- Chainlink’s price decreased by 7% overnight.

- It may resume the uptrend if the previous monthly breakout level can hold as support.

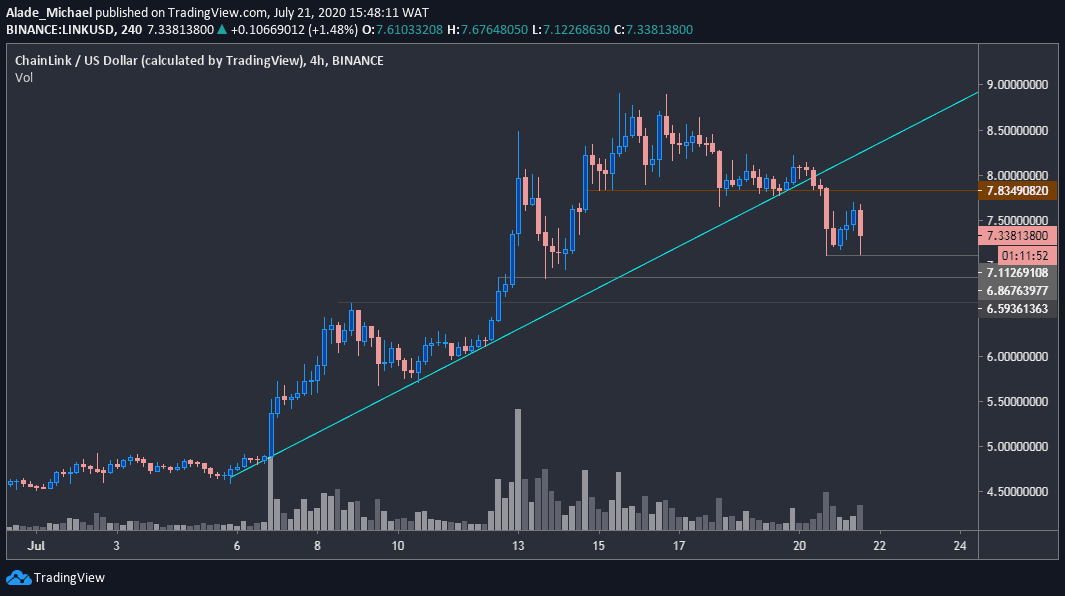

LINK/USD: Price Holding Above $7.1

Key Resistance Levels: $7.83, $8.2, $8.9

Key Support Levels: $7.11, $6.86, $5.7

Earlier this month, Chainlink saw an impressive 95% surge to reach $8.9 on July 16 after finally claiming the crucial $5 resistance-turned-support level that suppressed bullish actions in the weeks before. Today, however, LINK lost over 6.10% of its value to reach the current trading price of $7.33.

Following yesterday’s breakdown of the rising trend line – which confirmed the weekly reversal – LINK could head to the support at $6.8 (last week’s low) in the next couple of days.

A break below this support could cause more pain in the market. For Chainlink to reactivate a strong bullish trend, it would need to regain momentum above the current monthly high. For now, it appears bearish on the current 4-hours chart.

Chainlink Price Analysis

Looking at the current market structure, Link is holding the $7.11 level as support for the past 24-hours. Below this level lies last week’s support of $6.86. If the level breaks, the next level to watch is $6.59, followed by key support at around $5.6 –where buyers regrouped from on July 10.

As said earlier above, the $8.9 resistance is a key breakout level to watch for a strong buy. But the potential level for a pullback can be found at $7.83. The next resistance above this level is $8.2 before the breakout.

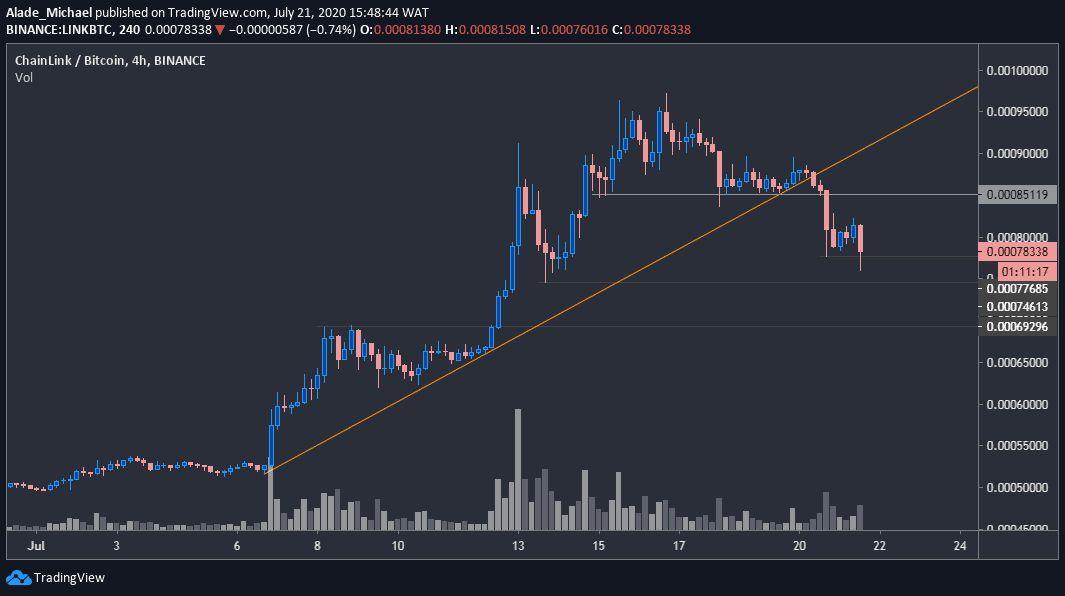

LINK/BTC: Chainlink Nears Last Week’s Low

Key Resistance Levels: 85119 SAT, 91222 SAT, 97260 SAT

Key Support Levels: 77685 SAT, 74613 SAT, 69296 SAT

Despite Bitcoin’s latest surge above $9400, Chainlink is still down by 8.5% following a five-day correction from the 97260 SAT level. The price is currently in the middle of consolidation after plunging beneath the orange support line (now acting as resistance) yesterday.

It is looking bearish on the current 4-hours chart, although the trend is still in favor of the bulls on a mid-term perspective.

While consolidating, Chainlink could retest the recent breakout level of 85119 SAT – last week’s low.. It could start a new increase if it manages to reclaim this mentioned level. Technically, the correction could last for a while before it finds a strong level for a rebound.

Chainlink Price Analysis

Considering the latest selling volume, Chainlink’s bottom could be somewhere around the 61000 SAT level. However, for that to happen, it would first need to fall beneath yesterday’s low at 77685 SAT. The support to watch below this level is 74613 SAT, followed by 69296 SAT.

Towards the upside, there’s a resistance at 85119 SAT. Above this level, further resistance can be located at 91222 SAT and 97260 SAT, where the decline began from Thursday. A climb above this monthly resistance should confirm a new bullish phase for Chainlink.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato