This article is part of our new series of crypto research content, produced by the Bitcoin Magazine team and sponsored by BitMEX. To learn more about our wide-ranging partnership with Bitcoin Magazine, click here.

This article is part of our new series of crypto research content, produced by the Bitcoin Magazine team and sponsored by BitMEX. To learn more about our wide-ranging partnership with Bitcoin Magazine, click here.

Comparing Bear Market Rallies

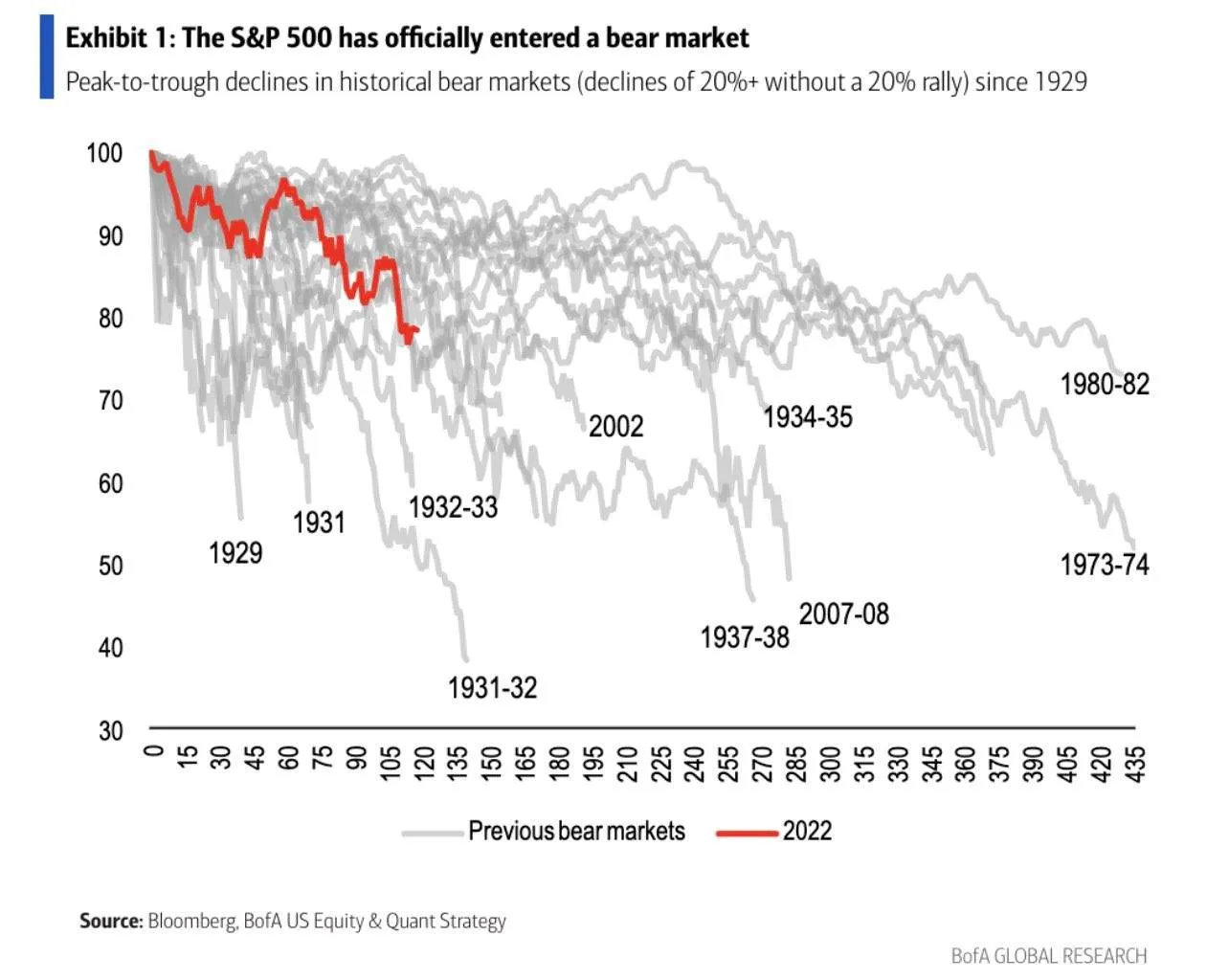

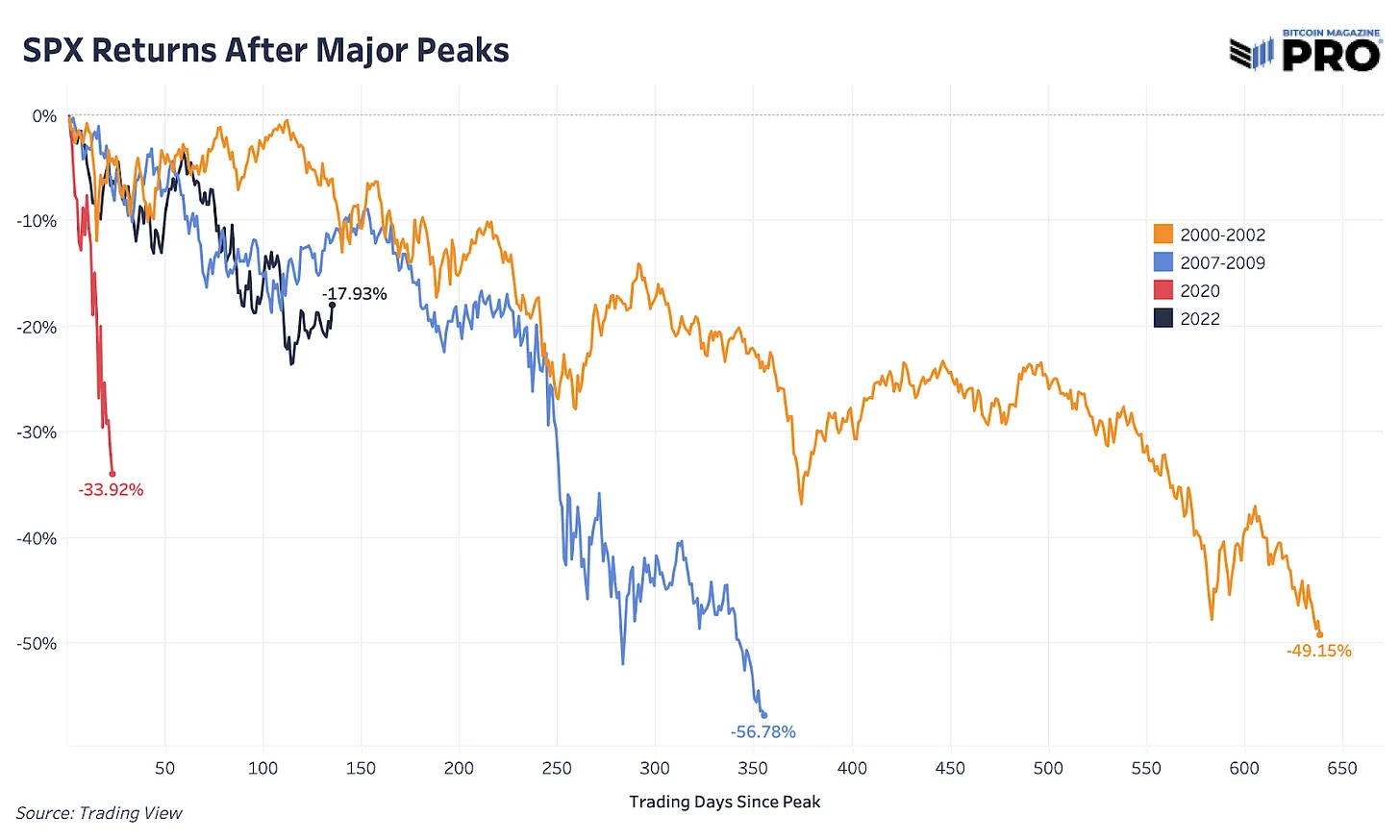

In Bitcoin Magazine’s issue from June 6, Equities Bear Market Unfolding, they highlighted bear market rally comparisons for the S&P 500 Index looking at the last two major financial cycles of 2000 and 2007. Bear market rallies, whether they are equities or bitcoin, are a similar cyclical move that’s played out in markets time and time again. They can be convincing and volatile as investors become too far positioned in one direction.

In this issue, we want to highlight the bear market rally case across both equities and bitcoin. As bitcoin has been closely following broader risk-on assets this cycle, it’s likely that it will continue as the market heads lower over the coming months.

If you haven’t yet signed up for a BitMEX account, you can do so here.

First off, we have the historical cycle moves in the S&P 500 after a 20% decline. If it’s anything like previous cyclical moves, the move down is still far from its conclusion. There’s a strong case to be made that this cycle will be as catastrophic as 2000 or 2007 so we’ve highlighted those specific comparisons below. S&P 500 is now down 17.93% from the all-time high and 135 days into the bear market. Bear markets on average have lasted 289 days or 9.6 months. 2000 and 2007 lasted much longer taking 355 and 638 days respectively to reach a bottom.

Bonus Content: Bitcoin Magazine PRO Head of Market Research Dylan LeClair appeared on Bitcoin Magazine Live to discuss his medium-term macroeconomic outlook and what it may imply for Bitcoin.

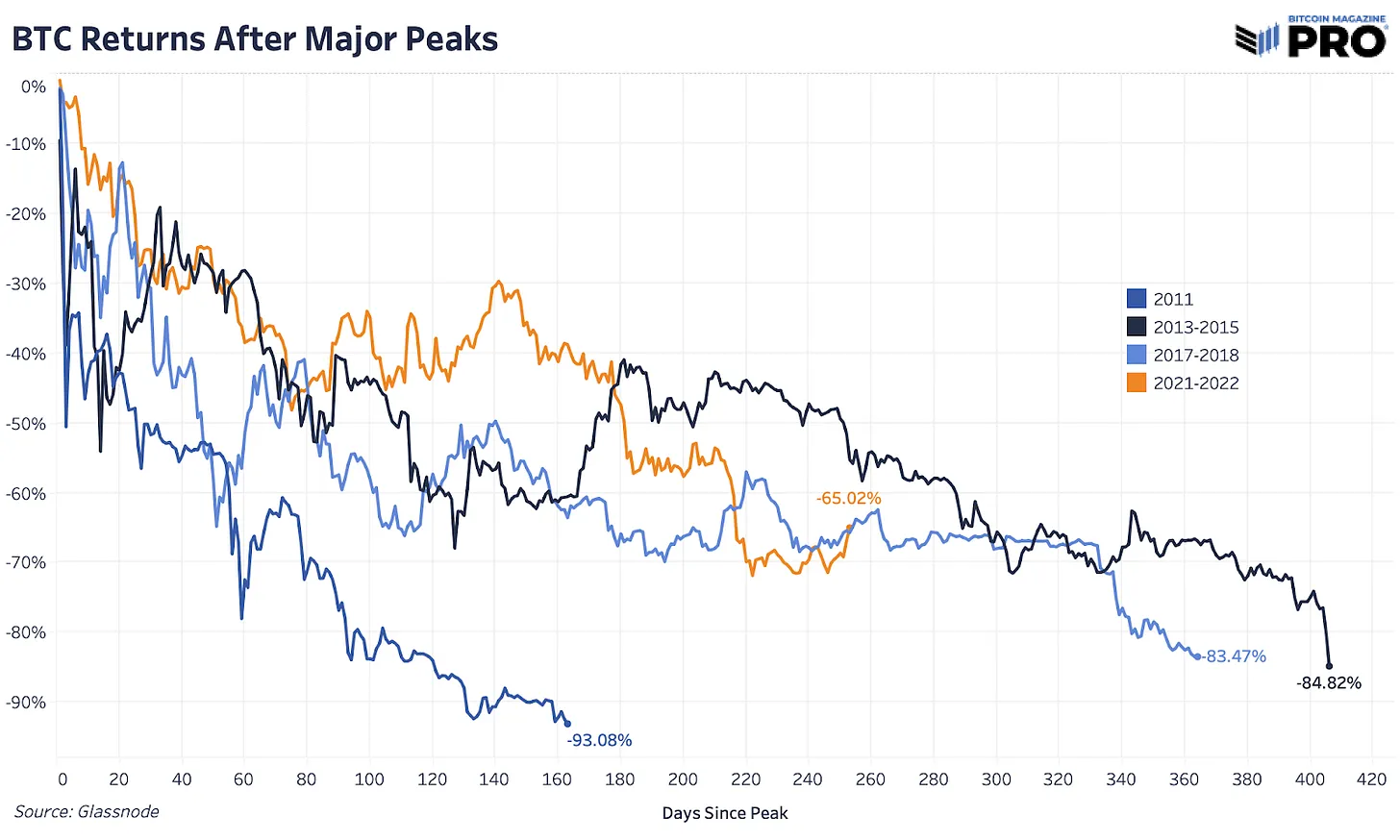

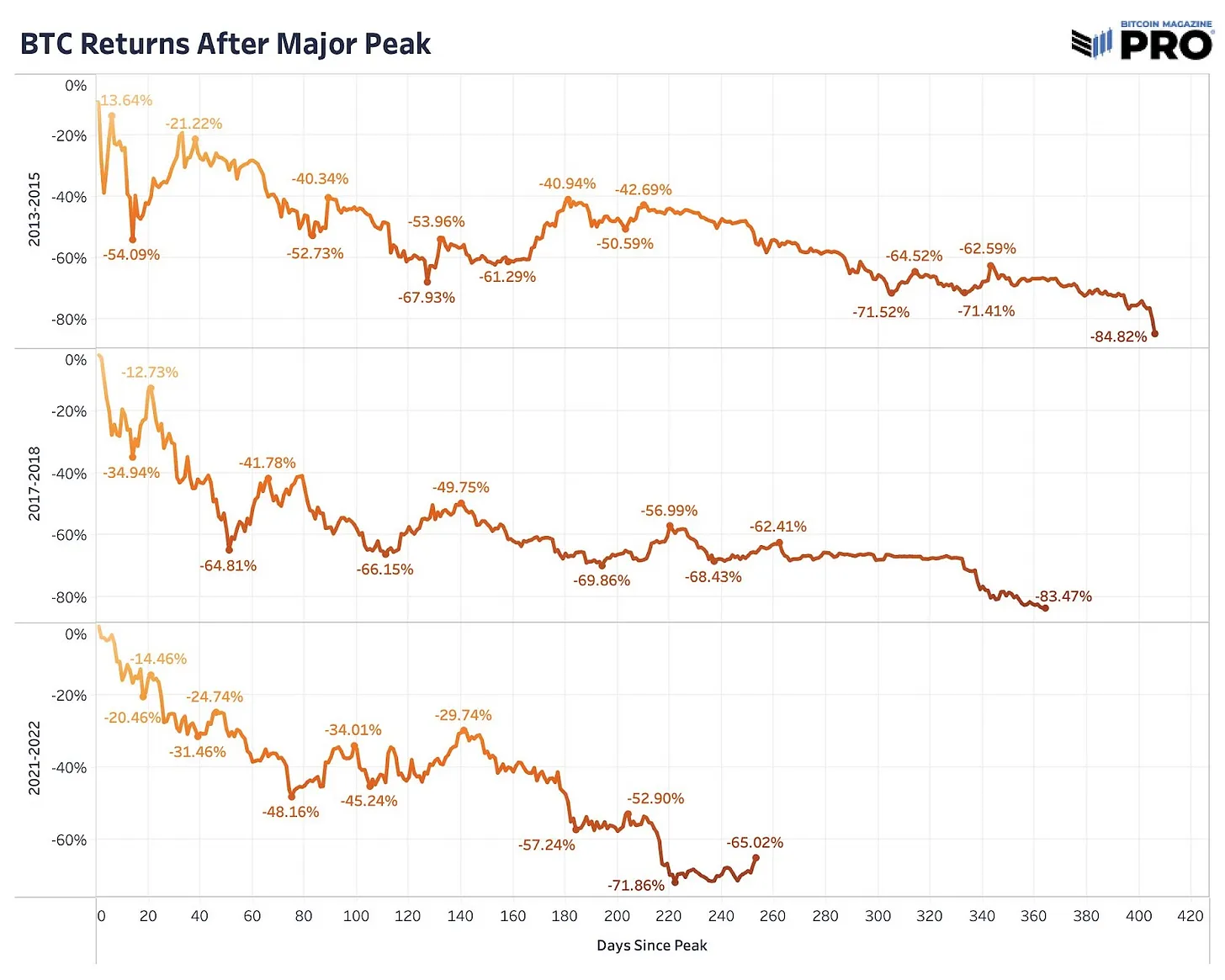

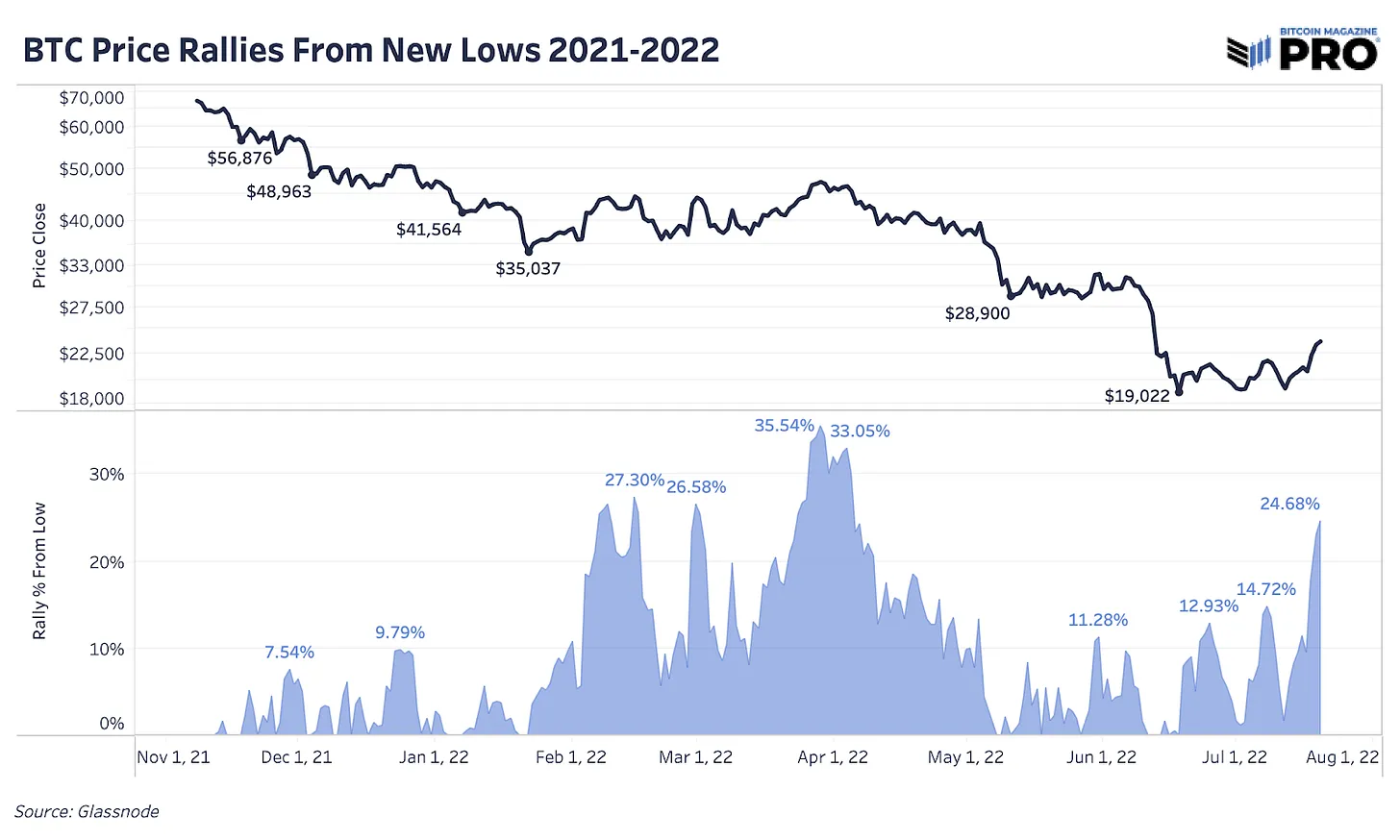

Next, we have bitcoin-specific bear market cycles. After the most recent rally, bitcoin is down 65% from the all-time high in November, 253 days in. 2013 and 2017 cycles found a bottom at 84.82% and 83.47% drawdowns, respectively, with both lasting close to around 400 days. Bitcoin’s latest rally is not out of the ordinary for the typical bear market rally move. Even a move to $30,000 is reasonable.

Many suggest that looking at the latest November 2021 all-time high is incorrect and that the April 2021 high is a better comparison. March and April 2021 started to show signs of much lower demand and volume, decreased on-chain activity and a collapse in the GBTC premium. That said, it doesn’t make much of a cyclical comparison when looking at previous cycles.

Typically, bear market cycles in the legacy world end after a 20% move up from the lows so having a cycle that printed new all-time highs seems like a stretch. Yet, looking at this way is compelling from a duration of 435 days and drawdown of 70%, which would fit the idea that all-time high drawdowns lessen over time.

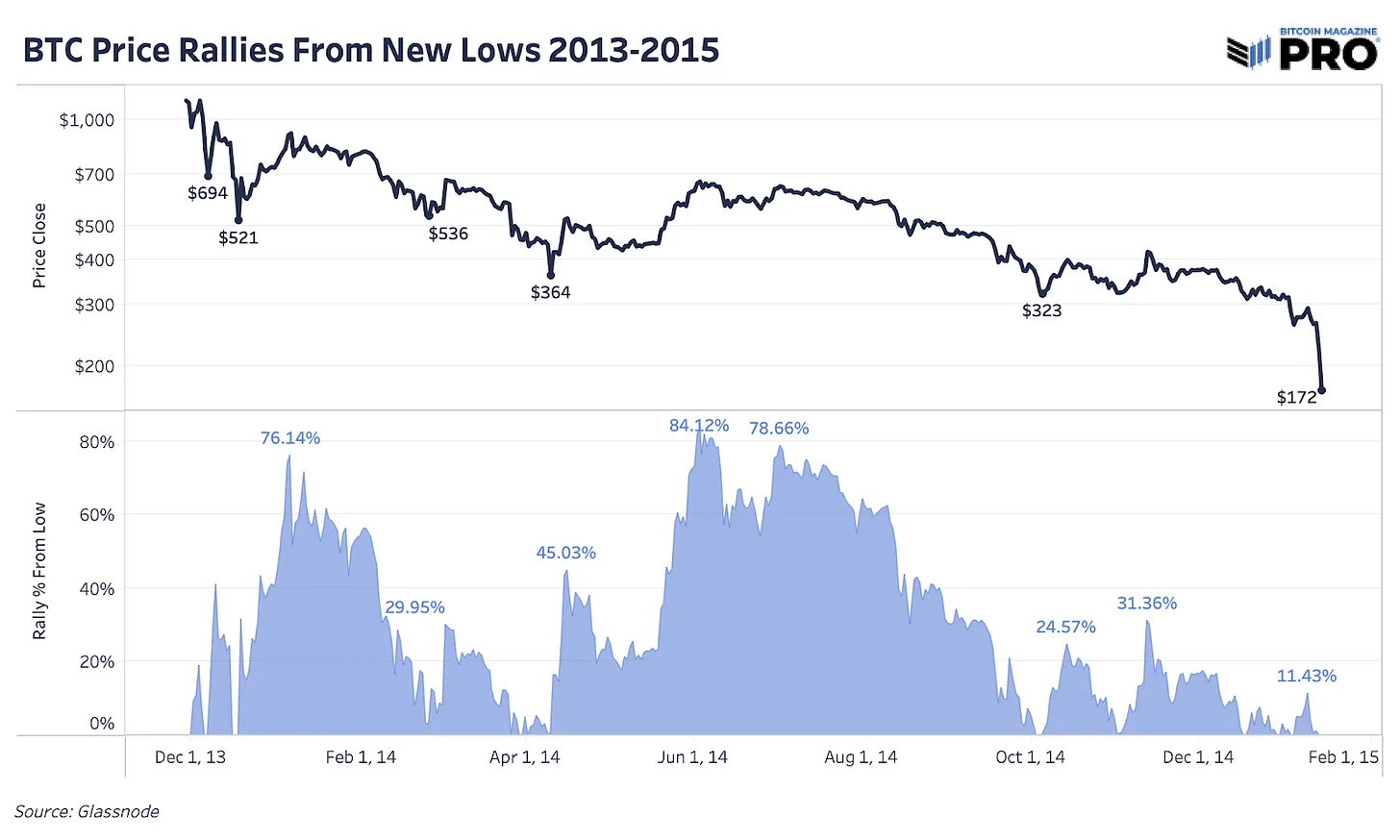

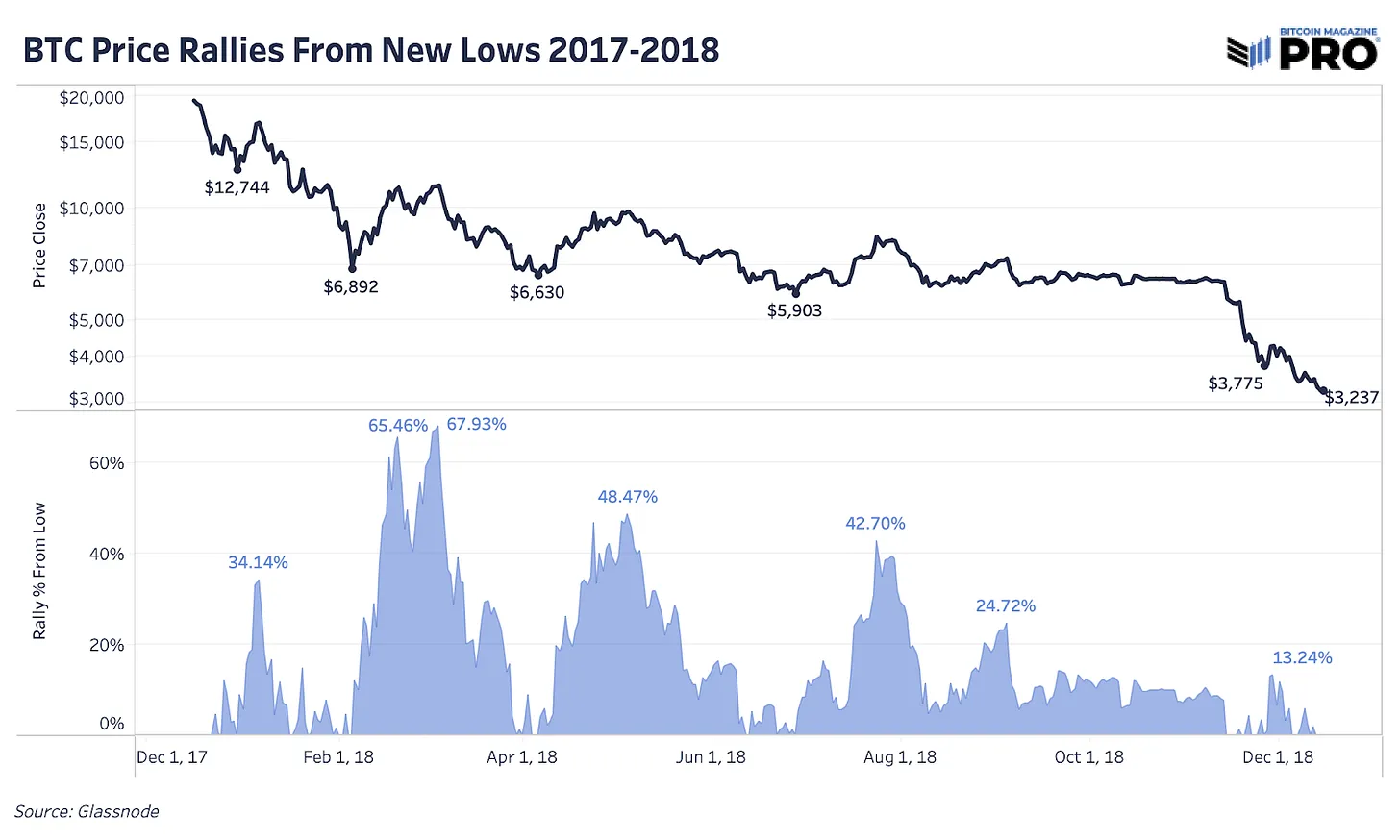

The other way to look at the rallies is to see how high prices move off of new lows. Below we have the rally percentages from new lows across cycles. Using daily close prices and not absolute bottom wick prices, the 2013-2015 cycle saw rally gains of 84.12% at its highest while 2017-2018 saw 67.93%. In the current cycle we’ve seen a 35.54% rally move at its highest while the latest move, at the time of writing, is around 26%.

Final Note

There’s a case to be made for the bitcoin bottom being in amid the wave of forced liquidations, capitulation-like behavior and nearly every mean-reversing cycle metric printing a good long-term opportunity to accumulate. Yet, our research and analysis leads us to these questions:

How far will equities fall? Is a 23.55% drawdown from all-time high in the S&P 500 Index the worst we see in this market? Are economic and liquidity conditions getting better to justify a reversal? Has there been a fundamental change or catalyst for bitcoin to suggest it won’t follow broader market moves?

It’s possible that bitcoin has already front-runned that move and will likely be the asset to bottom first, anyway. We’re convinced that the more likely case is that bitcoin will at least revisit previous lows and likely make a new one.

To be the first to know about our contracts, new listings, product launches, and giveaways, you can connect with us on Discord, Telegram, and Twitter. We encourage you to follow our blog and subscribe to the Bitcoin Magazine Pro newsletter.

In the meantime, if you have any questions please contact Support.

Related

The post appeared first on Blog BitMex