- Bitcoin reaches a record inverse relationship with China’s currency

- But it is not yet a macro asset

In 2019, there were several instances that showed Bitcoin is becoming a hedge against the global issues.

The trade war between the US and China turned fruitful for the leading cryptocurrency and then when Chinese Yuan dropped below the important psychological level of 7 against the US dollar, we saw BTC surging yet again.

Record Bitcoin-Yuan Divergence

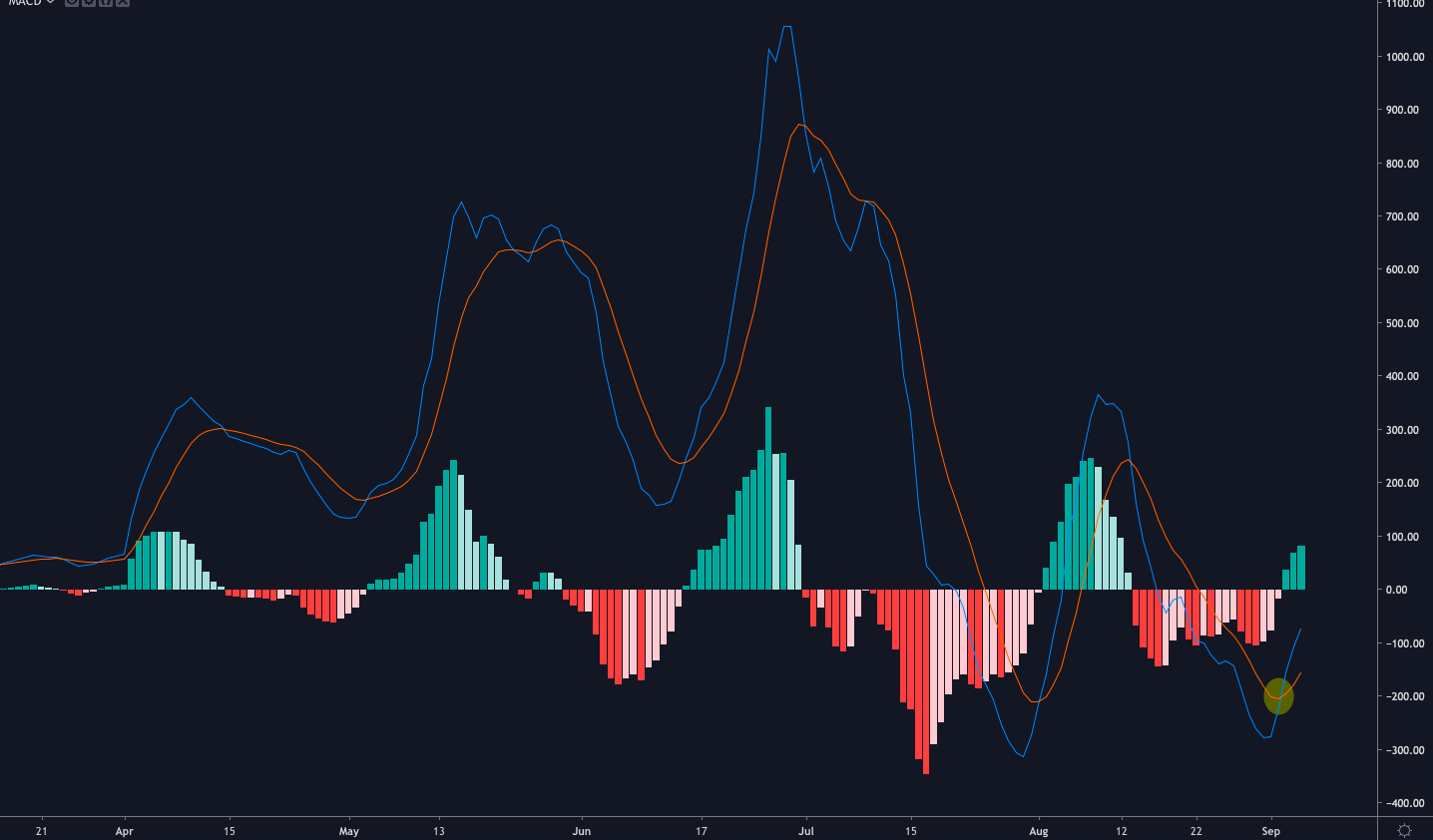

In the past few months, bitcoin’s correlation with gold, a traditional safe-haven asset, increased from 0.496, over the past year, doubling to 0.837.

The geopolitical and macroeconomic situation is possibly playing a part in this data like the escalating tension between the world’s two biggest economies, against which investor Tim Draper said Bitcoin can offer a

“remarkable hedge.”

Now, another data supports this argument.

Bitcoin has reached a record inverse relationship with China’s currency, in the past week, as per Bloomberg analysis of their 30-day correlation. This suggests the leading cryptocurrency may have “become a refuge for people hedging the yuan’s depreciation.”

The corroborating evidence to this is people in Asia paying more for Bitcoin than elsewhere.

“You can see it in the premium price paid sometimes for Bitcoin in exchanges like Huobi that primarily cater to Chinese,”

said Dr. Garrick Hileman, a researcher at the London School of Economics and Blockchain.com’s research director.

This inverse correlation became evident in April and May when “tensions ratcheted up with the deterioration on U.S.-China trade relations,” he added.

Bitcoin is Not a Macro Asset, Yet!

But economist and trader, Alex Kruger beg to differ.

“Bitcoin is not yet a macro asset,”

he emphasized.

The commentaries of Bitcoin being driven by gold, yuan, stocks, the US dollar or any other asset, to him “feels like mass delusion” which is not different from

“‘this is a new paradigm, not a bubble’ narrative of late 2017.”

Macro assets like stocks indices, rates, FX, copper, crude oil, precious metals, and sovereign bonds are mostly driven by geopolitical and macroeconomic factors.

Unlike non-macro assets like natural gas, grains, single stocks, and bitcoin, they react in real-time consistently to any major news, said Kruger.

Moreover, macro assets move with large market moves and that too in a predictable manner. They also have a relatively constant correlation with risk-assets.

Due to the fact, everything moves together and at the same time, Kruger said a speculator that has multiple positions in a number of these assets has to monitor correlations and portfolio risk.

This, however, is not the case with Bitcoin, which he said is a “wonderful feature.”

Meaning Bitcoin is not a macro asset yet but “it should become one as the market matures” because the flagship cryptocurrency has already been seen as a digital gold and hedge against the tail risk of fiat systems collapsing.

The post appeared first on Crypto Asset Home