Disclaimer: The findings of the following article are the sole opinion of the writer and should not be taken as investment advice

At press time, LINK was trading at $9.19, with the cryptocurrency’s price within a bearish channel. Hence, a drop can be expected on the charts. In fact, a recap of Chainlink’s charts shows that the coin was due for a drop of 24%. So far, the drop is only halfway through, and more might be on its way.

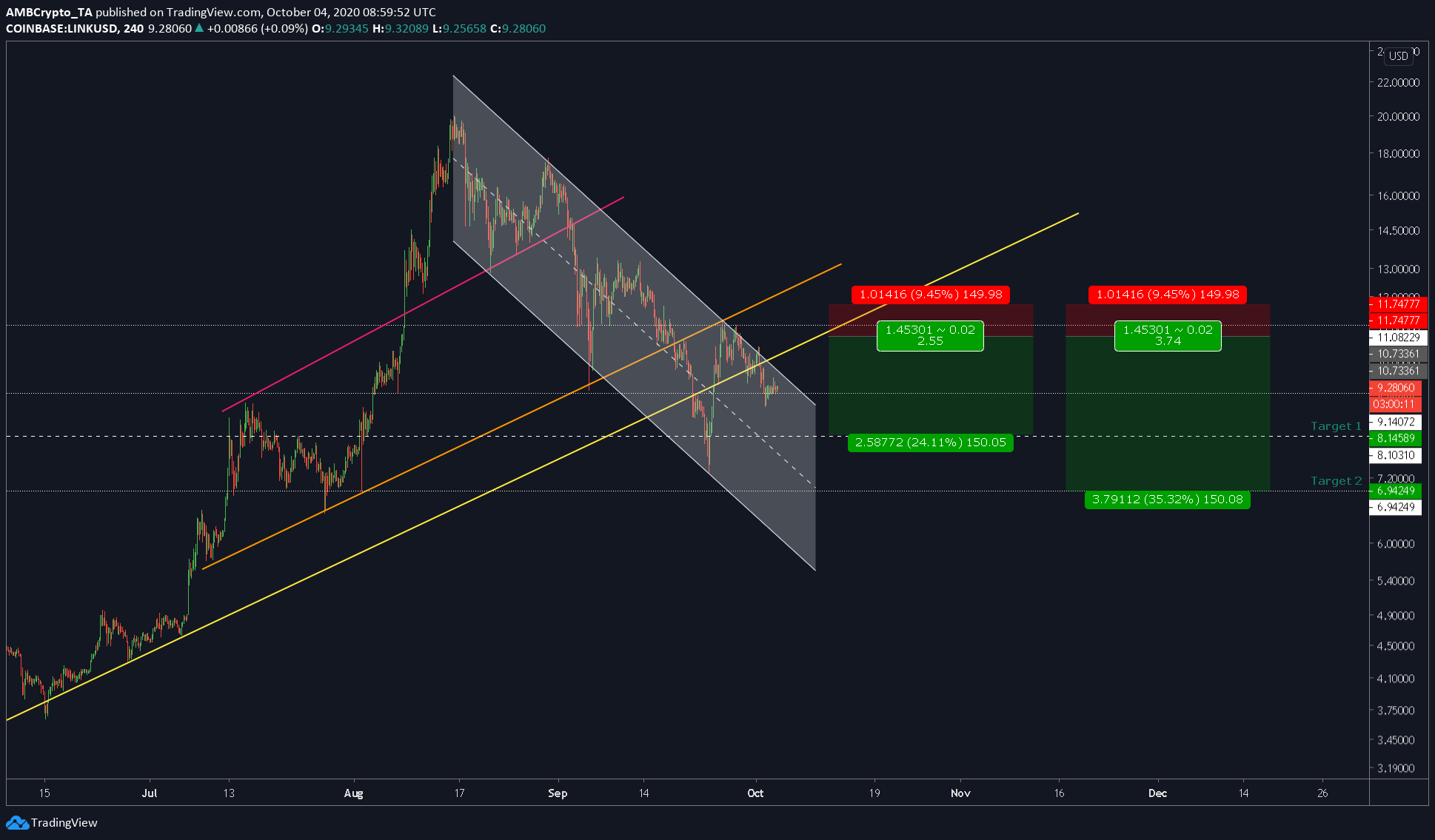

LINK 4-hour chart

Source: LINKUSD on TradingView

LINK’s price, at the time of writing, was still in a down channel, with the same hugging the top of the channel. The 1st target, as mentioned in a previous article, was $8.145 and the second target was $6.942.

These predictions were with respect to a longer timeframe, and so were the targets presented. However, when zooming in, one can see that the shorter timeframe is suggesting that yet another bearish move might be incoming.

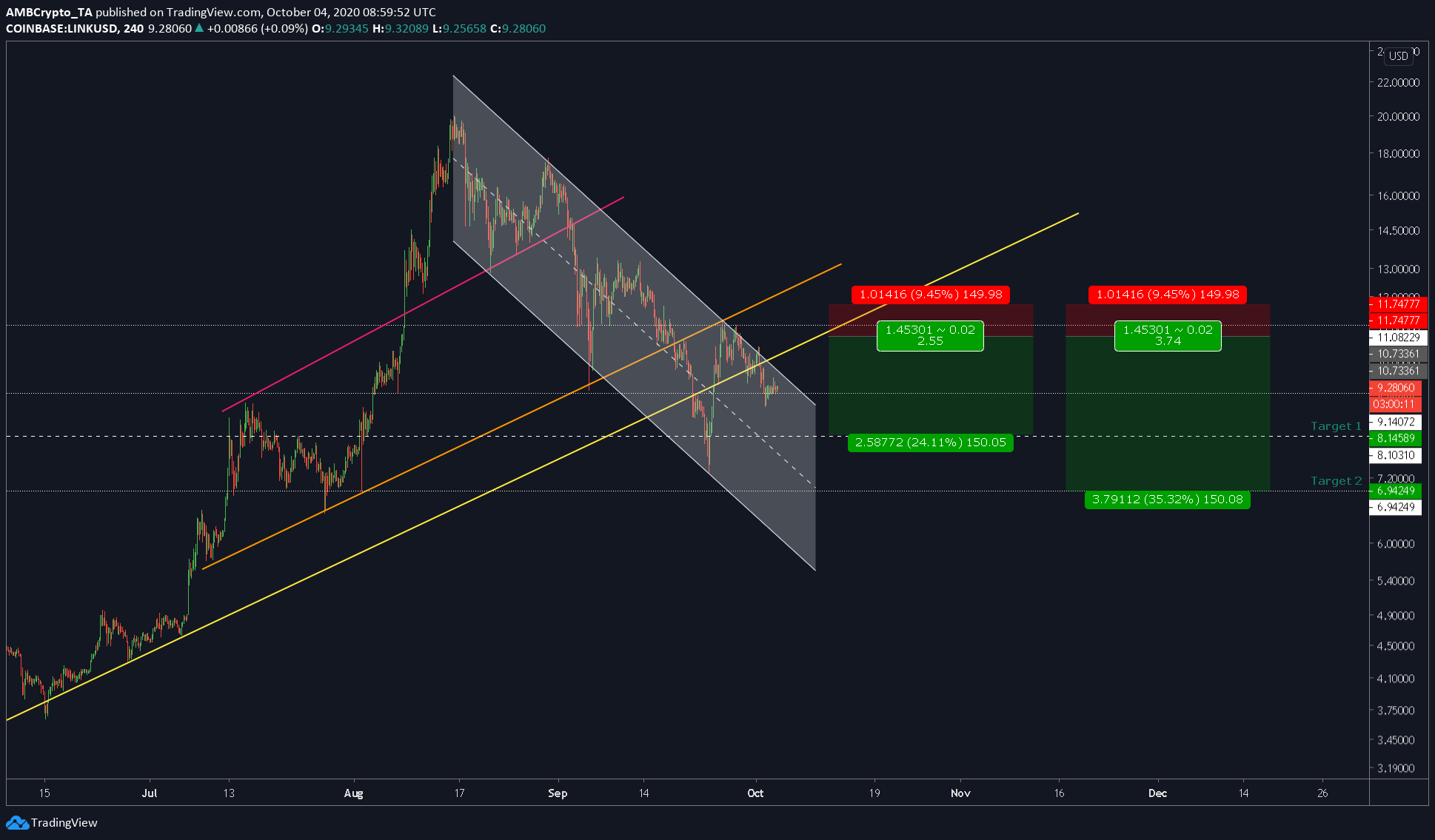

LINK 1-hour chart

Source: LINKUSD on TradingView

The one-hour chart for LINK showed the formation of a bear flag, one that was close to a breakout. There are two possible targets following the breakout, the first is a conservative target of $8.65, a little higher than the actual mentioned in the higher time frame above. The second target is the actual target – $8.14.

Based on the cryptocurrency’s prior price trend, the breakout will push the price from 10% to 16%. Hence, a short trade here would yield a good profit, especially with leverage.

The RSI indicator also formed an ascending channel, which was relative to the price. With the breakout of the price, we can expect RSI to head towards the oversold zone and beyond it.

The OBV indicator registered a higher low, but the same had already broken the trendline and was heading lower. This decrease in volume indicated that the breakout of the price might be near.

A short position with an entry at $9.32 with a stop-loss at $9.838 and a take profit at $8.14589 would yield an R of 2.34 and a profit of 12.68%.

Overall, this trade is in line with the overall, long-term trade, as mentioned previously.

The post appeared first on AMBCrypto