- The four-hour and daily time frame show that a bullish triangle breakout is underway

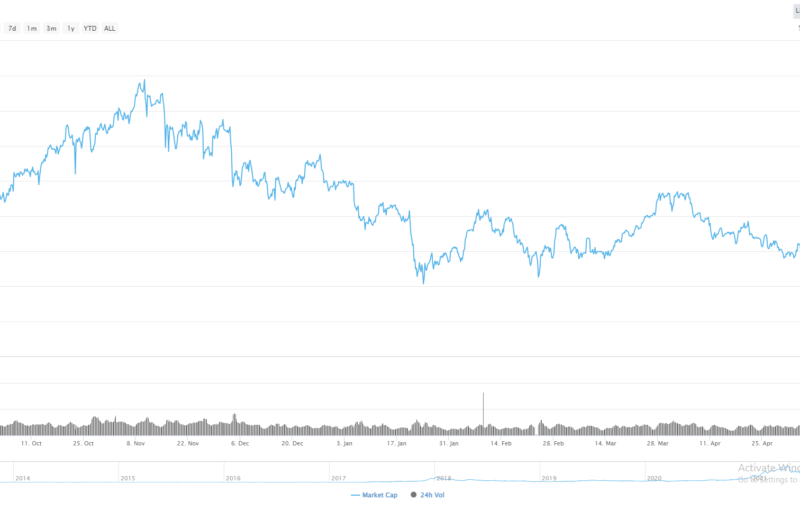

- The daily time frame highlights a huge bullish reversal building across the daily time frame

Chainlink appears to be stabilizing around major long-term support, as green shoots spread through almost the entire cryptocurrency market. Like many other popular cryptocurrencies, the LINK / USD pair has been suffering lately, having lost over thirty-five percent of its value from its August price peak.

Since late June the cryptocurrency has suffered a seventy percent decline. Remarkably, it remained among the top 20 cryptocurrencies by market capitalization, which further underscores the scale of bearishness inside the altcoin space.

The technical indicators for the short and the medium-term both suggest that the LINK / USD pair can start to recover higher, with an exceptionally bullish falling wedge pattern on the daily time frame indicating that a strong technical reversal may be on the horizon.

Looking at the daily time frame, price is consolidating around the lower end of the previously mentioned falling wedge pattern, which is a positive development. The reversal pattern itself suggests an eventual move back towards the $5.00 level, if we see a sustained technical breakout above the wedge around the $2.18 level.

The four-hour time frame also highlights that a bullish triangle breakout is currently underway, with the size of triangle pattern suggesting that the LINK / USD pair is headed towards the 2.22 level. The upside potential on the lower-time frame triangle break further supports the thesis that a medium-term recovery is coming.

According to the latest sentiment data from TheTIE.io, the short-term sentiment towards Chainlink is neutral, at 58.00 %, while the overall long-term sentiment towards the cryptocurrency is resoundingly positive, at 71.00%.

LINK / USD H4 Chart by TradingView

LINK / USD H4 Chart by TradingView

Upside Potential

The four-hour time frame shows that a bullish triangle pattern breakout is underway, with the $2.22 level the overall upside objective of breakout area. The overall size of the pattern also suggests that LINK / USD pair can break above its major moving averages over the short-term.

The previously mentioned falling wedge pattern is intriguing, as these types of bullish reversal patterns generally have a high probability of succeeding. The daily and weekly time frames are both showcasing the pattern, which flags the $5.00 level as an upside target.

LINK / USD Daily Chart by TradingView

LINK / USD Daily Chart by TradingView

Downside Potential

The downside potential for the LINK / USD pair is currently capped by major trendline support on the daily time frame. After numerous attempts to break under the trendline, it appears that bears have thrown in the towel.

Short-term technical indicators are rising, while the daily time frame shows that the Relative Strength Index is now at its most oversold on record, which certainly hints that a corrective move is coming.

Summary

The short-term technicals highlight that the LINK / USD is due for a strong upside correction towards the $2.22 level, at a minimum.

In the medium-term, the $5.00 level is the preferred upside target, according to the highly reliable reversal patterns on the daily and weekly time frames.

Find out more about Chainlink in our coin guide.

The post appeared first on CryptoBriefing