- Today, Cardano is up by 8% after regaining momentum from $0.042.

- ADA is revamping bullish setups but immediate resistance is posing threat to buyers.

- Cardano is currently trading around key price areas against Bitcoin and US Dollar.

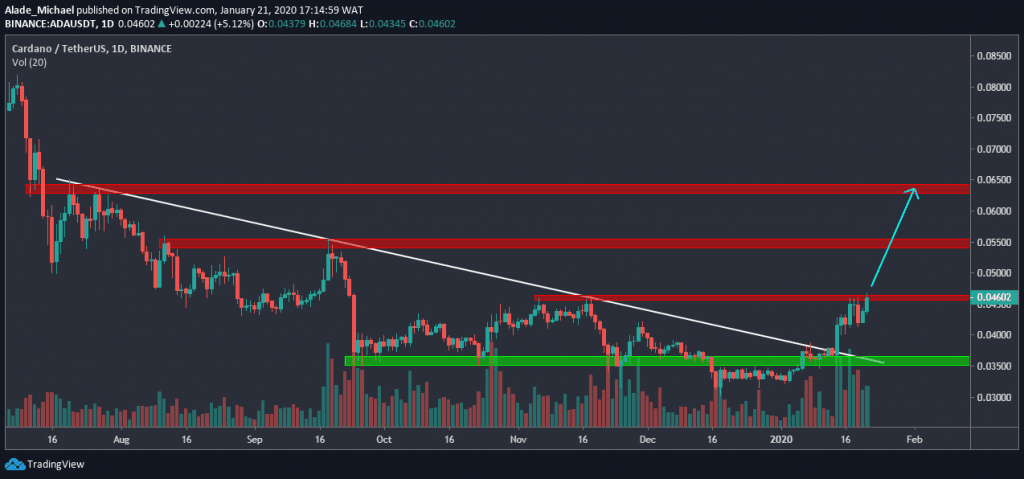

ADA/USD: Cardano Targets $0.064 But Facing Tough Resistance At The Moment

Key Support Levels: $0.0415, $0.0355

Key Resistance Levels: $0.055, $0.064

Since Cardano found a bottom at $0.030 in late December, the price has continued to pace up slowly against the US Dollar. Following the steady growth, ADA reached three weeks high of $0.0455 mark before dropping slightly to $0.042 last week.

After a two day recovery, Cardano’s price has continued to grow but currently trading at around $0.046 resistance level. Once a breakout occurs at this mentioned level, the price of ADA is expected to charge at the next resistance level. As it stands now, there’s a high probability for a buy than a sell.

ADA/USD. Source: TradingView

Cardano Price Analysis

Looking at the bigger picture, Cardano has left the long bearish zone with a sharp surge above the white descending trend line that is drawn from July 2019 pullback level. Now, buyers are struggling with the $0.0455 resistance again.

Breaking this resistance could allow buying towards the red resistance zones of $0.055 and $0.064 in future trading. In case ADA continues to encounter rejection at the $0.0455 resistance level, we may see a downward price shift to near support at $0.0415.

If this support fails to provide a rebound, the price may further roll to the green horizontal support area of $0.0355 before climbing back. Nevertheless, the bullish pattern is still valid at the moment. We need to see a clean break before fueling a more bullish run.

ADA/BTC: Cardano Keep Struggling in a Tight Range, Breakout Still Shaky!

Against Bitcoin, ADA has continued to trade below the 550SAT resistance level that got broke since August 2019. Although, Cardano is looking bullish in the short-term but has remained within a tight range of 445SAT-550SAT price levels over the last four months.

Once again, Cardano is currently trading near this 550SAT – a tough area that has suppressed buying pressure in the past. The range-bound may keep active if the price gets rejected again at the above-mentioned area. However, it might as well become inactive if a break occurs.

ADA/BTC. Source: TradingView

Cardano Price Analysis

Cardano has reached a critical resistance area of 550SAT on the daily chart after witnessing a seven days increase. At the moment, two things are likely to happen: a make or break. However, we can see that the last candle formation saw a slight rejection.

As shown on the price daily chart, Cardano’s price is most likely to shoot at the next resistance zone of 640SAT once price break occurs. Alongside a possible break, there’s a minor resistance at 600SAT.

Should ADA fail to break; a bounce could send the market back to the immediate green support zone of 445SAT. A steep fall beneath this mentioned could result to trigger an intense selling to 410SAT level, which appeared as the last defense line for the buyers. As of the time of writing, the bulls are still regrouping for more push.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

The post appeared first on CryptoPotato