- Link resumed its bullish trend after breaking above a crucial resistance line.

- Buyers may continue the trend if the price increases above the current monthly high.

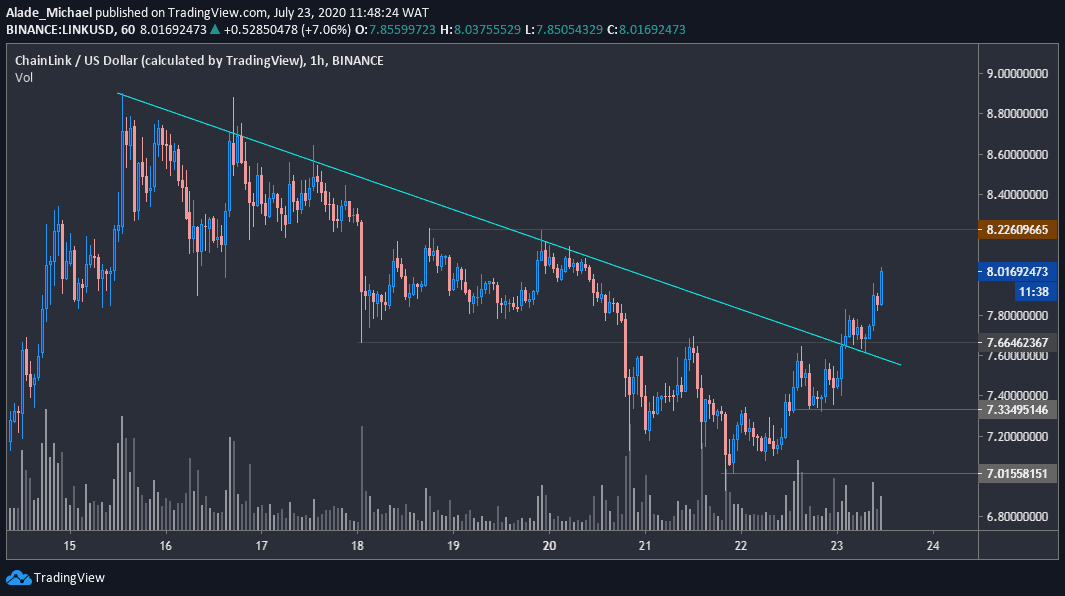

LINK/USD: Link Starts Fresh Increase From $7

Key Resistance Levels: $8.2, $8.6, $8.9

Key Support Levels: $7.6, $7.3, $7

Last week, Chainlink almost hit $9 after breaking above a four-month high with over 90% gain in two weeks. But unfortunately for the bulls, the price got rejected with a weekly correction to near $7 – where it bounced back yesterday.

Looking at the bigger picture on the hourly chart, the cryptocurrency is looking bullish again after breaking through an important resistance line earlier today. It is now trading well above the $7.6 resistance-turned-support after seeing nice 6% gains overnight.

Chainlink Price Analysis

As can be seen on the hourly chart, the buyers are pushing towards the orange resistance line of $8.2. If they manage to break this resistance, the next move would target $8.6 before it recovers back to $8.9. An increase above $9 level might trigger a run to $10 in the coming days.

If bears resume selling below the current daily support at $7.6, it would need to face yesterday’s low at $7.3, followed by the weekly low at $7 before it can initiate a new drop. But as of now, the bulls have technically taken over the market again.

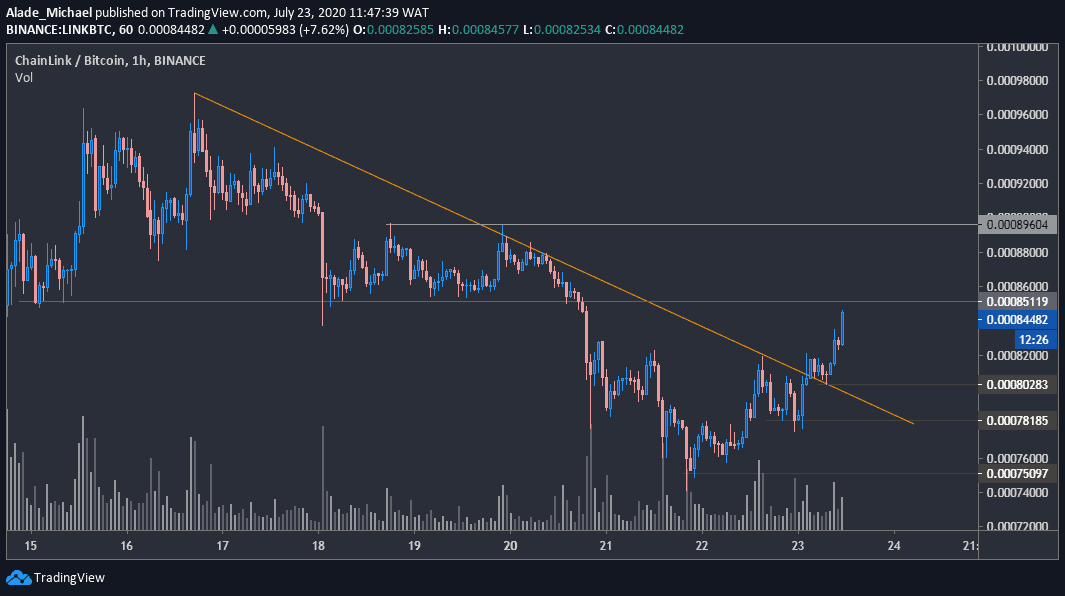

LINK/BTC: Chainlink Regaining Momentum!

Key Resistance Levels: 85100 SAT, 89600 SAT, 97000 SAT

Key Support Levels: 80000 SAT, 78000 SAT, 75000 SAT

Against Bitcoin, Chainlink is currently trading around 84444 SAT following a steady push from the 74000 SAT level on Tuesday. Looking at these setups, it appears that Link is plotting another upward move, although the buying volume is not enough at the moment.

The latest break above the orange descending line indicates a potential change in the trend, as can be seen in the current lower time frame. Although, it needs to surpass the last week’s high of 97000 SAT to validate a continuation of the mid-term bullish trend.

Notwithstanding, the bulls are slowly gaining control.

Chainlink Price Analysis

The price is now charging towards the 85100 SAT resistance level – last week’s support. Once Chainlink manages to close above this level on the daily, it could target 89600 SAT in the next swing. It may reclaim the 97000 SAT resistance level if the buyers keep pushing higher.

Currently, Link is relying on the 75000 SAT level as weekly support. At the same time, it has established further support at 78000 SAT and 80000 SAT levels. A drop below these mentioned supports could trigger selling pressure back for this pair.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato