Chainlink aka Link’s run from March to August has been good, especially in terms of its price appreciation. The cryptocurrency went from being valued at less than $2 in March to being overvalued at $20. This exponential rise came at a time when defi was soaring. In part, the defi craze has to be the reason why most altcoins rallied.

What lies ahead for LINK?

Important levels for Link include a resistance zone ranging from $18.76 to $17.76, followed by support at $14.73, $10.95 [which is also the 0.236-Fibonacci level].

It should be noted that Link’s overenthusiastic rally hit a ceiling at $20 and what’s coming is the retracement to balance out the surge. Since the peak, there has been a 38% retracement. However, at press time, it has reduced to 27%. The price was contending with support at $14.73, failing which, will push the price down the aforementioned support zone. This might put the Link’s value at half of its peak – $10.44.

RSI indicator showed a double top formation [a reversal pattern] while the price doesn’t. At press time, however, RSI is close to neutral zone, indicating the exhaustion of buyers.

The price looks to have a bounce in it, the question is when the price will see this bounce? At the current support at $14.73 or at the support zone at $10.44 and below? Considering the possibility of price dropping lower due to decreasing RSI, we can expect link to head lower, at least by 16% to 25% in the upcoming week.

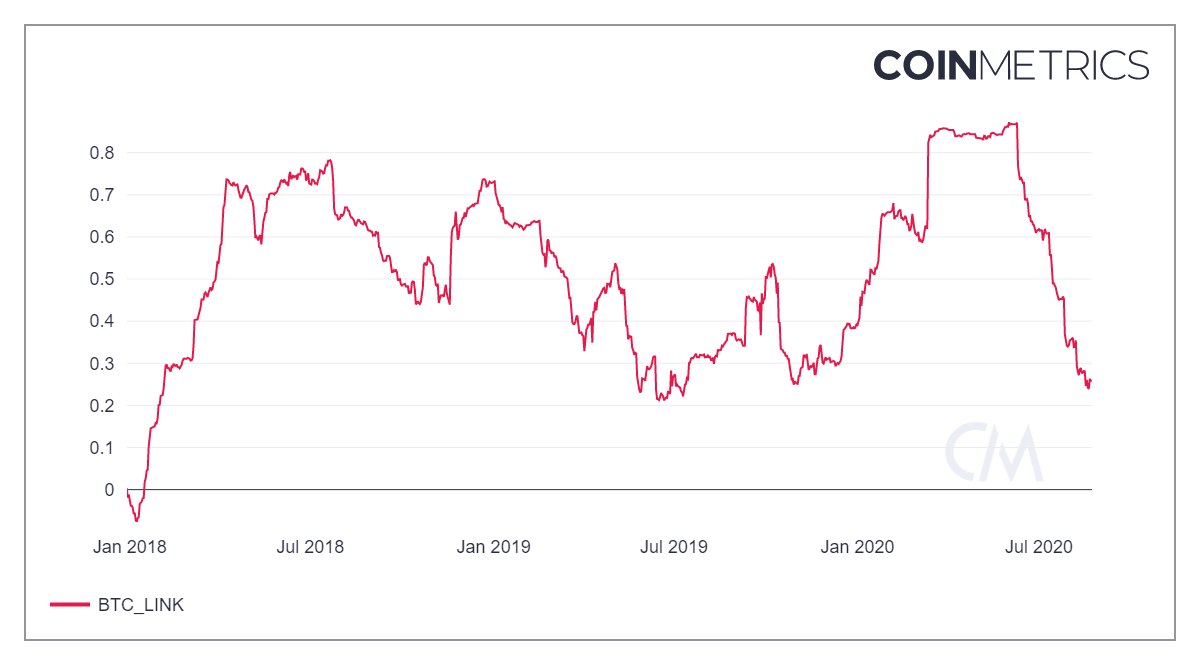

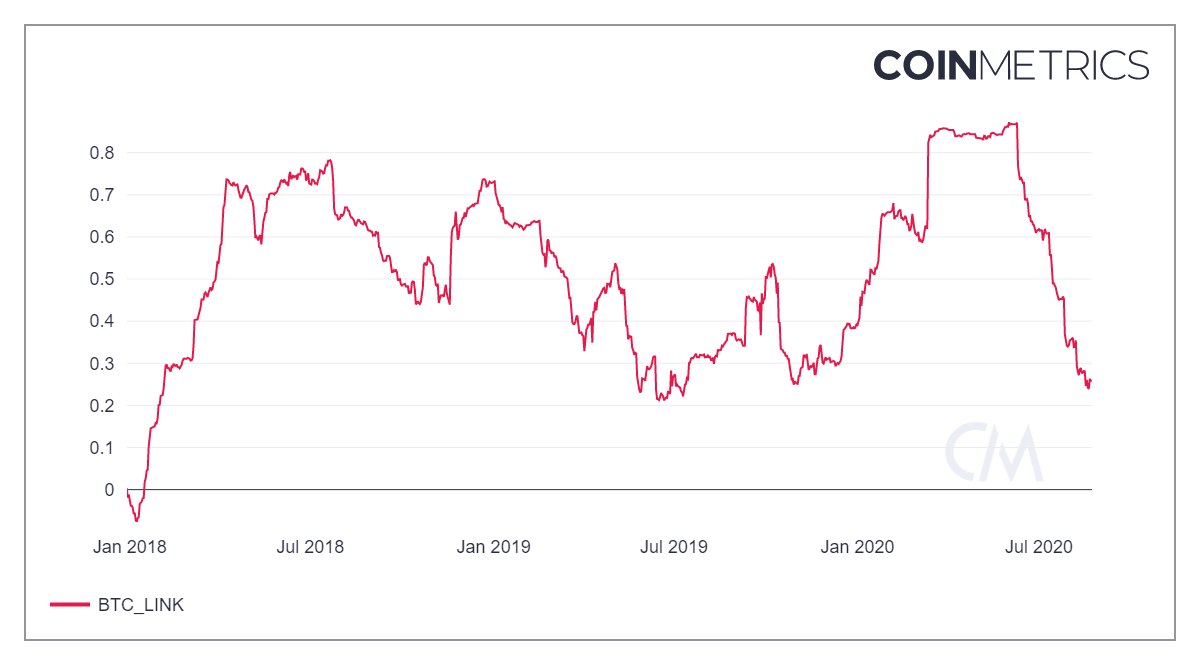

One good thing about Link is its low correlation with the rest of the crypto market. 90-day Pearson correlation showed that it has dropped to levels last seen during the peek of June-2019 bull run.

Source: Coinmetrics

Link is not the only coin that seems to be catching a break, the same is with ADA, another fan-favorite coin. Although there are some coins like LTC and XRP that still show potential surges in the near future.

The post appeared first on AMBCrypto