While the lows of September 23rd were not emulated in the recent decline, ADA’s price continued to sustain a position near the recent bottom. For Cardano, the trend has been consistently bearish since August 1st week itself but a minor bullish pullback was observed towards the end of September. The major difference remains the trend reversal, as a bullish one hasn’t surfaced quite yet.

At press time, Cardano has slipped down to 12th, with Bitcoin SV taking its 11th spot in the rankings.

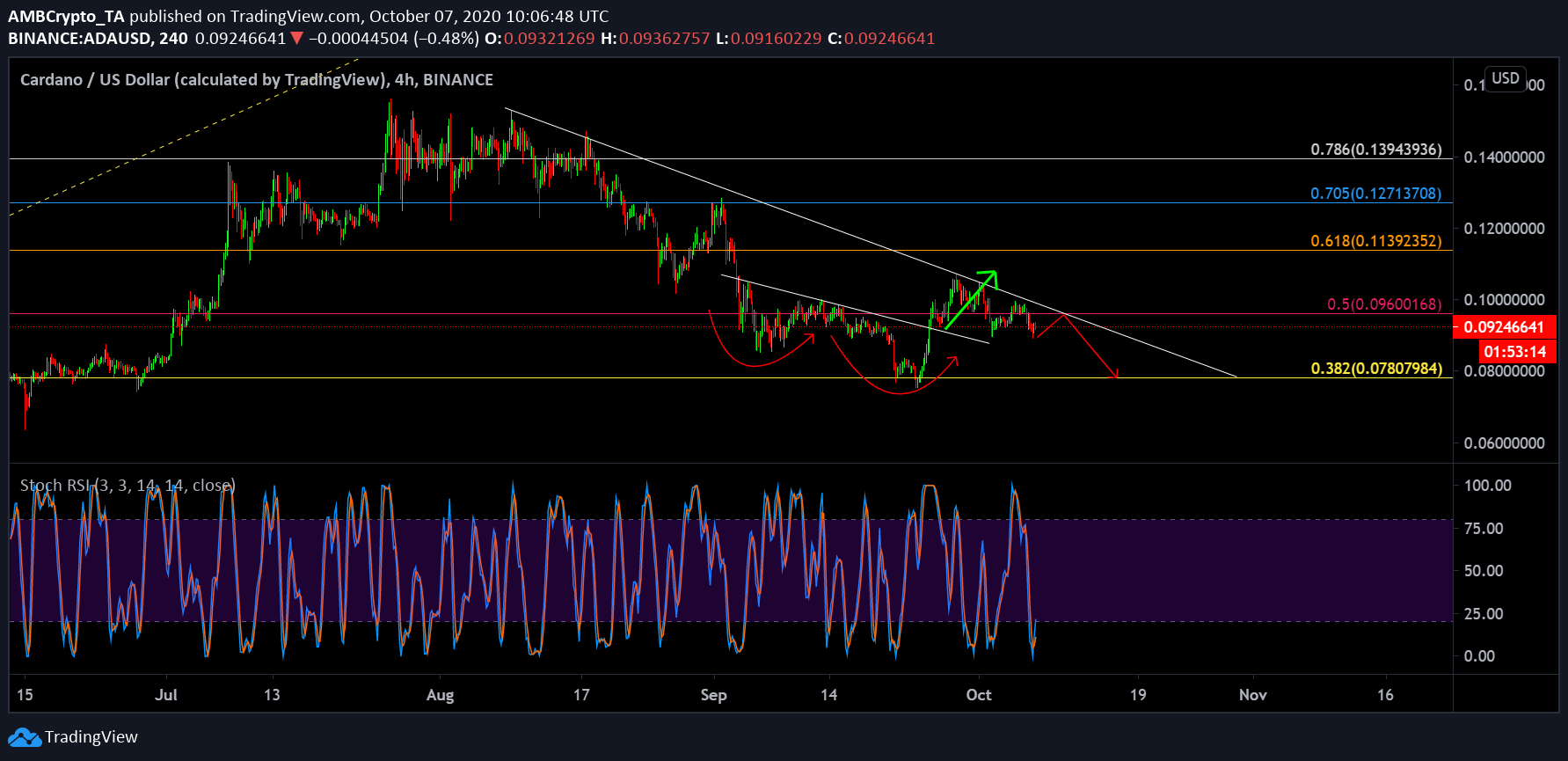

Cardano 4-hour chart

The 4-hour chart of Cardano clearly defined the long-term downward trend followed by ADA since the start of August. During the downtrend over the past couple of months, few lower highs were witnessed while the latest occurring during the price surge following 23rd September’s collapse.

Likewise, the asset was unable to breach above the downtrend, but the spike appeared to take place behind a legitimate double-bottom pattern. Currently dwelling with a market value of $0.0924, the asset remains right below 0.5 Fibonacci line($0.096). With the Stochastic RSI suggestive of a bullish turnaround, the price may re-test the resistance at 0.096 but with respect to the larger trend, the price is bound to move downwards yet again.

A re-test at 0.382 Fibonacci or $0.0781 continues to be a lively range after its recent exploits on 23rd September.

Cardano 1-hour chart

Keeping the above analysis in mind, a shorting opportunity is in the cards for bearish traders. While the entry price can go at the moment as well, the price might touch $0.096 before dipping down. Hence the entry position can be set up at $0.096 with a comfortable stop-loss at 0.102, which is highly unlikely to be met over the next few days.

With a profit exit at 0.781, a Risk-Reward ratio of 2.98x is attained and the reversal might take place from hereon. Relative Strength Index or RSI continues to meddle with returning buying pressure but over the next few hours, the asset is likely to face downward pressure from the collective market.

The post appeared first on AMBCrypto