Brian Kerr, Co-founder and CEO of Kava Labs, is in the news after he recently asserted that by the end of 2021, DeFi as a general topic will move beyond its initial hype phase.

However, this being said, Kerr added that there will still be some growth in specific areas – in particular, cross-chain products, DeFi, and CeFi integrations, and derivatives platforms. According to the Kava Labs exec, another “major new development for 2021 will be DeFi integrations into more traditional financial institutions.”

As we navigate the final quarter of 2020, there is reason to believe that this is already happening. In fact, over the past few weeks alone, there have been several unique product launches that have all stressed these CeFi-DeFi integrations.

Arguably the world’s biggest crypto-exchange, Binance has been looking to integrate DeFi within its own centralized trading venue. It recently launched BTokens, its own take on wrapped tokens on Ethereum, as an addition to Project Token Canal. This project has enabled users to access the interoperability of blockchains, while also exploring a new ecosystem of DeFi apps and projects.

Apart from Binance, Chainlink and Synthetix too have recently partnered to launch an oil derivative token, noting that in the “not so distant future,” cryptocurrency traders will be able to access a wider range of assets across industries without leaving their cryptocurrency wallet.

As much as this is good news for larger market adoption, it seems there has been some competition between CeFi and DeFi of late.

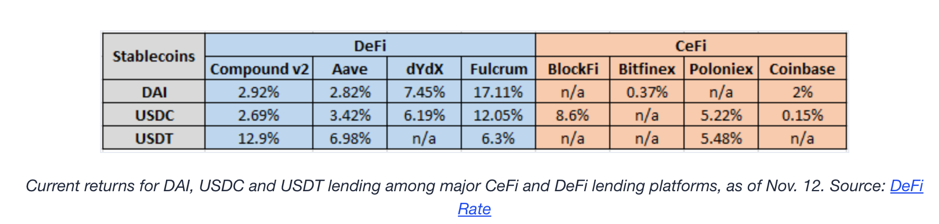

As was highlighted by a recent report by OKex, DeFi lending protocols climbed to an all-time high of $5.1 billion but faced intensified competition from crypto-exchanges and stablecoin issuers.

The aforementioned competition stems from increased investor protection being offered by centralized exchanges, compared to the largely unregulated DeFi sector.

As more innovations in stablecoins, cross-chain products, and crypto-backed derivatives continue to unfold, integrated CeFi and DeFi platforms have the potential to provide investors with the best of both worlds.

The post appeared first on AMBCrypto