Most of the industry’s altcoins are struggling to make-do in the present market. With all the bullish market momentum fizzling out in early-September, new monthly lows are being registered every single day. In fact, even Bitcoin seemed to be losing value at the time of writing, after many alts hoped the king coin’s price movement will brush off them. Cardano is one such altcoin and its press time price movement suggested that the near-term future did not look pretty.

Cardano’s 1-day chart

Source: ADA/USD on TradingView

As one of 2020’s most successful tokens, a period of correction was always on the cards for Cardano, with the crypto-asset dropping below $0.106 recently. Now, over the past week, optimism about its recovery has been on the back seat since ADA was noting an imminent breach from a descending triangle pattern. The breakout is possibly going to be bearish, with direct support at $0.073. However, the 1-day chart suggested that ADA might find refuge at $0.076, where the 200-Moving Average was present, at the time of writing.

With the bearish pressure from the 50-Moving Average consistent on the charts, it is important to note that the Awesome Oscillator underlined the trend from a bullish perspective. However, the price candles were falling in intensity, so the larger trend was still inclined towards a drawdown period.

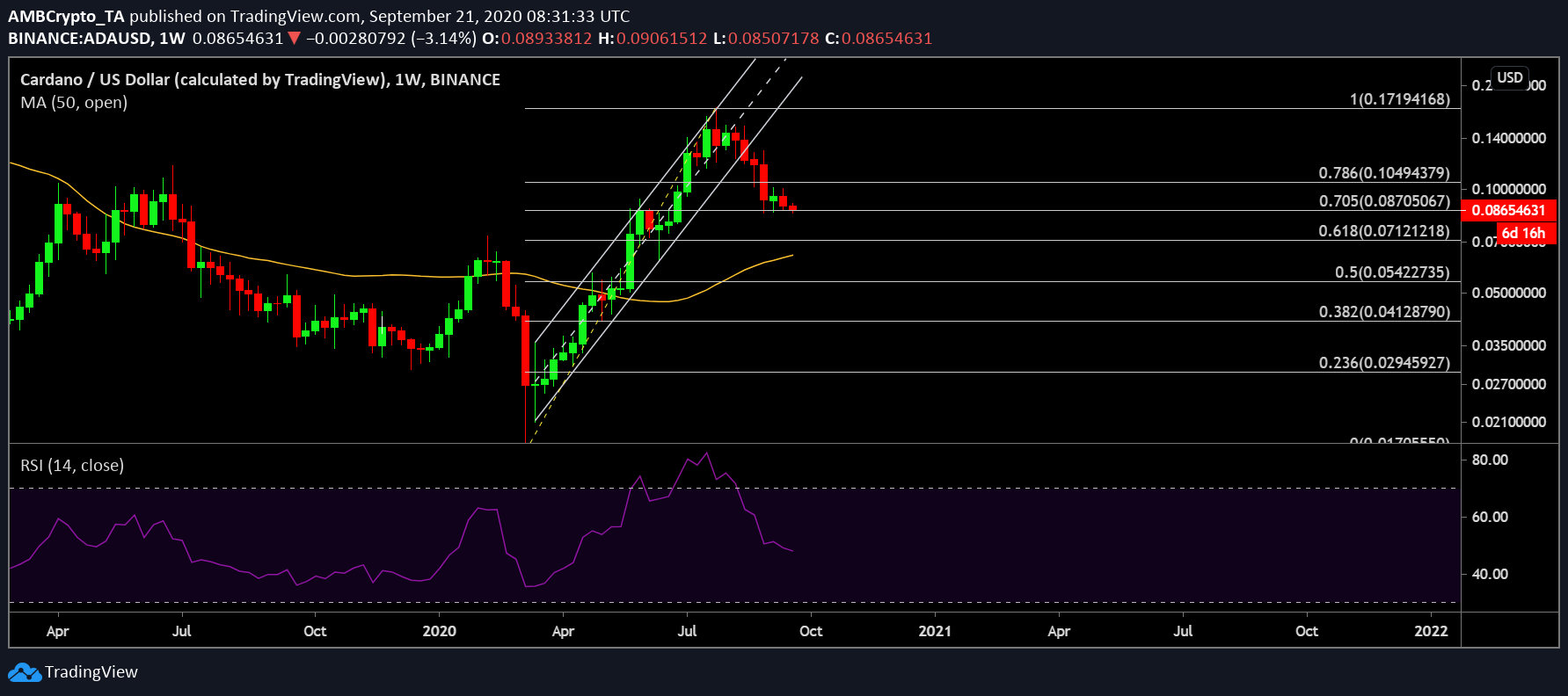

Cardano’s 1-week chart

Source: ADA/USD on TradingView

According to ADA’s weekly analysis, the breakaway from the ascending channel was quite clear. Over the past 7 weeks, 6 of them have been bathed in red, with the crypto’s value holding a position near $0.0865, at press time. Over the current period, it is now essential for ADA to sustain a position above the the Fibonacci 0.705 line. A position close below that level would improve the possibility of a re-test at $0.0712.

The Relative Strength Index or RSI had quietly stabilized, at the time of writing, but the sell-pressure was still dominant over the long-term. To sum it up, Cardano proponents should be bracing themselves for another bearish period.

The post appeared first on AMBCrypto