Bitcoin and its holders experienced a fruitful 2019 with almost 90% in recorded returns. However, there has been an ongoing debate about the treatment of crypto-assets, especially when it comes to the returns generated by holders of a particular asset. According to CoinMetrics’ recent report, cryptocurrencies are not just an incremental asset class innovation, but “they are a first principles re-evaluation of ‘money.’”

The traditional capital market is an example of how corporate actions like mergers, acquisitions, stock splits, etc. could change the securities [equity or debt] of a public company. These actions are handled on a routine basis and are standardized, with investors experiencing them seamlessly. However, cryptocurrencies do not have a transparent set of industry standards dictating the treatment of crypto-corporate actions like forks, airdrops, and staking yields, leaving investors returns at bay.

Even if the holders are credited with the results of corporate actions, there exist inconsistencies in application and there is a lack of clarity around the entire process. According to the report, these inconsistencies “are a gating item for broader adoption.” However, as the crypto-industry evolves, a need to receive economic returns on these assets will emerge from the retail and institutional holders.

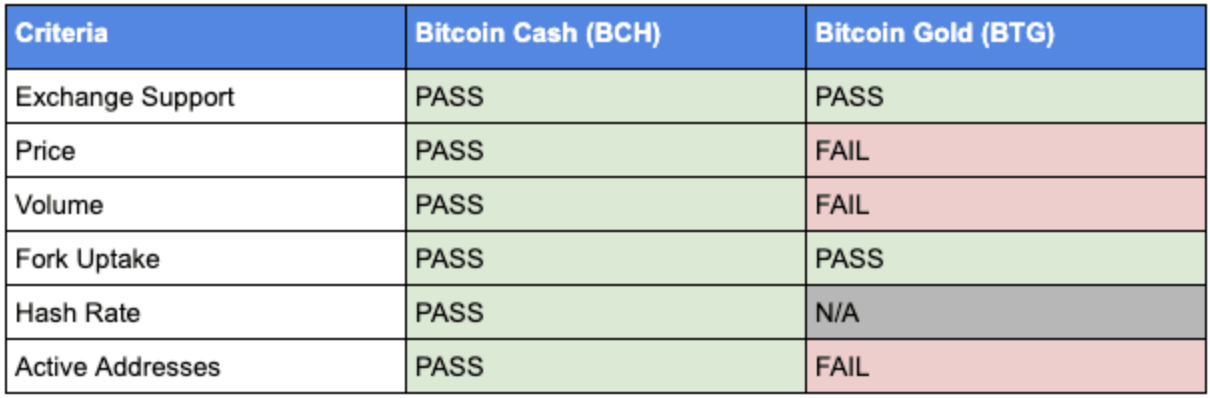

The report deemed hard forks to be the most important corporate action in the crypto-world. Bitcoin has 73 forked coins, but only a handful of these coins were adopted enough to cause an economic impact. Bitcoin Cash [BCH] is one such example of a successful fork, whereas Bitcoin Gold [BTG] was the one that failed. In a situation where holders register a return, Coin Metrics plans to develop two series for every index product, price index and total return index, each of which will track returns recorded by holding crypto-assets and its ‘legitimate’ forks.

After evaluating the legitimacy criteria for the aforementioned Bitcoin forks, Bitcoin cash passed all the tests, while Bitcoin Gold just passed two.

Source: Coin Metrics

However, there is a need for clarity, transparency, and consistency in order to increase adoption and in determining the economic returns crypto-asset holders are entitled to.

The post appeared first on AMBCrypto