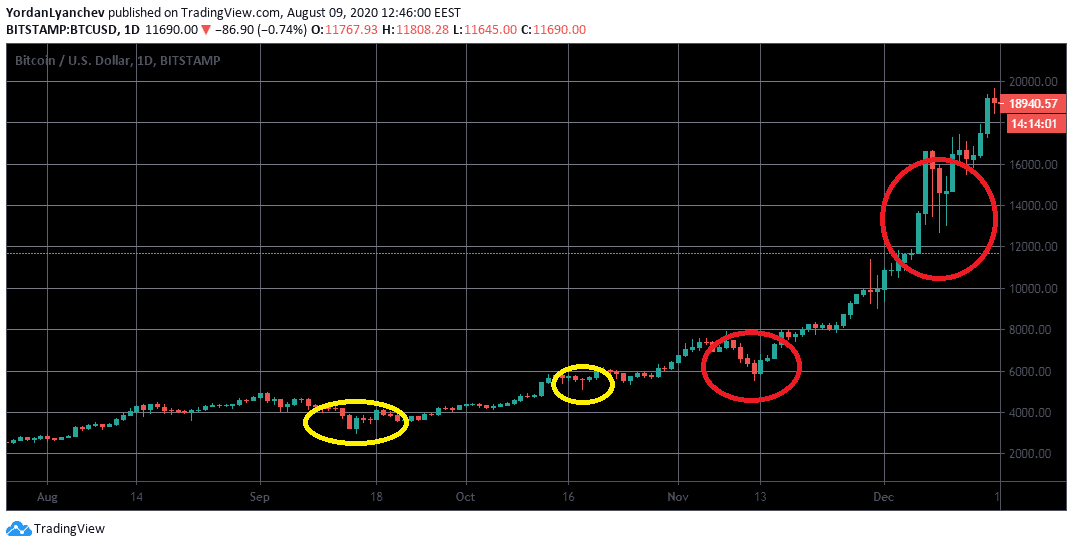

From the smaller dives (marked above in yellow) to a few quite steep ones (in red) where the asset lost up to 15% of its value in a matter of hours, and sometimes minutes, these events provided opportunities to accumulate more at a lower price.

Of course, when actually seeing that Bitcoin goes from over $12,000 to below $10,500 in a matter of minutes, it’s not as simple to overcome that inherent fear and just press the ‘buy’ button. Yet, this is what could differentiate the successful traders from the not so prosperous ones, as well-known analyst Chris Dunn recently asserted.

In a perfect scenario where one was able to time the market and bought the dip at $10,500, he would be sitting at a juicy 11% winning position with Bitcoin’s price trading at $11,700 at the time of this writing. Not mentioning that minutes after the dip to $10,500, the price recovered to $11,200.

Buy The Dip During The Bitcoin Bull Run of 2017

Arguably the most impressive bull run in Bitcoin’s history materialized in 2017. The primary cryptocurrency began its decisive ascend at the time from below $4,000 in the summer and topped at nearly $20,000 in December, whereas the last leg – from $6K to $20K – lasted only three weeks.

However, the road wasn’t without bumps, which highlight the buy the dip strategy once again, and created great opportunities for traders to hump on the riding train.

As illustrated on the daily chart above, the asset went through some massive turbulence. In mid-November, it tanked from $8,000 to below $6,000. That turned out to be a rather apparent dip as it skyrocketed in price shortly after before the next substantial dive in early December from over $16,000 to $13,000. These dips even reached 30% of Bitcoin’s value.

It’s worth noting, though, that buying the dip for trading works as long as the overall trend is bullish. Following the top of $20,000, Bitcoin entered a bear market, which saw its price nosedive to $4,000 at the end of 2018, recording Bitcoin’s lowest price of $3120 in the middle of December 2018.

The way down was followed by dips, just like the way up. However, those dips didn’t turn into higher highs. They actually turned into lower lows – which can be a massive disaster for traders who bought the dips along the way.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato