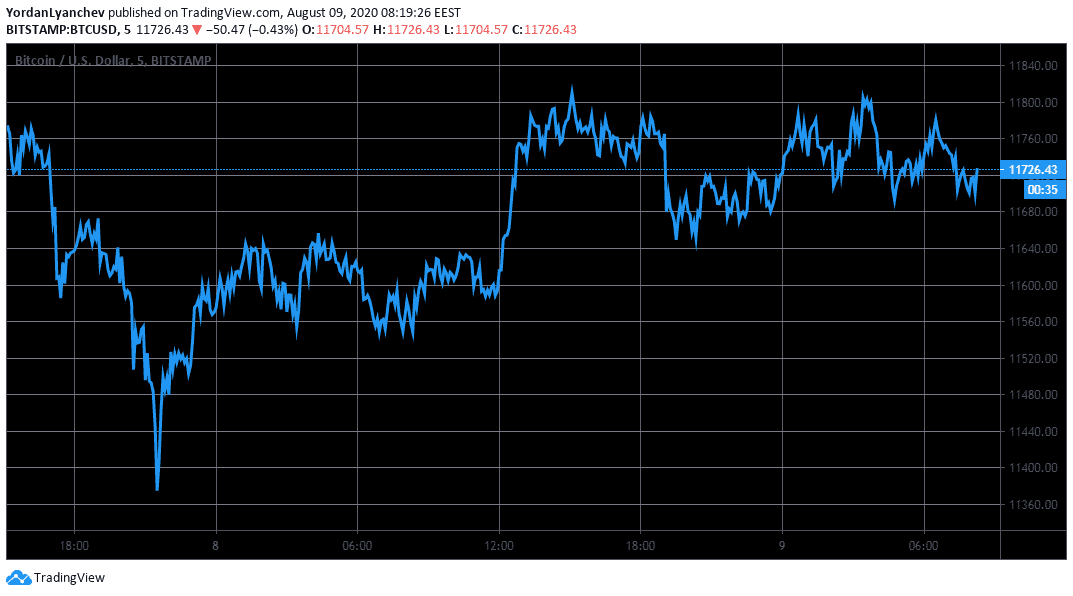

As of the middle of the weekend, Bitcoin continues to fluctuate in a range from $11,400 to $11,800, while most altcoins are trading in green.

Yet, Chainlink has attracted another wave of serious interest after an eventful 24 hours and a fresh all-time high painted.

Bitcoin and Altcoins In The Green

After a sudden dip to $11,200 on Friday, the primary cryptocurrency has managed to regain its composure. The bulls didn’t allow any further declines and pumped the price upwards.

Since then, Bitcoin has been relatively stable and fluctuates between $11,500 and $11,800. At the time of this writing, BTC sits just above $11,700.

11,800 USD, which was yesterday’s high, remains the first significant resistance that has to be overtaken decisively if the asset plans to challenge the psychological line of $12,000 and head above into uncharted 2020 territory. Alternatively, $11,400 stands below as a major support level to assist in case of a price drop, before a possible dive to $11,000, and $10,800.

Green dominates the rest of the market. Ethereum has recovered from its short-term losses yesterday with a 4% increase to $395. Ripple trades again at approximately $0.30 without any substantial movements. Bitcoin Cash, EOS, and Litecoin are up by nearly 2%, while Binance Coin ascends by over 3% to $22.80.

Tezos and VeChain are among the most significant gainers in the top 20 coins. XTZ is up by 11% to $3.42, and VET by 9% to above $0.02. Double-digit price surges are visible from Balancer (50%), Decentraland (44%), Flexacoin (28%), Band Protocol (18.43%), Algorand (18%), Swipe (15%), Aragon (14%), Terra (13%), and Kava (12%).

With such notable increases, the total market cap has risen to $357 billion after dumping to $343 billion two days ago, while Bitcoin’s dominance has retraced to 60.5%.

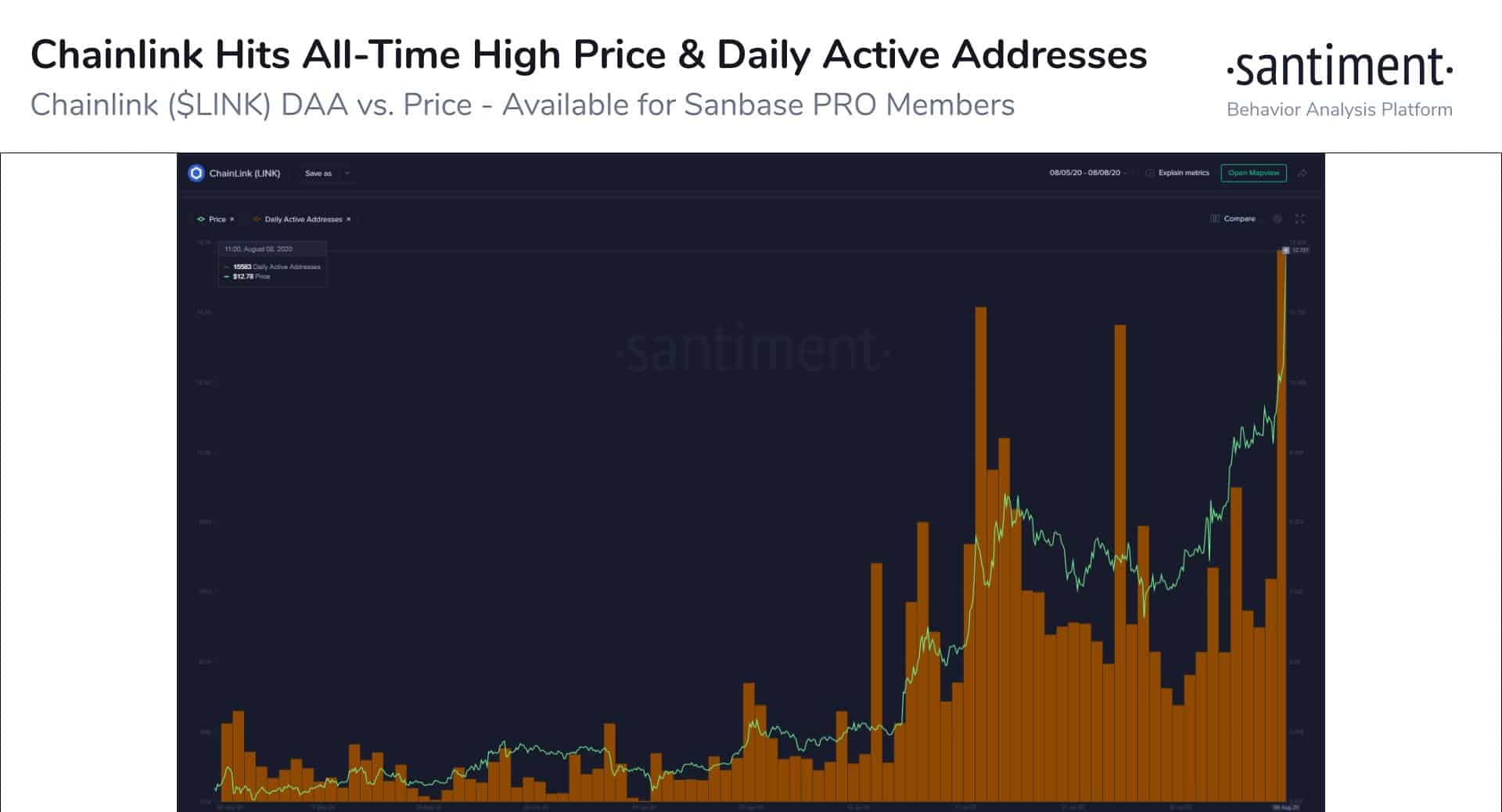

Chainlink’s Magical World

One cryptocurrency missing from the gainers mentioned above is the decentralized oracle network – Chainlink. Its native digital asset (LINK) has been one of the best performers throughout the entire 2020. It entered the new century at about $1.73, and just yesterday, after another substantial price pump, reached $13.9 (on Binance) to solidify a 700% surge in eight months, and 60% ROI over the past five days alone.

On a micro-scale, LINK dipped to $9.4 two days ago, and reaching $13.9 a day later meant a price jump of nearly 50% (in 48 hours). Although the asset has retraced slightly to $12.75 as of writing these lines, it still managed to climb several spots in terms of total market cap ranking and is now situated at 6th place.

Apart from the impressive price action, the popular cryptocurrency analytics company Santiment brought out another all-time high metric for Chainlink as the number of daily active addresses reached 15.6K.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato