We’re now into the third month of low volatility in the cryptocurrency markets. Owing in larger, or complete part, to Bitcoin trading in a tight trading zone between $8,800 to $10,000. But it looks like the wait for the largest cryptocurrency in the market, holding over two-thirds of the total market, to turn the tide is finally over, or at least a countdown has begun.

Volatility is a prized part of the Bitcoin market, so much so that the cryptocurrency has been labeled as ‘too volatile’ by its traditional market peers. This volatility which has been absent since May, will likely return in the next three months according to Jay Hao, CEO of cryptocurrency spot and futures exchange OKEx.

Speaking to AMBCrypto, Hao, looking at the data from the Bitcoin Options market, said that there will be “high volatility in the longer-term perspective” providing a time-range of 3 to 6 months. With the return of volatility, especially after a long period of drought, and given the leveraging tools of cryptocurrency exchanges, Bitcoin trading will undoubtedly “surge.”

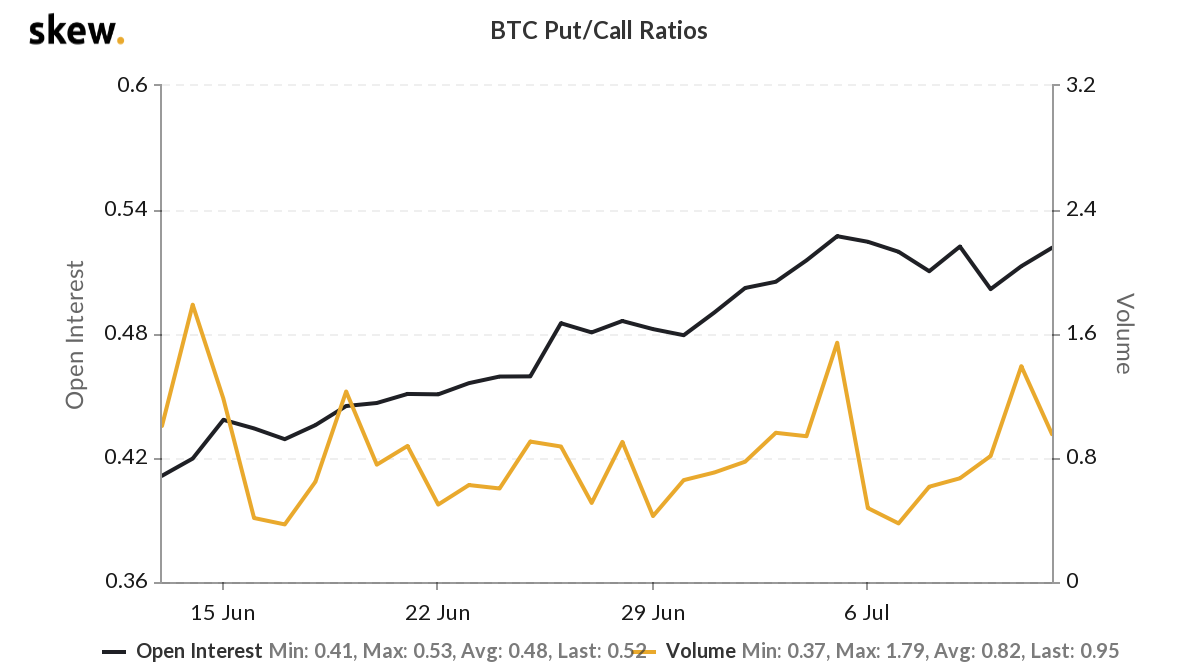

Keeping this time period in mind, let’s look at the larger data of the Bitcoin Options market to get a sense of the degree and direction of this volatility once it does arrive in the time period stated by Hao. Looking at the collective market’s Bitcoin Options data i.e. for regulated and unregulated derivatives exchanges the puts to calls ratio for volume is at 0.95.

While this does mean that there are more calls traded than puts in the BTC Options market, the difference is marginal in the traded amount. However, looking at the opened amount i.e. puts to call ratio on open interest, rather than volume, it stands at 0.52, which suggests there are almost 2 calls for every put contract in the larger market. It should be noted that over a month ago, the ratio was 0.41, indicating that more puts have been accumulated on derivatives exchanges than calls, but the latter still outnumber the former.

While the difference may be 2:1 in favor of the calls for the larger market, for the regulated market of the CME, the attitude is far more bullish. A recent report from Ecoinmetrics indicated that the puts to calls ratio was 1 put for every 13 calls, based on data from July 8. Based on this data, the report suggested that CME’s Bitcoin Options market’s story “isn’t bearish.”

In the aforementioned report, Ecoinmetrics added a caveat to this narrative, stating that while the story “isn’t bearish” the “appetite for bullish positions is dead.” During the beginning of June, the call options outnumbered the puts 30 to 1, which has now decreased to 13. So, while there isn’t an increase in puts, there isn’t an increase in calls either.

Looking at the larger picture, Hao suggests that the next 3-6 months will show increasing volatility. The derivatives market which lives off volatility is expecting more bullish than bearish movement, especially in the United States as data from CME alludes to, while the rest are less bullish but still expecting a rise than a fall.

The post appeared first on AMBCrypto